JAKARTA, INDONESIA — After changing the digital banking game through a game-like saving feature, TMRW is launching TMRW Power Saver: a new deposit saver offering rewarding interest and flexibility. This new feature is launched through a campaign in collaboration with Pantarei as the Creative Agency. The campaign highlights the diversity of Indonesian young professionals with their financial aspirations and saving habits through personality tests and a series of videos.

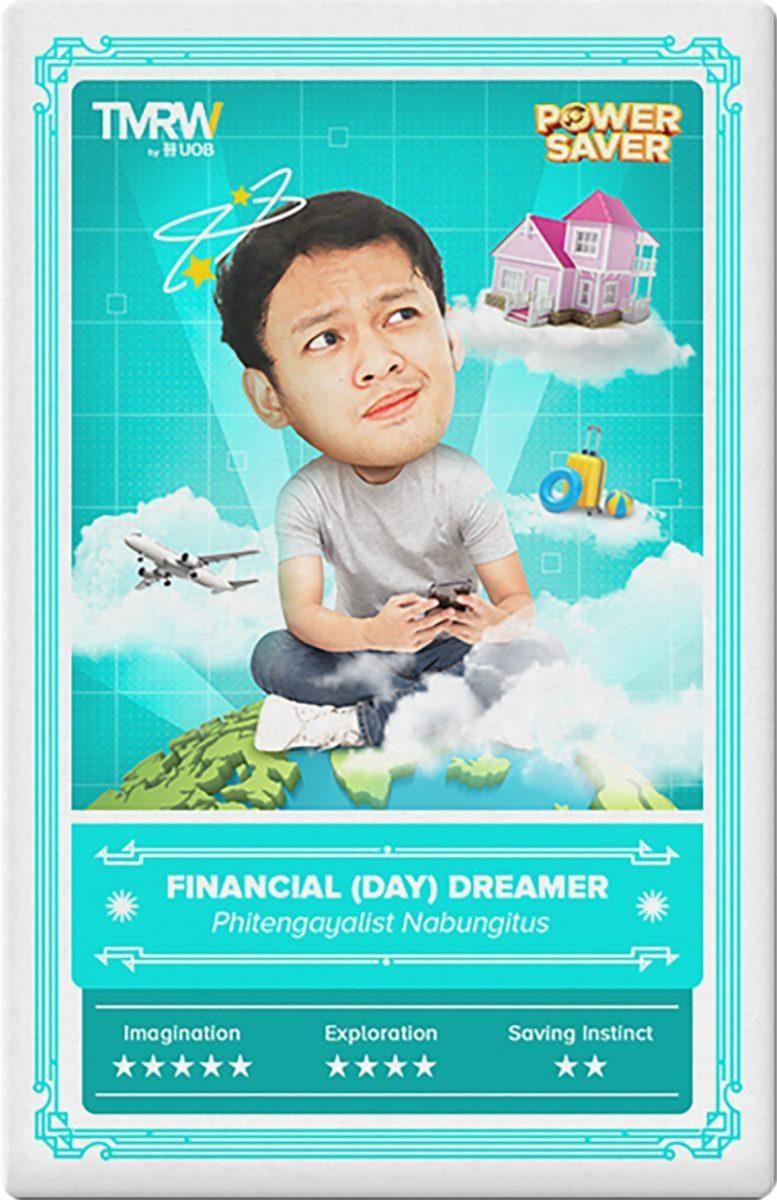

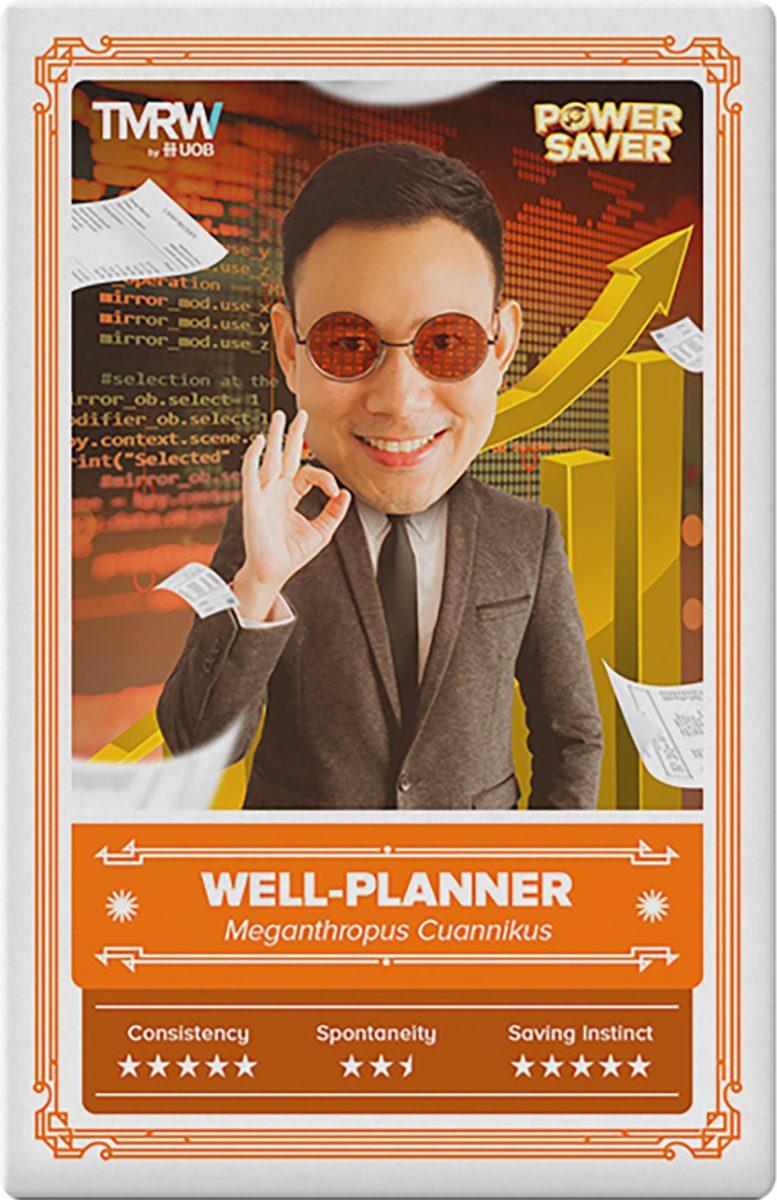

To launch TMRW Power Saver, Pantarei came up with Nabung Gaya Kamu: a campaign that supports the diverse saving style “species” with their own ways of saving to optimize their saving habits with TMRW’s saving features.

Aidil Akbar Latief, the Creative Director of Pantarei shares his thoughts on this creative approach “People are just like different species with their unique ways to survive the wilderness. We want to support each of them to optimize their saving by acknowledging their aspirations and their saving styles. Whichever their style is, they can save according to their ways in TMRW.”

Pantarei’s creative approach goes hand in hand with the objective of Arief Tjakraamidjaja as the Country Marketing Head UOB Indonesia. “We intend to support the different needs of different savers through products that are compatible with their habits. We also want to help them expand their portfolio by bringing the flexible and accessible deposit savings for the savers who have longer-term aspirations.”

Nabung Gaya Kamu is the most recent campaign by TMRW after Waktu Indonesia Nabung, a campaign that has been awarded the Best Revenue Generator Initiatives by TMRW Regional Award. TMRW has also won many international awards, such as The Best Digital Bank in Asia by 15th Annual Alpha SouthEast Asia Best FI Awards 2021, Top 10 Banking Apps by App Annie, and World’s Best Consumer Digital Bank in Asia-Pacific 2021 for Indonesia by Global Finance.

The Nabung Gaya Kamu campaign launches in a timely manner considering how Indonesian young professionals’ financial aspirations and habits are affected by the pandemic. They have different ways of managing their money for different aspirations. For 59% of Indonesian young professionals, emergency funds and money for enjoyment matters more, making liquid investment in the short term more appealing. On the other hand, many others prefer long-term investment as a way to combat short-term splurge, for example, the 50,7% of young professionals who choose an additional non-salary income for their future needs. For each of their aspiration and saving habits, TMRW offers saving features that suit them.

Suryani Asikin, the Chief Executive Officer of Pantarei mentions that she finds this campaign fun and inclusive. She also expresses her excitement for future collaborations with TMRW. “We hope we can continue to support many Indonesian young professionals- -and their different styles and habits–to optimize their finances so they can pursue the tomorrow that they aspire to have,” said Suryani.