MANILA, PHILIPPINES — The need to have money set aside for emergencies is one thing that Filipinos have learned in light of the uncertainties brought about by the COVID-19 pandemic.

Although the average Pinoy may have set aside money one way or another, this is most probably kept in their “alkansya” (coin bank) or stashed away in a corner of their house instead of being safely deposited in a bank.

In the latest Bangko Sentral ng Pilipinas Financial Inclusion Survey (2019), only 12.2 percent of the surveyed adult Filipinos 15 years old and above have bank accounts.

Recognizing the need to educate Filipinos about saving and putting their money in the bank, the Philippine Deposit Insurance Corporation (PDIC), the state deposit insurer, has taken on the role of promoting savings consciousness amongst Pinoys through its new campaign.

Partnering with DDB Group Philippines, PDIC came up with its 2021 campaign, ‘Maniguro, Magbangko’ that aims to promote the habit of saving in banks among ordinary Filipinos.

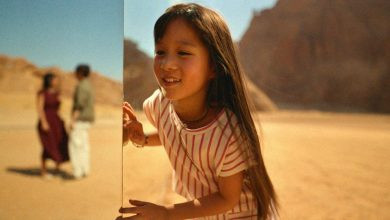

The nationwide campaign consists of two television commercials (TVCs) directed by multi-awarded film and TV director Sheron Dayoc, and three radio ads designed to strike a chord and resonate with existing and potential bank depositors, and show the unbanked the benefits of using the services provided by banks.

PDIC Vice President for Corporate Affairs Jose G. Villaret, Jr. said the new campaign is geared towards promoting financial inclusion among Filipinos from all walks of life and, at the same time, familiarizing them with the PDIC, and the benefits and limitations of deposit insurance.

“We saw the importance of having some form of savings during the strict quarantine periods. Those who set aside some funds were the ones who were able to successfully weather the impact of disruption in businesses and financial flows. In this campaign, we want to tell people that they need to save their money in a bank where it is safe from loss, theft and other threats like natural disasters. Moreover, PDIC as deposit insurer assures the depositing public that their deposits are protected by PDIC with deposit insurance up to PhP500,000 per depositor per bank,” said Villaret.

DDB Group Philippines Group Chief Culture Officer and Project Lead Anna Chua-Norbert feels fortunate that DDB has been entrusted with such an important communication campaign that will positively impact the lives of Filipinos.

“We believe that financial inclusion is a basic need. As such, we want to see the campaign encouraging more Filipinos to open bank accounts that will enable them to avail of financial services that will help better their lives. With the safety net that PDIC provides all bank depositors, being able to save in a bank will definitely give Filipinos an equal fighting chance to enjoy a comfortable life with less worries,” said Chua-Norbert.

The campaign also conveys that opening a bank account has been made more accessible and easier, thanks to the new “Basic Deposit Account” framework of the Bangko Sentral ng Pilipinas, which does away with the prohibitive ID and deposit requirements as a barangay certificate and a P100 initial deposit will already enable one to open a bank account. This Basic Deposit Account is available in select banks nationwide.