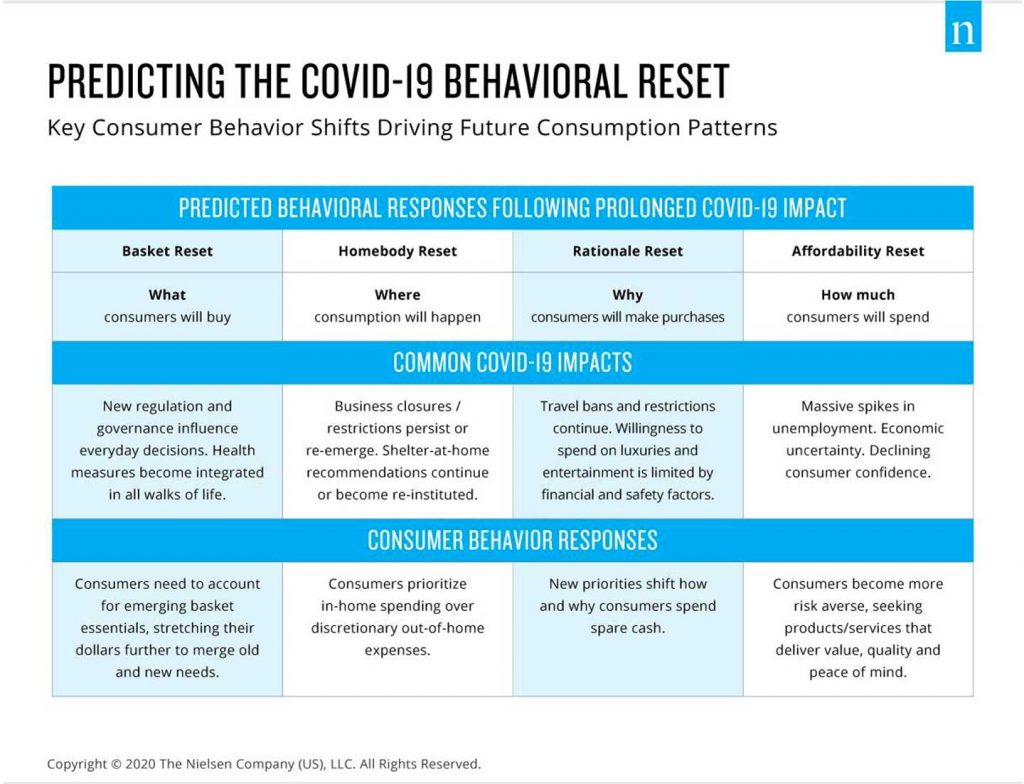

SINGAPORE–A new Nielsen study indicates that the news cycle related to COVID-19 transmission no longer influences trends on the FMCG market in Southeast Asia — rather, new socio-economic and behavioral patterns have come into play and are shaping the future state of the industry. The basket reset, homebody reset, rationale reset and affordability reset, underpinned by worsening unemployment situations and uncertain financial prospects in Southeast Asia, are the new drivers of consumption patterns.

The study presents how behavioral responses could differ according to the circumstances and level of personal impact the pandemic has had on consumers. Predictions are made across the spectrum of two, polarised consumer groups: viz. Insulated spenders and constrained spenders. Across Asia nearly two out of every five consumers (38 percent) said they have been impacted by Covid-19, versus 32 percent consumers globally.

Basket reset. Nielsen anticipates that consumers will start to re-prioritize what goes into their baskets, and that broad-based adjustment reflects a fundamental consumption reset. Throughout measured Southeast Asian markets, key FMCG categories like alcohol (-9%), health care (-3%), personal care (-5%), and beverages (-8%) are seeing sales declines in the year-to-date period ended in June. Nielsen believes these trends reflect signs of consumers pulling back and minimizing added basket expenses brought on by the pandemic. Stockpiling behavior hasn’t persisted to the extent of March and April, reflecting the lack of correlation we had previously seen between news stories on the rates of virus transmission and FMCG sales spikes. It also signals that the basket composition is being reset, and consumers will place additional scrutiny on basket decisions now and moving forward.

“As consumer response deviates from the news cycle, the building blocks of the everyday shopping basket have bent in the face of economic downturn and transformation of the workforce,” says Scott McKenzie, head of the Nielsen Intelligence Unit. This caution will alter where and how households continue to pad their pantries and shelves amid COVID-19. According to McKenzie, “Decisions will need to be made to reconcile purchase habits people have had in place for years alongside today’s new reality where health and value priorities compete side by side.”

Homebody reset. Another consumer shift that Nielsen predicts will reshape FMCG markets is the evolving routines of consumers at home. ‘Do-it-yourself’ (DIY) behaviors and demand for in- home branded experiences have persisted even beyond living restrictions and store re- openings in many Southeast Asian markets.

In the Philippines 24 percent of consumers switched pack sizes, suggesting that they are seeking FMCG that suit homebound lifestyle. Across Southeast Asia consumers continued to demonstrate a focus on in-home consumption, where food and dairy saw strong uptake in markets like Singapore (up by 42.6% vs last year), the Philippines (11.4%) and Malaysia (6.8%). 1 In Malaysia, sales of hair colourants increased by 22.8% as consumers opted for hair grooming at home, similarly in Singapore at home eating led to an increase in consumption of processed frozen food (sales up by 113.7%). In Vietnam, 82% consumers said to reduce out-of- home consumption occasion 2 , corresponding to heightened sales of instant noodles (up by 14.1% vs last year), sterilised sausage (17.9%), meal maker (7.4%) and mayonnaise (31.0%).

“Companies that can intelligently align with DIY behaviors will succeed in empathizing with current consumer interest in creative, cost-conscious and safe consumption. Consumers are already willing to do the legwork to bring a product experience into the safety of their homes. Therefore, companies have the opportunity to seize that interest and respond with affordable, accessible and branded take-home experiences,” says McKenzie.

Rationale reset. Consumers may soon redefine the significance and meaning of the FMCG goods they buy. As measured via The Conference Board conducted in collaboration with Nielsen, 83% of consumers in Asia Pacific said they were cutting down their expenses in Q2 2020 (vs. 73% in pre-pandemic Q4 2019), and among surveyed consumers who have changed their spending, 30% or more are spending less on take-away meals, holidays, out-of-home entertainment and new clothing. Nielsen predicts that consumers will turn to consumer goods as a means to fulfill emerging entertainment and experience gaps in smaller ways.

Analysis in the U.S. highlights examples of how consumers of key leisure and lifestyle activities hold the potential to trade up their FMCG product repertoires to compensate for the larger dining or vacation experiences they can no longer safely access. U.S. consumers who went on foreign travel in the last 3 years are 21% more likely to purchase artisan bread and 11% more likely to purchase sushi than the average American. Similarly, Americans who visited restaurants in the last 12 months are 15% more likely to purchase cheese party platters and 10% more likely to purchase alcoholic beverage mixes than the average American. Across Southeast Asia, there are already signals of strong demand for FMCG categories that could benefit from this rationale reset: key segments in Singapore have experienced an acceleration in sales during the year-to- date period ended in June including snacks (+25%) and alcohol (+15%).

“Consumers throughout the region are constrained to spend as every purchase holds greater significance, while those consumers who remain insulated too will justify premium spending based on benefits and convenience,” says Vaughan Ryan, Nielsen’s Managing Director for Consumer Intelligence in Asia.

Affordability reset. With less disposable income in their pockets, consumers will search for ways to optimize their basket spend to prioritize both health and value needs. More than one- third (36%) of surveyed consumers in multiple markets around the globe have noticed a decline in promotions across stores they’ve shopped at, and retail measurement confirms it. Nielsen has observed a historically low level of trade promotion activity across various countries. Channel preferences are also shifting as the criteria for affordability evolves in the minds of consumers.

In Malaysia, mini-marts are gaining importance with almost 18% rise in sales in June 2020 (versus 9% last year) as these outlets provide close-to-home access for everyday grocery shopping at desired pricing in comparison to distanced large-format stores. In Vietnam, Modern Trade channel posted positive sales growth in YTD June 20 (+13% value sales vs last year) with number of stores on constant rise (+35% stores in Jun 20 vs Jun 19), driven by the mini-mart format (+51% stores in Jun 20 vs Jun 19).

“As consumers become more discerning in their purchasing decision, FMCG companies need to think about their offering tailored to consumers’ priorities, simplify omni-channel fulfillment and enhance shopping experiences in the new reality.” notes Vaughan Ryan.