By Arthur Policarpio

I belong to an industry that is dying a slow, painful and agonizing death.

Yes, I am in the digital business – the hottest industry in the world right now. Yes, I do have ownership of two currently strong digital agencies, with a combined workforce of close to 100 people. Yes, we are growing. Mobext, a mobile-first marketing solutions company that is a subsidiary of the Havas Group, is winning clients at a rate that will make us the biggest independent digital agency group in the Philippines in a couple of years.

Yes, my other agency, Snapworx Digital, is rapidly growing, winning the war for the neglected, tier 2 clients – the small and medium enterprises which are largely ignored by the bigger agency groups.

But the fact remains that these two businesses belong to a larger industry – the advertising agency industry, to be precise – that is undergoing a technology-driven, transformative and gut-wrenching shift that may kill off many traditional advertising outfits who are not able to adjust.

40% Stock Price Drop in 19 Months

Take a look at the king of all agency groups, WPP. In the past 19 months, the stock price of WPP has dropped a staggering 40%. From a high of 1,900 GBX per share on February 17, 2017, to only 1,165 GBX as of September 7, 2018.

Five years ago, on September 20, 2013, WPPs stock price was 1,293 GBX per share. This essentially means that the 130,000++ employees of WPP have failed miserably in the past five years to give WPP owners and investors any kind of decent returns in terms of market value growth. 130,000+ employees have failed to create any incremental market capitalization increase for WPP in five years.

Consulting Firms and Big Tech: 2 to 3.5x Growth in Five Years

Contrast WPPs stock performance in the past five years with those of the big consulting firms and big tech firms, and you will see the dramatic difference in market performance.

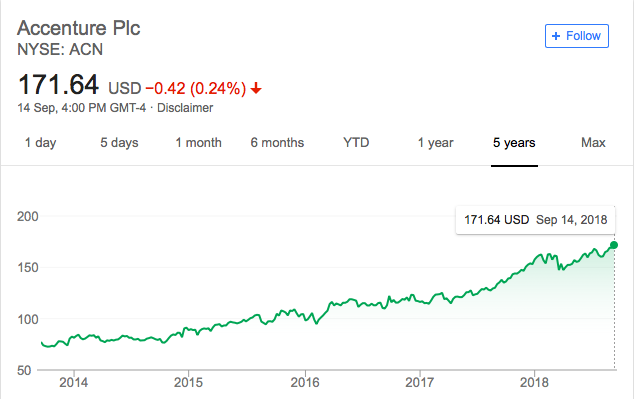

Consulting firm Accenture incidentally now owns the biggest digital agency in the world – Accenture Interactive – with $6 billion in revenues. In the same five year period, Accenture has more than doubled (2.2x) in terms of market capitalization, from a share price of only $77.32 in September 20, 2013, to $171.64 as of September 7, 2018.

The comparisons are even more dramatic if you compare WPP with the tech behemoths, Google and Facebook. In the same five year period, Facebook’s share price has grown almost 3.5 times: from $47.49 per share on September 20, 2013, to $162.32 per share as of September 7, 2018.

Google, on the other hand, grew its stock price in the same five year period 2.6 times: from $451 per share on September 20, 2013, to $1,178 per share as of September 14, 2018.

Why is the Agency Business Model Dying a Slow Death?

There are many factors that are leading to the slow demise of the agency business model. Competition is fierce – everyone is now essentially competing for a piece of the digital pie. Google and Facebook are going straight to the big advertisers and slowly cutting out the agency middlemen.

Beleaguered traditional online publishers – their display advertising business having a hard time competing with the scale and efficiencies of Google and Facebook – are entering the agency space, offering their own branded content marketing services.

Telecom operators, grappling with the problem of declining margins due to a shift to capex-heavy, mobile data-driven services, are looking to get a piece of the advertising pie by creating their own specialist mobile advertising units.

Finally, even some clients themselves are completely cutting out the agency – setting up their own in-house creative shops, as well as creating their own in-house programmatic buying teams.

Amidst all this competition, traditional advertising agencies struggle with declining fees due to client-procurement driven pitches, as well as increasing compensation costs due to the competitive war for talent as well as general inflation.

Is the Agency Model Really Dead?

Although the current agency business model is dying a slow, natural death, I do believe that some of the key services that agencies provide will always remain. There is no guarantee that existing traditional agencies will be the ones to dominate these services in the future. But whatever the case, I do think that there are five key services that will always remain and will always be valued by clients:

Expert advice on digital will always remain a necessity for clients. Clients will always need in-depth advice to navigate the complexity of digital. Digital will not become simpler, in fact it will become more complicated. New platforms, new features, new technologies, will always emerge. Deep expertise is needed to navigate this.

Platform-neutral communications planning will always be needed. Clients cannot place their bets on a single platform. If they do, they will have entrusted their digital future to a few powerful digital tech platforms who may change the rules in a whim. Eyeballs can shift, new platforms can emerge. Clients will always need platform-neutral advice and planning.

Creativity and ideas will always remain at the heart of every powerful advertising campaign that will move hearts and make people whip out their wallets. I truly believe that ideas can never be replaced by technology and AI. True there are now AI creative bots and platforms, but I highly doubt that these can replace the magic behind the rare genius of a seasoned creative.

Clients will always need to build new digital experiences. There will always be the need to build digital experiences on top of various platforms. Today, these are apps, chatbots, websites, virtual reality experiences, and the like. Tomorrow, these may be completely different experiences altogether. But the bottomline is that clients will always need to build something. User experience, mastery of tech platforms – these will remain necessities, the only question is who will end up doing it (clients? Agencies? consultancies?).

Finally, content will always remain king. To win in the digital age, brands need to create meaningful content that will resonate with customers. I do believe that the future remains with mastering content creation and distribution. People will always consume content. People may hate digital ads more over time, but they will always love great content. The future therefore, belongs to those companies who can help brands and business create meaningful content and experiences that people will absolutely love and share.

How Can Agencies Create Meaningful Market Value in the Next Five Years?

To create meaningful value over the next five years, I believe that agencies need a fundamental shift in its business model: how we make money, how we charge clients, how we structure our services.

The hourly-based fee model and the commission on media spending model for me are all relics of the past – to create breakthrough growth, we need to re-invent how we as an industry make money.

Why can’t agencies become “growth partners” of clients, similar to how consumer product companies treat powerful distributors and retailers? If we are able to quantifiably grow sales, why can’t we be compensated based on the incremental value we create?

Why do agencies have to remain middle men – distributors of brands content over other companies’ platforms? Why can’t we become the platform ourselves? Why can’t we invent the next Buzzfeed? Why can’t we become the owners of the content ourselves?

The Agency will Live. Long Live the Agency!

Agencies will continue to live – and thrive even – provided we do not remain middlemen in the entire digital supply chain. We need to move beyond an arbitrage model, to a model where we own a larger piece of the entire value chain.

That’s why I do think that Havas and Vivendi’s model – the merging of content creation, marketing and distribution – is the future of the agency business. Whoever controls the digital content supply chain – from creation, to marketing, to distribution – will control the future.

About the Author

Arthur Policarpio is the CEO of Mobext, one of the leading mobile-first marketing solutions agencies in Asia | Digital, Mobile Marketing, E-Commerce Pioneer in Asia with 16 Years of Experience.