PASIG, PHILIPPINES – With more Filipinos living in restricted conditions due to the imposed lockdown in Luzon and other parts of the Philippines, television has gained additional 3.8 million viewers in any given minute in a day or 27% growth from pre-Covid period (January to March 7), according to Nielsen, a global measurement and analytics company.

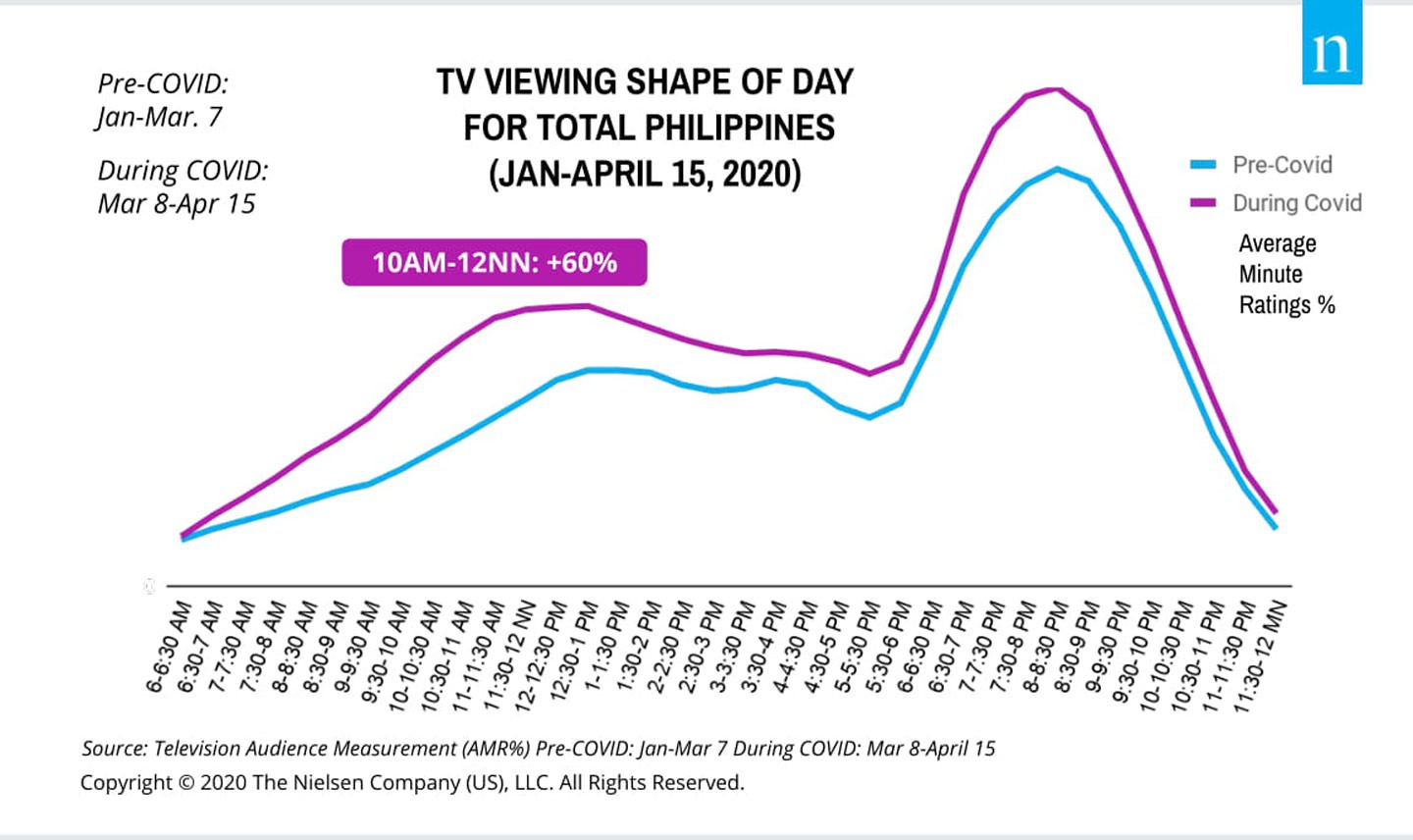

The latest Nielsen report, COVID-19 and the State of Media in the Philippines, noted a significant upsurge in TV viewing throughout the day, with bulk of viewers watching at night time. Meanwhile a new “prime” time emerges as pre-noon garners the highest growth in ratings with a viewing bump of 60% (See Chart 1).

“Forced confinement coupled with concerns on the rapid increase in the number of cases in the country were key factors to why Filipinos tuned in more to media sources such as television and online media,” says Ernestine Amper, executive director of Nielsen Media in the Philippines. “In these times of uncertainty, Filipinos want to get as much information as they can about COVID-19 and its impact to their lives, work, and community that is why it is not surprising that their need for COVID-19 information extends from on-screen to online.”

With close to 90% of Filipinos having access to television, it is understandable that viewers will tune in to TV for information but the Nielsen report noted that Filipinos are actively searching for COVID-19 content and engage in online conversations about this topic. COVID-19 and other related keywords are trending mainstays in social media sites like Twitter and even Google Trends.

Pinoy TV Viewing in the Midst of the Pandemic

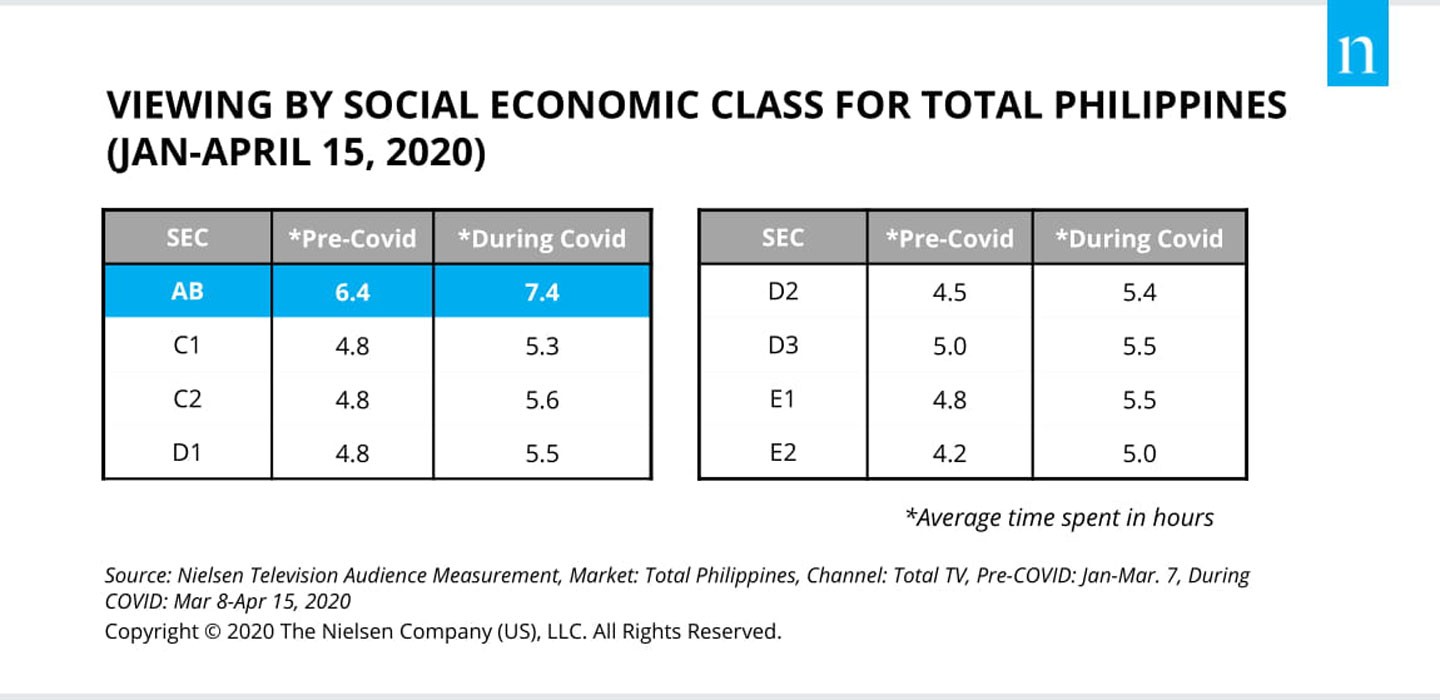

A closer look at the new TV viewing behavior of Filipinos reveal that the affluent classes (SEC A&B) are watching more, spending an additional hour over their usual 6-hour TV screen time (See Chart 2).

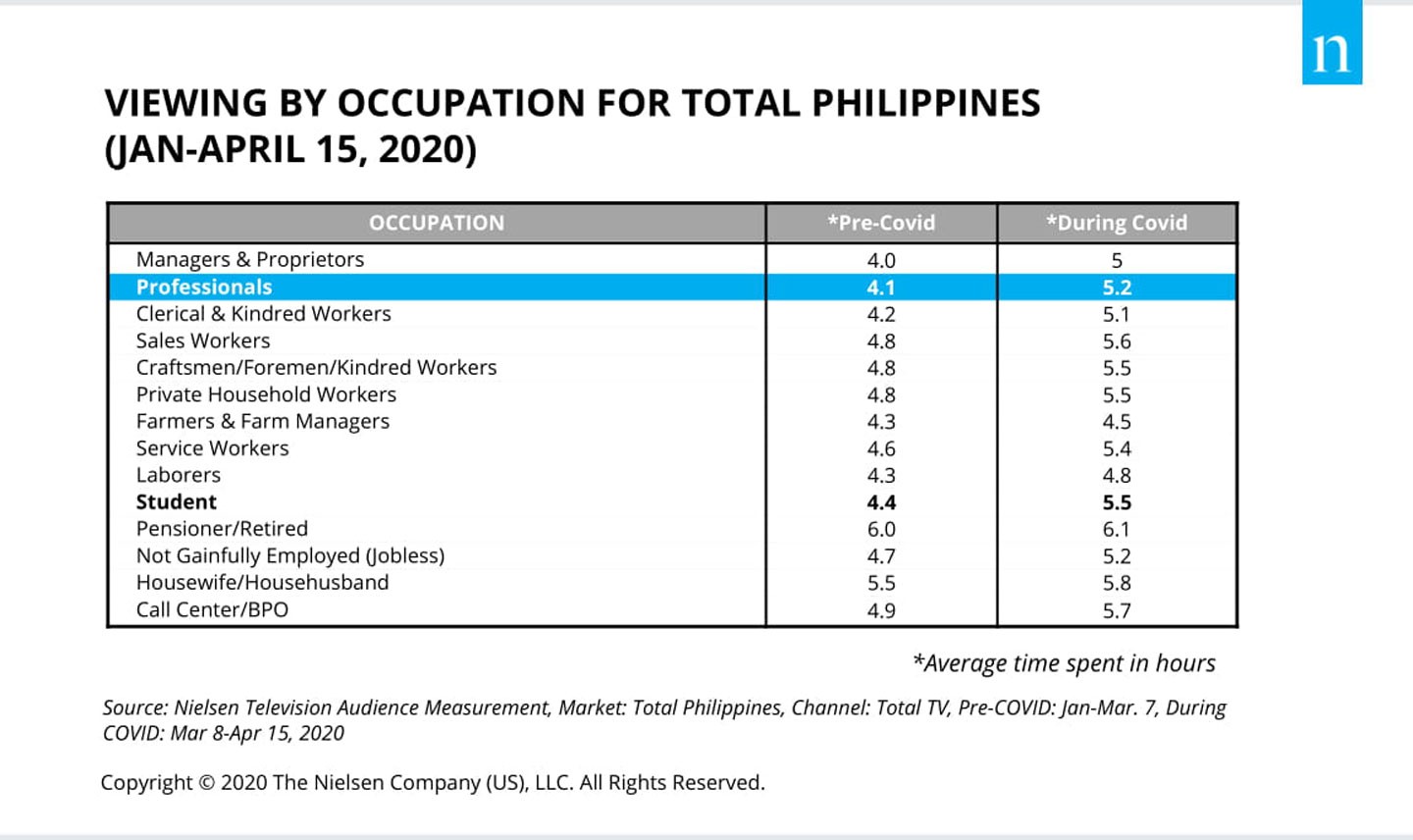

In terms of occupation, office workers who are now working from home spend more time watching TV while the manual workforce that includes laborers and farmers or those who follow a no-work/no-pay policy posted minimal growth in terms of TV viewing duration (See Chart 3).

In observing the current media landscape, Nielsen found that aside from ramping up the volume of news content, broadcasters are presenting a lineup of shows espousing the idea of ‘Thoughtful Programming’. “Major networks re-aired hit drama series on primetime that presented a common theme of ‘Hope’ and a strong sense of ‘Community.’ With the cancellation of classes, replays of classic educational programs catered to students are likewise being shown,” shares Amper.

“We’ve noted that local broadcasters acknowledge their influence and responsibility amid this pandemic — knowing their strength to entertain and inform, they have curated a lineup of programs with the purpose of uplifting the viewing public. This portrays what we call now as “Thoughtful Programming,” observes Amper. “Based on the ratings performance of these shows, it seems that broadcasters are well attuned to the type of content the Filipino audience needs at these trying times.”

Key advertisers still on the frontline for TV ad spending

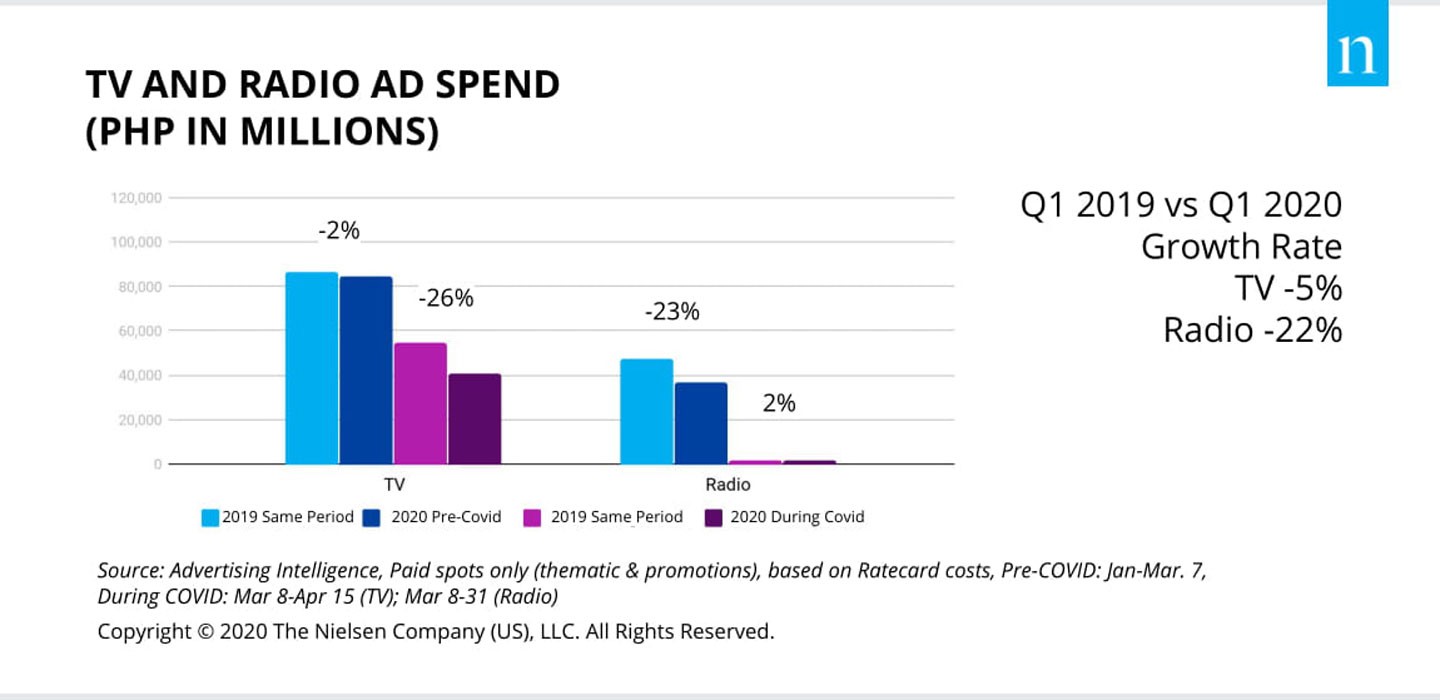

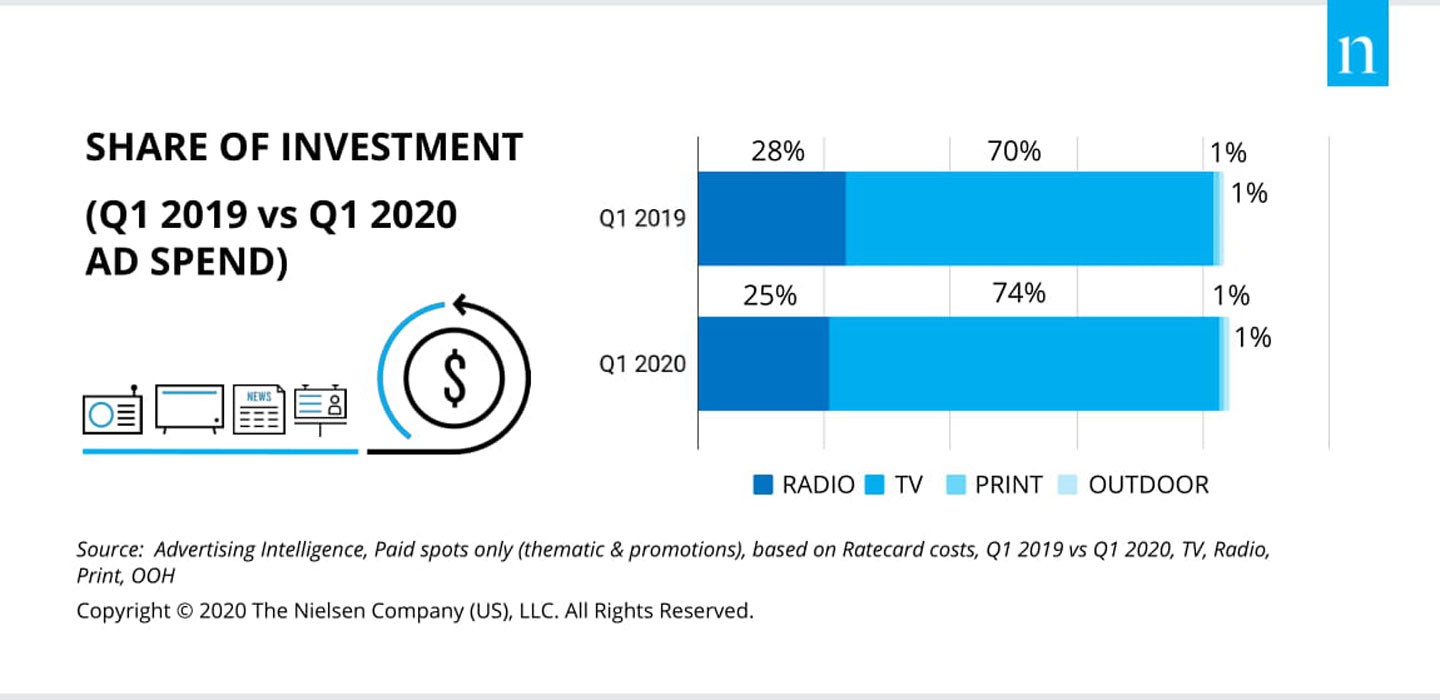

Compared to the same period last year, it is evident that TV and radio ad spend softened in Q1 2020 with a more pronounced dip during the height of the pandemic for TV at -26% (See Chart 4). However, share of investment (SOI) is still led by TV at 74% in Q1 2020 versus the same period last year. (See Chart 5).

Top advertisers continue to advertise despite a drop in ad investment. Some are maximizing the heightened media consumption by spending more on TV ads especially pharmaceutical advertisers. Interestingly, some key advertisers boosted their radio ad spending during COVID period (Mar 8-31, 2020 vs. previous year) as they lessened their TV budgets from last year.

As expected, on-site businesses such as cinema, hotels, restaurants, and department store ads declined versus past year during the COVID period, while food product categories such as seasonings and canned goods increased in ad investment. Categories which are in high demand such as cough and cold remedies and vitamins grew spending for Q1 compared to last year, as well as for sanitation products manufacturers.

“This pandemic is pushing the industry against the wall – it’s forcing us to abruptly shift our focus, adapt a different mindset, and experiment with new things. It is by experiencing all these that we are able to carry on and come out stronger post-pandemic,” says Amper.