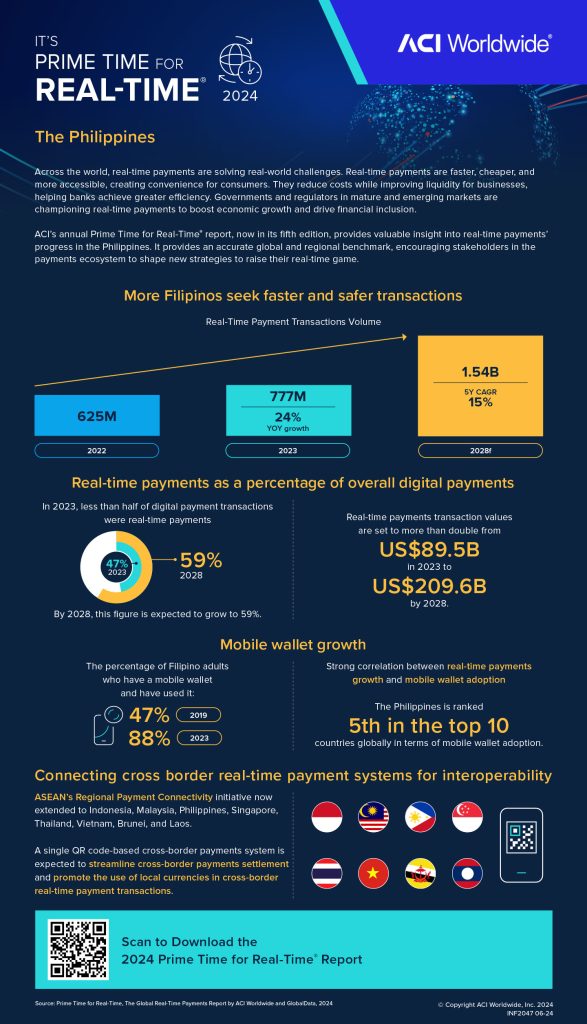

MANILA, PHILIPPINES — Real-time payment transactions in the Philippines posted a 24% year-on-year growth in 2023, with transaction volume reaching 777 million and expected to hit 1.54 billion by 2028, according to the “2024 Prime Time for Real Time Report” published by ACI Worldwide, a leader in real-time payments, in partnership with GlobalData, a leading data and analytics company. Real-time payments pertain to the immediate transfer of funds 24/7 within a matter of seconds to the recipient’s account.

According to the report, the real-time payments’ share of all digital payments in the country is projected to grow to 58.7% by 2028, while its transaction value is expected to reach USD 209.6 billion in the same year. As of 2023, real-time payments accounted for 47.2% of all Philippine digital payments, with a transaction value of USD 89.5 billion.

In 2018, InstaPay was introduced as the first real-time payment system in the Philippines. This served as one of the critical rails for the national government’s thrust to digitize payments through the Bangko Sentral ng Pilipinas (BSP) Digital Payments Transformation Roadmap. The launch of the BSP’s national quick response standard, QR Ph, in November 2019 further boosted familiarity with InstaPay by providing consumers with a faster and more convenient way to make person-to-person fund transfers by simply scanning a QR code.

“Real-time payments hold the potential to facilitate greater economic growth and financial inclusion in the Philippines by eliminating payment friction and injecting greater liquidity in the financial system. As Filipinos continue to embrace digitization, we encourage the local banks and financial institutions to harness technological innovations that will enable them to fully leverage the capabilities of real-time transactions,” said Leslie Choo, Senior Vice President, Managing Director – APAC at ACI Worldwide.

The surge in digital payments — including real-time payments — in the Philippines accelerated during the Covid-19 pandemic and prompted the shift towards a cashless economy. According to the report, it addresses a growing consumer demand for simpler, speedier, and more secure transactions, which Filipino consumers indicated as the top reasons for using digital payment tools.

The report has found that there is a strong correlation between real-time payment growth and mobile wallet adoption. The Philippines is ranked fifth in the top 10 countries globally in terms of mobile wallet adoption, with 88% of Filipinos having used a mobile wallet in the past year. ACI Worldwide’s report also revealed that QR codes, mobile wallets, and bank accounts are the main authorization methods used by Filipino consumers to initiate real-time payments. With growing consumer demand for real-time payment methods, businesses are set to follow suit.

Meanwhile, the BSP is set to join the Regional Payment Connectivity initiative, which aims to link all Association of Southeast Asian Nations countries under a single QR code-based system and presents a potential use case for real-time cross-border payments in the Philippines. The move is part of the central bank’s broader strategy to promote financial inclusivity and the adoption of digital payments, which it believes could significantly reduce remittance costs and boost the country’s economy.

Drawing on the tremendous potential of real-time payments for banks in the Philippines, Lesie Choo further stated, “Real-time payments are now a real-world reality and banks have the opportunity to innovate where real-time payment sits in the customer journey and the end-to-end payments landscape to provide a differentiated experience. At ACI Worldwide, we want to collaborate with banks, merchants, and billers in the Philippines and around the world to enable them to tap into emerging use cases of real-time payments through payment modernization and transformation.”

Globally, ACI powers 26 domestic and pan-regional real-time schemes across six continents — including 10 central infrastructures — providing solutions to central banks, participant banks, fintechs, and other payment service providers.