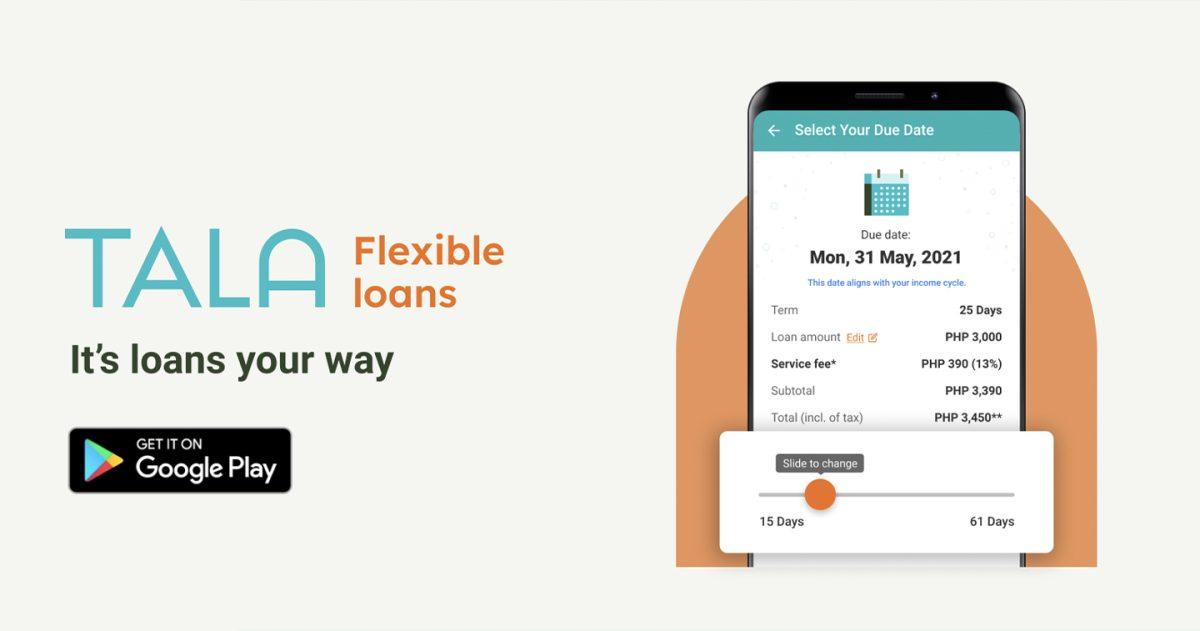

MANILA, PHILIPPINES — Tala, the global technology company building the world’s most accessible financial services, launched a unique credit option for its customers today. This first-of-its-kind feature, called Tala Flexible Loans, allows customers to choose the due date that works best for their needs, up to 61 days.

Filipinos can now time their due date around their next payday and other financial obligations, making repayment easier, and enjoy lower fees depending on the duration they choose. Tala offers affordable, transparent and one-time fees on every loan. Tala has also made repayment easy in over 18,000 locations such as GCash, Paymaya, Coins.ph, 7-Eleven, Cebuana Lhuillier, or M Lhuillier where borrowers can pay in full or make partial payments, anytime on or before their due date. Customers who make timely payments can earn more favorable terms over time, including doubling and tripling their loan limits within just a few months.

“At Tala, we always listen to our customers and innovate our products based on their needs,” says Shivani Siroya, Tala founder and CEO. “Our new, improved flexible credit gives borrowers the power to choose the due date that works best for them, not Tala. We are confident that this new feature will give Filipinos more financial access as well as the confidence to reach their financial goals.”

Any Filipino with an Android phone can apply for Tala credit 24/7 using Tala’s easy-to-navigate mobile application. For first-time borrowers, simply open the application, fill out the personal information form, and provide one picture and a government-issued ID. Tala provides a decision within minutes after application. Once approved, borrowers can choose their terms by confirming the desired loan amount, due date, and where they want to receive their cash. Loans may be deposited to their bank account, transferred to their Coins.ph wallet, or claimed at the nearest remittance center such as Cebuana Lhuillier, M Lhuillier, or Palawan Express Pera Padala.

Trusted by more than 6 million customers worldwide, Tala is on a mission to empower the financially underserved using its proprietary technologies, encouraging responsible borrowing while preventing over-indebtedness. At the same time, the lending app consistently enables financial literacy through its robust library of content, which includes articles related to loans, savings, business, and general expenses.

Registered with the Securities and Exchange Commission (SEC), Tala ensures safe and accessible lending by employing best practices and championing consumer protection globally with world-class SSL encryption.

To start a journey with TALA, visit the Google Play Store now to download the app or simply click here.