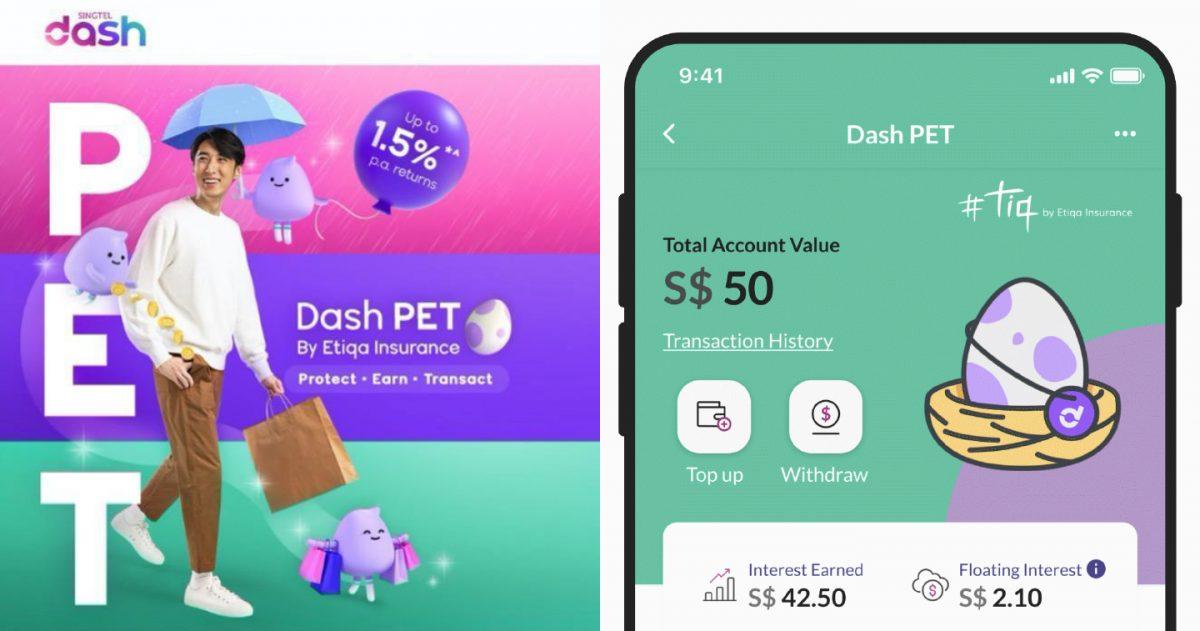

SINGAPORE — Singtel Dash’s latest insurance savings plan, Dash PET by Etiqa Insurance, was declared the plan with the best rates of return in its category. [1] Dash PET provides users with a unified product, design, and marketing experience.

Following the success and learning of the first insurance savings plan Dash EasyEarn, Dash PET has lowered the barrier to entry with a minimum premium of S$50, one of the lowest in Singapore and offers free insurance coverage and additional interest. In its latest update on 9 September, users who sign up for Dash PET may opt into the free protection and get up to S$50,0002 coverage and boost their returns from 1.3%2 p.a. to 1.5% [2] p.a. for their first S$10,000 savings in the first Dash PET policy year. Alongside saving at high returns, policyholders can conveniently manage or purchase add-on protection for their individual insurance policies and top up or withdraw money from a single mobile wallet.

In a Singtel Dash survey with its users, 50% of the respondents in the age group of 17-24 years old did not own any insurance policy. The same age group also cited saving as their key financial objective. Dash PET is an inclusive product that provides those with lower earning power the access to financial products with high returns.

There were three challenges to overcome in designing this product. Firstly, the team needed to communicate the product’s multiple benefits including savings, insurance, and its function within the Dash mobile wallet. Secondly, the product needed to be simplified and accessible in a world of complicated financial jargon. Finally, it needed to address the heavy topic of insurance, especially to first-time insurance customers.

Standing for Protect, Earn, Transact, Dash PET was conceptualised and created by the Singtel Dash marketing team to marry the multiple product benefits in a simple, relatable word. Inspired by trending online searches, research showed that more Singaporeans were turning to pets for companionship during the COVID-19 pandemic. In that same manner, Dash PET aims to be a product that stays right by consumers’ side throughout their financial journey while engaging and encouraging good financial behaviour.

Few financial products are designed to be visually creative, emotionally appealing, and simple enough for consumers new to growing and managing their finances. Singtel Dash wanted to close that gap and help anyone get started on a stress-free financial journey, regardless of where they are in life. Dash PET managed to break away from typical insurance marketing and give users an enjoyable experience.

The product was designed to simplify saving while providing a reliable companion for the users’ financial journey. The Singtel Dash design team created an egg that signifies the start of the journey, hatching into a quirky creature that evolves as a consumer continues to grow their savings via the mobile wallet. The experience is made more delightful through the simple, intuitive user interface.

Singtel’s Dash PET was brought to life with an unconventional yet extremely simple idea: “What if you had a pet that takes care of you?”, coined by creative agency Superson and production partner Tangent Singapore. The creature was given the persona of a loyal companion that looks after you, sharing jargon-free financial ideas and communicating the benefits of protecting, earning, and transacting.

Understanding where the target audiences were most engaged, Dash PET built its engagement through advocacy and education: with a combination of social media campaigns, niche content creators, consumer reviews on Singapore’s biggest personal finance community platform Seedly (where the product was rated #1 in its category), and SGAG as a partner.

Antti Toivonen, Superson Singapore’s managing partner, and creative director, commented, “This is a lovely collaborative effort with Singtel and Superson’s specialist team together with Tangent to create an ever-evolving world around this cute pet character. ‘The pet that takes care of you’ is such a simple idea that it almost writes itself, and there’s a lot we can do with this concept over time. Coming from a film narrative background, I’m a big believer in creating characters and worlds that can have depth over time. That can help us make the traditionally complex category of insurance and finance more engaging and understandable.”

For more details on Dash PET, click here https://dash.com.sg/dashpet. This policy is underwritten by Etiqa Insurance Pte. Ltd. Terms apply. Protected up to specified limits by SDIC.

[1]Based on existing digital insurance savings plans available for new subscription. Information accurate as at 9 September 2021.

[2] For the first S$10,000 Account Value: 1.3% p.a. for the first policy year. Crediting rates are non-guaranteed. Additional 0.2% p.a. to the existing 1.3% p.a. returns for the first S$10,000 Dash PET savings during the first policy year while the complimentary Death & Total and Permanent Disability protection is active. Complimentary protection sum assured is based on up to 5X of the first S$10,000 of the Dash PET Account Value. Complimentary Accidental Death coverage will be offered for the same duration if the user is not eligible for this add-on protection. Sum assured will be based on the user’s age and occupation.