SINGAPORE — In-game mobile ads are making Asia Pacific (APAC) gamers ditch gaming, according to Omnicom Media Group (OMG) APAC’s latest research titled “Unlocking Gamers in Asia Pacific.” The 12,204 respondents surveyed were asked to rank their attitudes towards ads when gaming on mobile.

Most respondents say ads are too often causing them to stop playing the game. Respondents also prefer in-game ads to be seasonal or on rotation in a game setup. Some remember the brand for a later purchase in the real world while others say such ads do not incentivize them to buy an item in the real world.

Interestingly, Indian gamers accept in-game mobile ads and perceive them to be a positive experience. On the other hand, those in Hong Kong feel brands are uncreative and boring, which is probably due to too many ads or their repetitiveness.

According to PwC, ad revenue for gaming is projected to reach US$100 billion in 2025, proof that brands have their eyes on this sector as gaming cements its position in culture. The report aims to offer a better understanding of gamers across the region and covers four areas: advertising and brand attitudes, gaming behaviors, gaming preferences, and online engagement.

Nina Fedorczuk, OMG APAC’s Chief Enablement Officer, said, “The gaming universe is an incredibly exciting one and there are numerous opportunities for brands and marketers. We need to understand the different nuances within the gaming ecosystem, including the types of moments gamers experience. For example, they can connect with friends via gaming over the weekends and be fully immersed in the experience but also play a quick puzzle game during a weekday commute. It is no longer enough to treat gamers as a niche audience because almost everyone is a gamer. Brands need to find the sweet spots for this audience, and think hard about how they can add value to the gaming experience, instead of blatantly interrupting it.”

For brands eager to target APAC gamers, here are some key consumer needs and behaviors to take note of:

Behaviors: mobile dominates the market; not all gamers identify as “gamers”

Mobile penetration in Asia Pacific will hit 70% by 2023, according to GSMA. The popularity of mobile is evident in the gaming scene, with mobile gaming ranked the most popular in APAC (89%), OMG’s research found. It dominates in markets including Indonesia (96%), India (95%), Philippines, (95%), Malaysia (93%), Vietnam (93%), China (93%), Hong Kong (93%), Thailand (92%), and Taiwan (91%). Mobile gaming is seen as a more convenient option and is mainly driven by markets with cheaper technology.

That said, PC is still popular among certain groups of gamers, specifically those in China (69%), Hong Kong (65%), India (43%), Singapore (42%), and Vietnam (48%). Some of the popular genres in these markets are PC-based and the device is also more accessible through communal spaces such as PC cafes.

Consoles are the third most popular device among APAC gamers, especially in Australia (49%) and Hong Kong (49%), and this is likely due to their affordability.

It is common for brands to use the blanket term “gamer” and 62% of respondents identify with that label. However, only 37% in South Korea feel the same and this can be attributed to esports being an actual career choice in the country. Hence, everyday gamers do not associate with that label as much as those in other markets.

On the other hand, those in China (86%), Vietnam (84%), Hong Kong (84%), and India (76%) indexed above the regional norm, which is due to a mix of cultural influences. For example, the Chinese and Western markets are culturally more open to the label of “gamer” and individuals in Southeast Asian markets spend more time gaming. Hence, they are more willing to see themselves as gamers.

Brands are advised to use different labeling such as “players” or target gaming audiences based on sub-cultural behaviors when reaching out to different markets across the region.

Advertising and brand attitudes: offer real-world incentives from mobile game ads

Memorable in-game experiences are helpful in enticing gamers, but brands can go a step further by extending this into the real world. APAC gamers want real-world incentives when gaming, especially from mobile game ads.

To delight mobile gamers, brands can take on initiatives such as creating original games, hosting gaming events, and offering real-world and in-game incentives based on in-game performances. As creating original games can be costly, brands can leverage existing popular games such as Fortnite and explore creating worlds or new experiences within them.

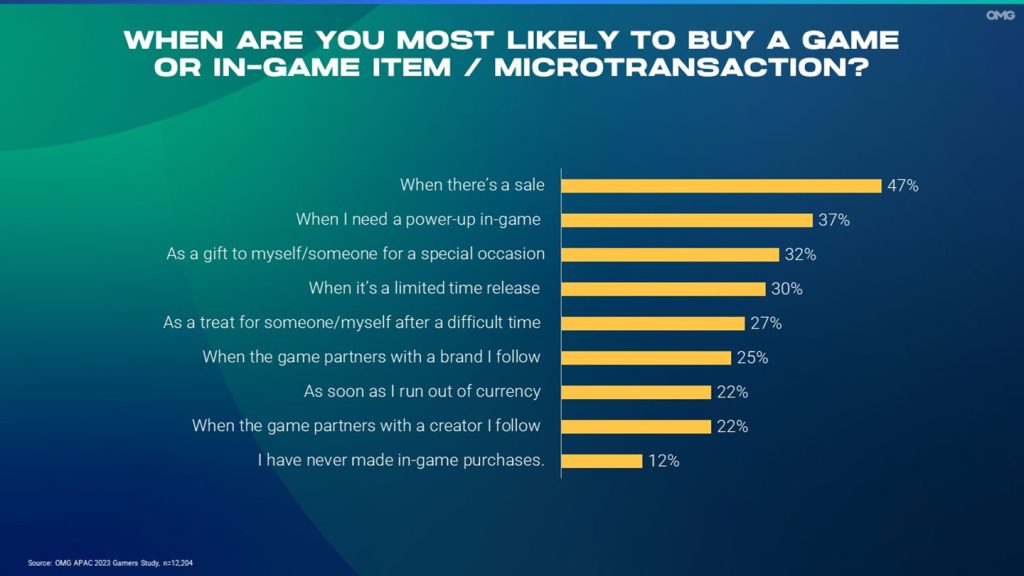

Some gamers are value-driven, aiming to get the best savings from games. Nearly half of APAC gamers (47%) will make an in-game purchase or microtransaction when there is a sale or when they need to power up (37%). Some also see it as gifts for special occasions (32%) or will only purchase it when it is a limited-time release (30%).

Brands can drive microtransactions by offering in-game boosts or carrying out seasonal executions.

Preferences: solo gaming versus wanting connections

The younger generations generally seek connections and more immersion, and this is reflected in their gaming preference. More than half of them (59%) are inclined to have in-game or person-to-person chats and 39% game with friends they know at least twice a week. Two-thirds will change game genres when playing with others.

On the other hand, most APAC gamers prefer gaming solo, especially the older demographics, with 45% of them gaming by themselves at least twice a week. 42% prefer quiet gaming experiences.

It is crucial for brands to tailor their gaming experiences for solo players mainly without the goal of driving or depending on communal gaming. To target a younger audience, a multi-player option can be offered.

Online engagement: PR efforts help build strong social credibility among gamers

In addition to offering incentives and tailoring experiences, word-of-mouth is crucial to winning gamers’ hearts. Family and friends hold slightly more sway in this area, with 89% of gamers in the region finding their game reviews important. That said, influencers or players themselves (90%) are also useful in building credibility among gamers, especially in China, India, Indonesia, and Hong Kong. Gamers in the Philippines place equal importance on recommendations from family and friends as well as influencers.

The outlier is South Korea, which places far less importance on positive word-of-mouth recommendations. Compared to the regional average, recommendations from family and friends are 20% less important and those from influencers are over 10% less important for South Korean gamers.

Based on these insights, brands need to constantly drive social amplification and seek ways to create more word-of-mouth opportunities to gain traction with gamers.

The research surveyed 12,204 respondents and an equal gender split between men and women across 13 markets. They are Australia, India, China, Indonesia, Philippines, Malaysia, Singapore, South Korea, Thailand, New Zealand, Taiwan, Hong Kong, and Vietnam. Slightly more than two-thirds of respondents are aged 25 to 44 years old. The remaining 20% are aged 18 to 24 and 13% are aged 45 to 54.