DHAKA, BANGLADESH – Bangladesh has always held a high place in the world rankings when it comes to child marriage within its borders.

The main reason behind underage marriages are parents in the poorer rural communities of Bangladesh areas, where most if not all, believe girl children to be a burden on their parents’ limited earnings.

This was found to be especially true for daily wage earners, who as many know, flock to metropolitan cities for work. However, as multiple COVID-19 lockdowns took away their sources of income, they were forced to migrate back to their villages across rural Bangladesh.

Once back, with dwindling savings and mouths to feed, many parents opted to marry off their young girl children to rid themselves of the burden of paying for their education, upbringing, and the high dowry associated with a late marriage.

Doing so, not only robs the young women of their childhood and education, but also their health, and ambitions.

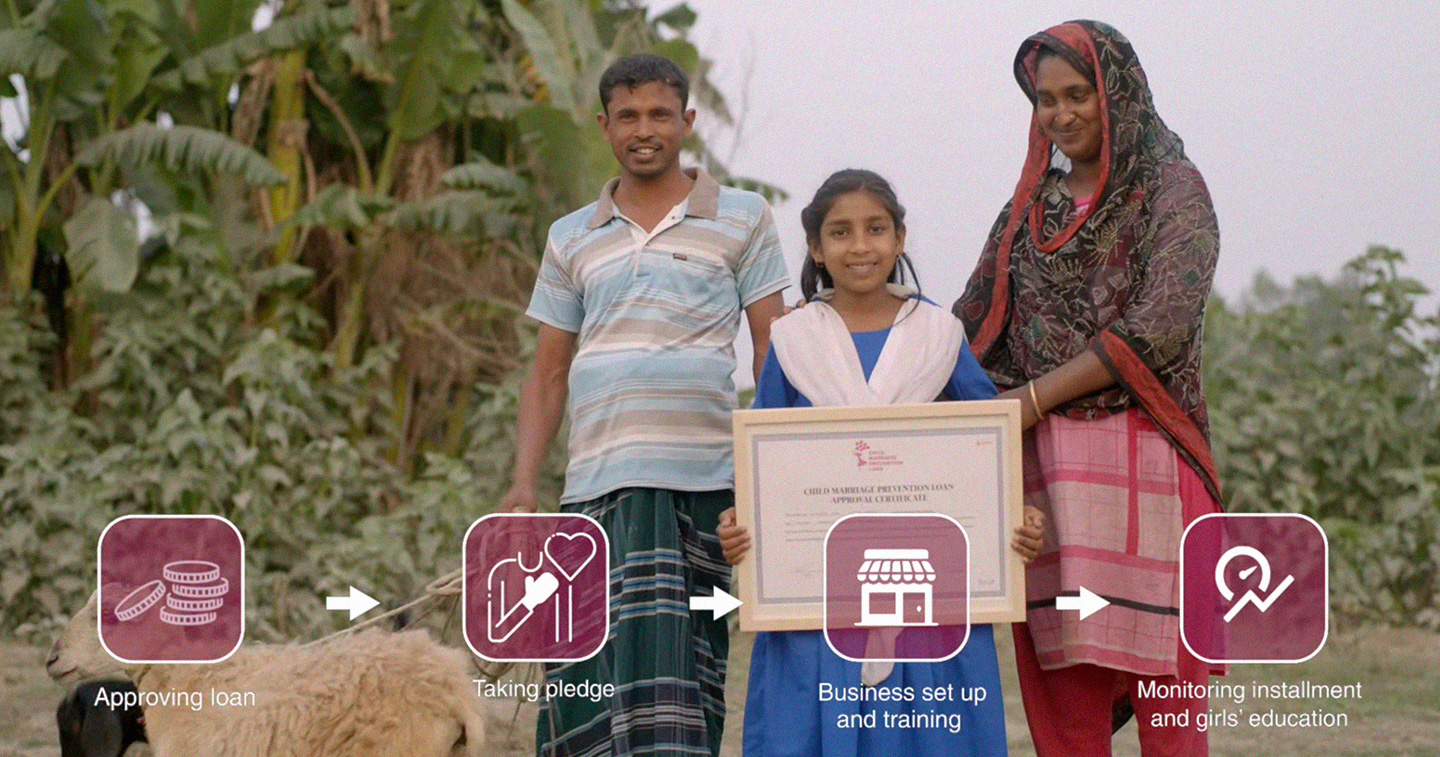

To combat this issue, IPDC, one of Bangladesh’s largest non-banking financial institutes and the Amal Foundation, an NGO specializing in preventing child marriage came up with a unique initiative – the Child Marriage Prevention Loan by IPDC, powered by Amal Foundation. As the name suggests, the initiative is one that provides underprivileged parents with a zero interest, zero collateral, conditional microfinance loan with an aim to eliminate child marriage.

Launched in the Bogra District of northwestern Bangladesh during the month of March 2022, the initiative gives underprivileged parents the opportunity to set up their own sustainable businesses if the conditions of the loan are followed. The conditions are as follows:

- Loan applicants must be parents of a girl child aged 12-18 years.

- The girl child cannot be married before the legal age.

- The girl child must be educated until end of high school.

With both a financial partner (IPDC), and a local logistics partner (Amal Foundation), the initiative involves receiving, verifying, and approving loan applications from interested parents based on the above-mentioned conditions. Once verification and background information is collected, loan recipients publicly pledge in front of their communities to uphold the conditions. After receiving the loan from IPDC, the Amal Foundation steps in to provide operational training and to set up sustainable businesses for the parents.

Soon, after a 30-day grace period, the Amal Foundation, on behalf of IPDC, starts collecting weekly loan installments while monitoring the girl’s education and her parents’ business. The collected installments are then recycled to finance more loans for other interested parents, making the initiative a self-sustaining one.

Through the Child Marriage Prevention Loan, IPDC, and the Amal Foundation hope to help eliminate discrimination by turning girl children into assets and alleviate poverty by providing a fixed income source to underprivileged families across rural Bangladesh.

CREDITS

Grey Bangladesh

Client: IPDC Finance

NGO: Amal Foundation