MANILA, PHILIPPINES — As part of its commitment to creating a safe and secure digital space, GCash has continued to take significant steps to protect its users from the growing threat of spoofing scams by equipping Filipinos with the knowledge and tools they need to safeguard their digital financial activities.

In recent reports by the Philippine National Police Anti-Cybercrime Group (PNP-ACG), spoofing scams are emerging as one of the primary threats contributing to the surge of cybercrime in the country. Spoofing is a technique in which fraudsters impersonate trusted entities, such as banks or service providers, to trick victims into revealing sensitive information.

Here are useful tips from GCash to help users spot and avoid spoofing scams and ultimately help Filipinos better protect themselves online:

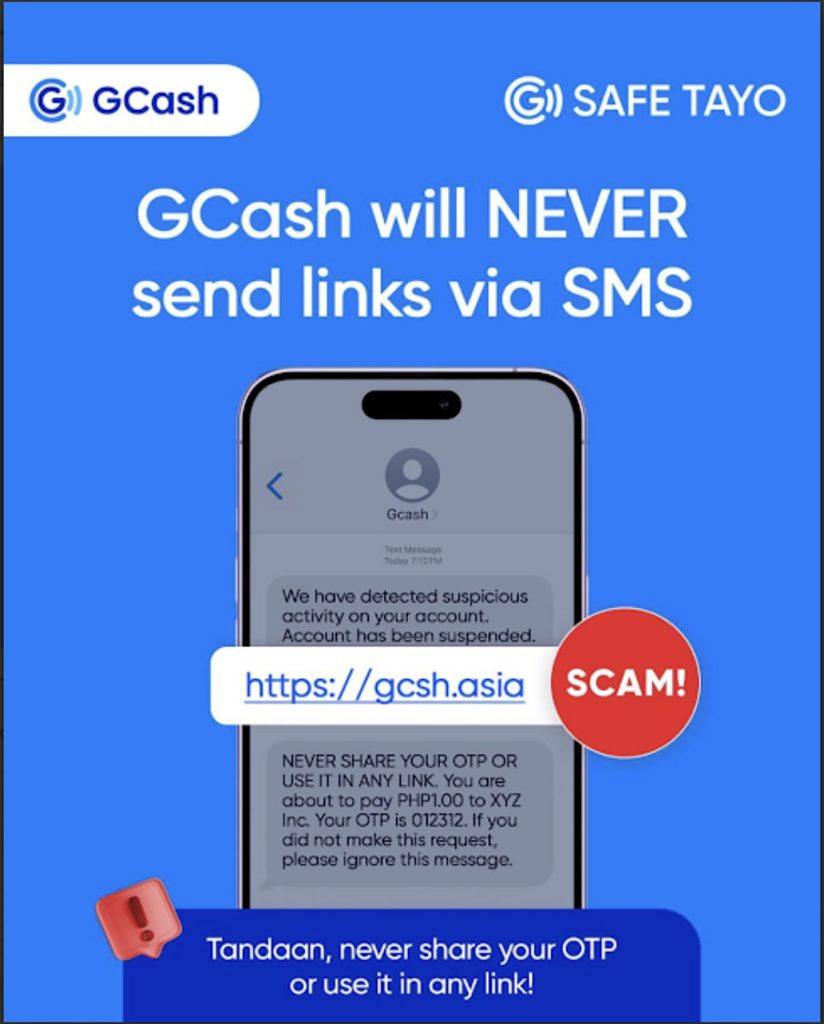

Be informed about spoofing modus: Considered one of the most rampant types of scams today, spoofing is used by cybercriminals to deceive users into believing they are legitimate entities like banks or services and trick them into revealing passwords, account numbers, or other personal details. Spoofers often use emails, phone calls, or texts that appear legitimate but are designed to steal the person’s data, giving fraudsters access to their online accounts, such as social media profiles, e-wallets, and banking accounts.

Verify communication sources: Always double-check the contact information of any message or call you receive. GCash emphasizes that official communications will only come from verified channels. If you receive an unexpected request for personal information, confirm its authenticity by reaching out to official GCash contact points.

Watch out for red flags: Scammers often create a sense of urgency or offer deals that seem too good to be true. Be cautious of messages that pressure you to act quickly or provide sensitive information. GCash assures users that legitimate communications will never ask for passwords or PINs via email or text.

Use secure connections: When accessing your GCash account, ensure you’re on a secure and private network. Avoid using public Wi-Fi for transactions, as these can be less secure and more susceptible to cyberattacks.

Report suspicious activity: If you suspect a spoofing scam has targeted you, report it immediately to GCash. The platform provides straightforward tools within the app for reporting and addressing suspicious activity, helping prevent further fraud. To report scams and fraudulent activities, visit the official GCash Help Center or message Gigi on the website and type, “I want to report a scam.” GCash will never send you a personal message to address concerns. Customers can also reach out to the official GCash hotline: 2882 for queries and other concerns.

By providing a safe and secure digital financial platform, GCash continues to transform Filipinos into more financially empowered and equipped individuals, ensuring a safer digital financial ecosystem for all.