Leading insurtech startup Saphron has announced that it is on track to sign up one million microinsurance policies through NAN.AI, the artificial intelligence (AI)-powered platform it developed for CARD Pioneer Microinsurance Inc. (CPMI), the Philippines’ first and leading microinsurance company. The partnership expects to hit the 1-million-policy milestone by the end of the year.

“NAN.AI allows CPMI’s agents not only to onboard more clients faster, but it is intended to enable them to serve more areas with uninsured populations,” said Lorenzo Chan Jr., CEO of Saphron. “Our target to onboard one million new policies by year-end will reinforce Saphron’s commitment to be responsive and make insurance radically accessible to agents and their clients alike.”

NAN.AI is a play on the Filipino word “nanay”—which means “mother”—given that many of CPMI’s microinsurance agents are also mothers. The platform’s AI-powered interface optimizes the client onboarding process, allowing nanays to sell microinsurance products and complete enrollments in a matter of minutes. This technology enables nanays to be more efficient in onboarding, communicating, monitoring, and serving their clients.

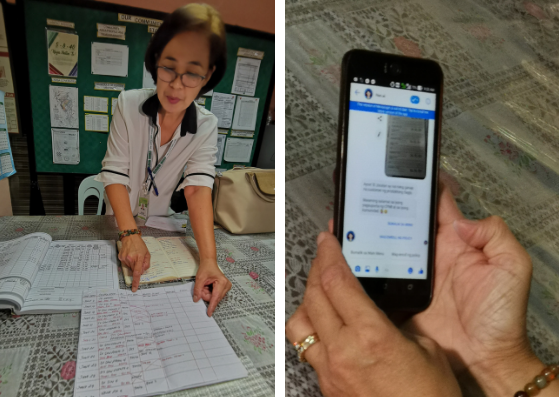

With a digital interface powered by AI and other deep technology, nanays no longer need to manually encode documents or keep handwritten records. This increases their efficiency—and ultimately, their effectiveness—in discharging their tasks when servicing the customer. The digital platform also takes into account infrastructure limitations in the areas that nanays serve. In fact, agents who rely on Free Facebook will still be able to use NAN.AI and benefit from technology.

“While the technology powering NAN.AI is complex, it has a very simple mission: to empower our nanay-agents and make their lives easier,” said Dr. Jaime Aristotle Alip, Founder of CARD MRI, the parent company of CPMI. “Whereas nanays previously had to bring large amounts of documents around to serve their clients, the NAN.AI platform allows them to deliver these services with only their mobile phones. The efficiency NAN.AI brings to our nanays allows them to perform their jobs faster, giving them more time to serve the community or spend with their own families.”

A 10-10-1 insurance fastbreak

As the country’s leading microinsurer, CPMI has made massive strides in bringing microinsurance to uninsured communities around the country.

“NAN.AI is placing this mass deployment of microinsurance on hyperdrive under a 10-10-1 model: as low as 10 dollars to purchase (the insurance product), 10 cents to process, and one minute to enroll. The utilization of NAN.AI will make insuring Filipinos a more seamless process,” said Winston Damarillo, Chief Strategy Officer of Saphron.

“Protecting lives and property doesn’t have to be expensive or intimidating; in fact, it costs more to be unprotected when emergencies occur. NAN.AI is a prime example of tech laying down the last mile, leveraging deep technology to spur financial inclusion, and in this case close the protection gap for the most vulnerable,” Damarillo added.

In May 2019, Saphron announced that it had received an investment of some PHP10 million (US$200,000) by CARD MRI Insurance Agency, In c. (CaMIA), the insurance arm of the CARD Group, and other key shareholders of CARD MRI, precisely to leverage technologies such as NAN.AI to bring microinsurance to the millions more who are uninsured in the Philippines.

Heightening insurance consciousness amidst typhoon season

The commitment to onboard one million clients comes at a time when there is heightened insurance consciousness amidst typhoon season in the Philippines. The London-based Lloyd’s market had earlier placed insurance penetration in the Philippines at less than one percent, noting the country’s great vulnerability to natural calamities and other potential disasters. At least 20 typhoons, several of which are of substantial intensity, enter the Philippine Area of Responsibility all year round, resulting in widespread destruction to crops and property, causing injuries and deaths.

CPMI has been at the forefront of insuring low-income Filipinos against calamities. When Super Typhoon Yolanda (international name “Haiyan”) battered the Philippines in 2013, CPMI disbursed over PHP120 million in claims.

CPMI’s most popular offerings include the Sagip Plan, which offers coverage for personal accident, funeral, and property damage arising from natural calamities—including typhoons—for families. Other CPMI products that nanays offer include the Kabuklod Plan, a group insurance covering personal accident, funeral, and damage from fire; and CARD Care, which bundles personal accident benefit with a daily hospitalization benefit.

Thanks to NAN.AI, CPMI’s nanays will be able to bring these products to their communities and onboard clients in real-time.

“There’s a strong case to make insurance radically accessible to the masses. We are a country exposed to numerous calamities, and yet many remain without the financial protection and safety net they need especially when they need it most,” said Chan.

“It often takes just a single unplanned episode—a calamity, an illness, a fire or, an accident —to plunge an entire household into crippling debt. This is what makes our work at Saphron even more urgent: to find different ways of making insurance accessible and convenient, and bring financial protection and inclusion to those who will benefit from it the most,” Chan closed.

Months to seconds. Where the paperwork used to take months, AI, robotics, analytics, and chatbots—highly advanced “deep technology” underneath NAN.AI’s simple user interface—is now making it possible to enroll clients in mere seconds. The connectivity requirements are so efficient, nanays can even use free Facebook to enrol their clients.

Mission-critical. Nanay Ruby holds up the insurance certificate covering her husband, a security guard. The most vulnerable need insurance the most, and new combined technologies are delivering the urgent, last-mile need with greater efficiency.

Saphron x CPMI. Saphron technology in the hands of CPMI agents like Nanay Josie (left) will make microinsurance coverage even more accessible and inclusive for her clients.