MANILA, PHILIPPINES – Despite the worldwide boom in online retail over the past years, shopping in physical stores is still key for consumers worldwide – but only if the purchasing experience integrates all sales channels, innovative technology and data-driven incentives. These findings are part of a global study of 6,000 consumers in select countries in Europe, APAC and the Americas, commissioned by Wirecard, the global innovation leader for digital financial technology.

“Our research has revealed that consumers clearly desire choice when completing purchases. Consumers shop in many different ways nowadays and this is challenging merchants to meet a widerange of retail demands,” commented Markus Eichinger, EVP Group Strategy at Wirecard. “A lot of focus is put on pricing, but not necessarily on the flexibility customers seek. A unified commerce strategy, with a focus on a consistent and frictionless buying journey, is integral to offering consumers the experience they would expect from any modern retailer. In the future, brick and mortar stores will only exist if they are technologically advanced with the latest in-store innovations and a fully integrated e-commerce backend.”

Key findings:

- Consumers need consistent offerings across all sales channels:

62% of shoppers in Philippines are most likely to purchase both in-store and on mobile apps over the past 12 months, showing that consistent cross-channel experiences are vital to consumers. 9-in-10 either research the products they want to purchase online before buying in-store afterwards (96%) or vice versa (97%). Filipinos would prefer to use an app or the store website via their phone (87%) to do research while in-store, compared to other methods like in-store screens or a VR booth. - Merchants not offering Unified Commerce possibilities will lose out:

The rise in popularity of more advanced cross-channel purchasing options, such as buying online and then picking up in-store (BOPIS), further supports this finding. 42% of Filipinos purchase through click-and-collect options, where they buy online and collect in-store. 87% of respondents in Philippines say that if a brand or merchant doesn’t offer these kinds of options, it would have at least some influence in their decision to shop there.

- Shoppers are “always on” so maintaining an up-to-date online shop is key:

While physical stores are the preferred buying location, how and when people find goods varies, with online browsing offering shoppers the most convenience. Consumers will shop online most often while they are relaxing (77%), in bed (63%), watching TV (56%). - On average, Filipinos order products from a foreign website 20 times a year, with half (59%) doing so at least once every month They do so to get products not available locally (74%) or are cheaper (31%). However, majority of shoppers (96%) indicated that the lack of a familiar payment method would influence their decision to order products from a foreign website.

- Consumers appreciate data-driven services and offerings:

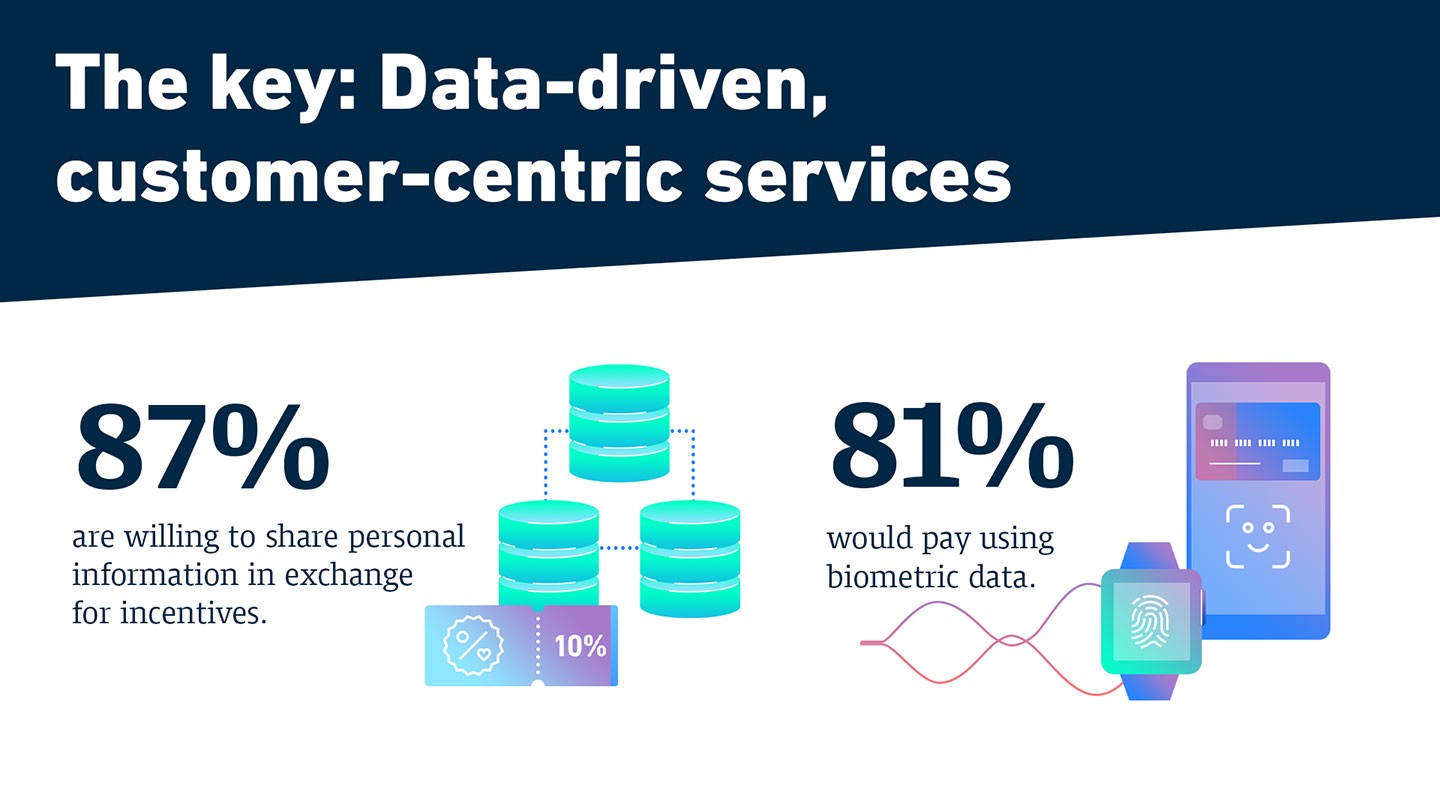

The vast majority of consumers value data-driven, customer-centric value-added services with loyalty programs. 87% of Filipinos reported that they would be willing to give retailers personal information in exchange for incentives such as a larger discount. Most Filipino shoppers (92%) use loyalty programs, with 40% preferring to accumulate loyalty points through their mobile apps and phone numbers, similar to countries like Hong Kong and Singapore. - Cashless payments are omnipresent:

Nearly all (90%) respondents are now using cashless payment methods when they shop in physical stores. The main reasons for paying cashless in-store is speed (35%), convenience (35%) and security (17%). More than half (65%) of the Filipinos surveyed indicated that they are less likely to shop at a physical shop if it did not offer ways to pay via their mobile phones, compared to the global average of 45%.

Other key findings from the research include:

- 81% of Filipinos are interested to use biometric data e.g. facial recognition, fingerprint) to purchase products in-store and online

- Consumers would spend an average of PHP 354 more if the payment is authorized with biometric data compared to a cashless payment that does not need authorization

- When shopping in-store, Filipino’s’ preferred method of payments are: swipe debit/credit card (60%), mobile wallets (50%), gift cards (28%) and QR code (28%)

- 79% are interested to use technologies like mobile apps, smart mirrors and VR while shopping

- Filipinos are very environmentally conscious, with 88% citing that being environmentally- friendly is a major purchase factor and 93% of respondents saying they would be willing to pay more for these products. On average, Filipinos are willing to pay the most (12.93% more) for the products if they knew the products were produced in a more environmentally-friendly way

“Retailers that want to engage with their customers via targeted offers, and improve their service across all channels need to leverage on customer data. Our report shows that if customers can see a concrete benefit when it comes to providing personal information, they are willing to share it with retailers, thus providing merchants critical data which they can analyze to optimize their offerings and improve customer loyalty,” continued Markus Eichinger.

The Wirecard digital financial commerce platform allows merchants worldwide to easily combinetheir distribution channels and meet the needs of today’s consumers. Wirecard offers a constantly expanding ecosystem of real-time value-added services built around innovative digital payments.

The international survey was carried out by Vanson Bourne on behalf of Wirecard in Q4 2019. A total of 6,000 consumers over the age of 18 in select countries like Australia, Brazil, France, Germany, Hong Kong, Malaysia, Philippines, Singapore, Thailand, the U.K. and the U.S. provided answers. For further insight and more information about consumers’ shopping behavior, download the Wirecard Global Shopping Report.