PARIS, FRANCE – Havas continued its strong performance in the first quarter of 2025, posting organic growth of 2.1%, which is in line with its full-year guidance. Overall growth came in at 5.2% when including the positive impact of recent acquisitions and currency effects. The company has reaffirmed its full-year targets for 2025, showing confidence in its ongoing momentum.

Yannick Bolloré, CEO and Chairman of Havas, said: “Havas has made a good start to 2025, maintaining its momentum and generating organic growth in net revenue of 2.1% and growth of 5.2% as reported. This performance, in line with our targets, reflects our business momentum, particularly in North America and Latin America, as well as progress on our bolt-on acquisition strategy. We continue to focus on the Group’s development, through the global roll-out of our ‘Converged’ strategy and operating system – which is powered by the best data, tech and AI – the expansion of our capacity in high-growth sectors, and an unwavering commitment to creative excellence. We are therefore confirming our objectives for 2025, while keeping a close eye on the global geopolitical and economic situation, in order to respond quickly and effectively, supporting our clients and teams in this context. I’d like to thank our clients for their trust, and highlight the dedication of our talented teams worldwide, who are key to our success.”

Business Review

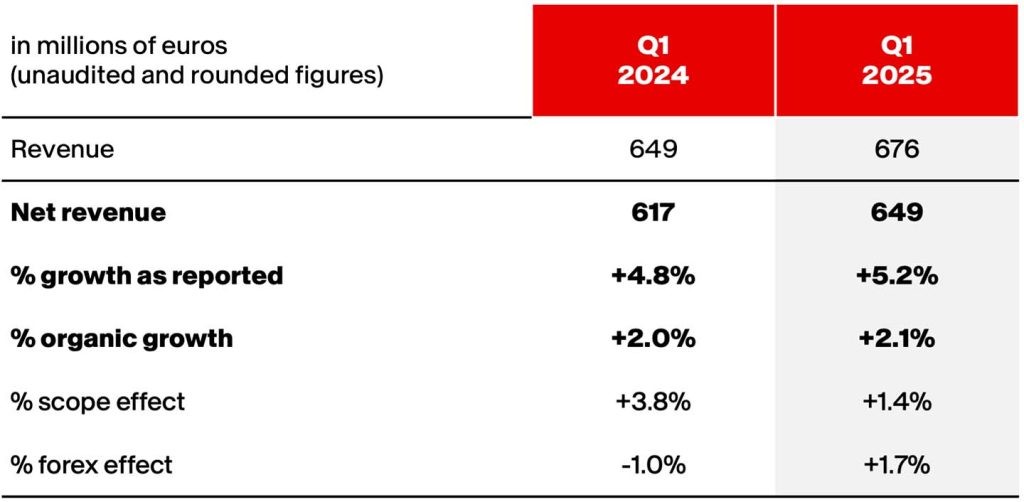

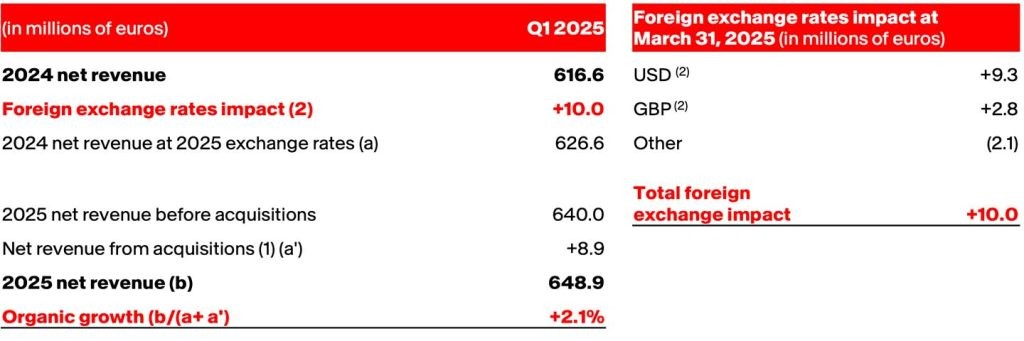

Havas recorded a good level of activity at the start of the year. In the first quarter of 2025, it posted net revenue of 649 million euros, up 5.2% as reported compared to the same period of 2024. During the period, Havas saw a return to organic growth, with net revenue up 2.1% compared to the first quarter of 2024. Changes in the scope of consolidation had a positive 1.4% impact on net revenue, while changes in foreign exchange rates (US dollar and pound sterling) had a positive 1.7% impact. Revenue for the first quarter of 2025 totaled 676 million euros, up 4.0% as reported compared to the first quarter of 2024 (up 1.0% on an organic basis).

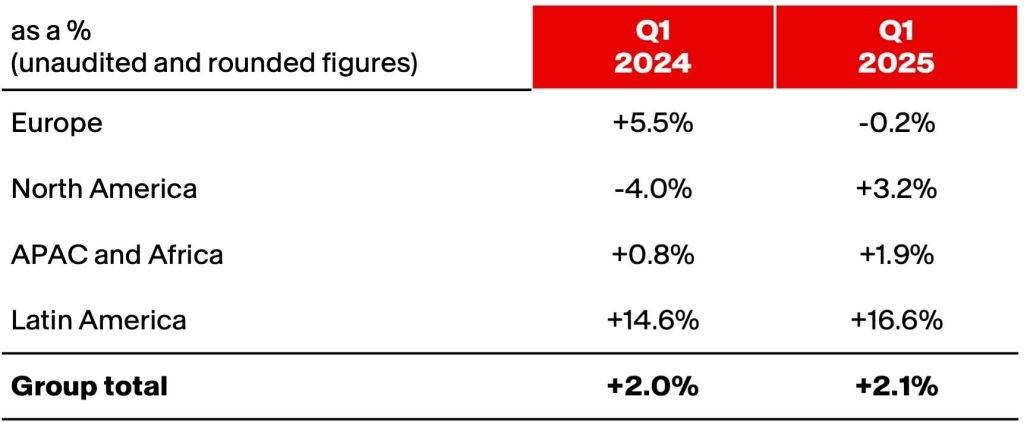

Organic Net Revenue Growth by Geographical Region

Europe: In the first quarter of 2025, net revenue contracted by a slight 0.2% in Europe on an organic basis, compared to the same period in 2024. Net revenue was up slightly in France (thanks in particular to Havas Media), but inched down in the United Kingdom (Havas Creative and Havas Health).

North America: The region had a very good start to the year, turning in markedly positive organic growth of 3.2% versus the same prior-year period, driven by double-digit organic growth at Havas Health (favorable basis of comparison).

APAC & Africa: The region continued to post satisfactory organic growth, with net revenue up 1.9% year on year, driven by Havas Media.

Latin America: The region once again delivered very strong organic growth, coming out at 16.6% in the first quarter of 2025. This excellent performance is driven by Havas Creative and Havas Media, which both recorded double-digit organic growth.

First Quarter 2025 Highlights

During first quarter 2025, Havas continued its bolt-on acquisition strategy, acquiring majority stakes in three agencies: CA Sports (Spain), an agency specializing in sponsorship strategy and business development through sports, which joined Havas under Havas Play, the Group’s sports and entertainment network dedicated to connecting brands to audiences through their passions; Channel Bakers (United States), an award-winning e-commerce media agency and leader in retail media innovation, reinforcing Havas Market’s global offering; this agency is an Amazon Ads advanced partner; Don (Argentina), one of the most prominent, multi-award-winning creative agencies in Latin America, strengthening Havas’ global creative presence and reaffirming its longstanding commitment to investing in creativity.

Key client wins

Havas Media Network: Campos Coffee, Carl Buddig, Collegium Pharmaceutical, Dr. Theiss, Elizabeth Arden, Hourglass Cosmetics, Isdin, Liverpool, MagicBricks, PINSA

Havas Creative Network: Asahi, Carl Buddig, Citeo, Crivit (Lidl), EA Games, EDF, ETI Turkey, Free Telecom, Groupe Barrière, GMCVB, Jacuzzi, Nacional monte de Piedad, PKO Bank, Red Lobster, RTX, Uzbekistan Art and Culture Development Foundation

Havas Health Network: Danone Nutrition, GSK (Benlysta, Camlipixant), Merck (Enlicitide, Verquvo), Novartis (remibrutinib), Sanofi (Alphamedix), Takeda Pharmaceuticals

Recognition for Havas: The Group’s agencies also continued to excel in creative excellence, with Uncommon New York named “Agency of the Year” by Campaign, and Havas Play is once again the top French agency in the WARC Media 100 Ranking.

Outlook

Since early April 2025, macroeconomic uncertainty has been growing following the announcement by the US Administration of protectionist measures, potential or already in effect, and the reactions that these measures have triggered. As advertising is, by nature, a regional and/or local service business, Havas has not observed at this stage any direct impacts of the new tariffs on its business. Nevertheless, the Group is monitoring the situation closely and remains fully committed to supporting its clients during this time.

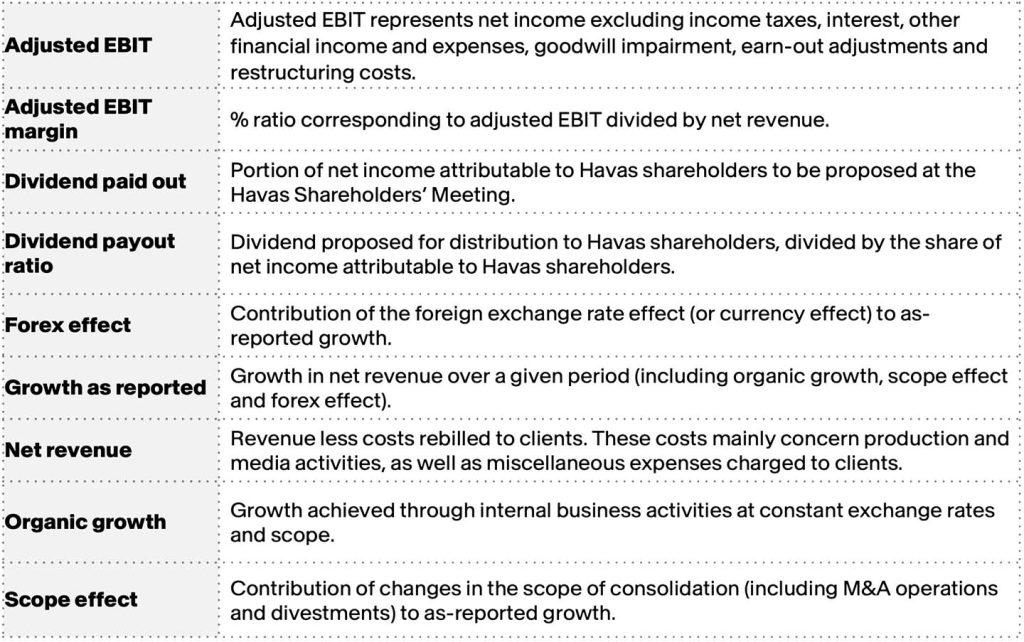

Today, Havas confirms its guidance for fiscal year 2025, namely: net revenue organic growth above 2% compared to 2024; adjusted EBIT margin between 12.5% and 13.5%; dividend payout ratio of around 40%. The Group also confirms its medium-term financial targets for fiscal year 2028: adjusted EBIT margin between 14.0% and 15.0%; dividend payout ratio of around 40%.