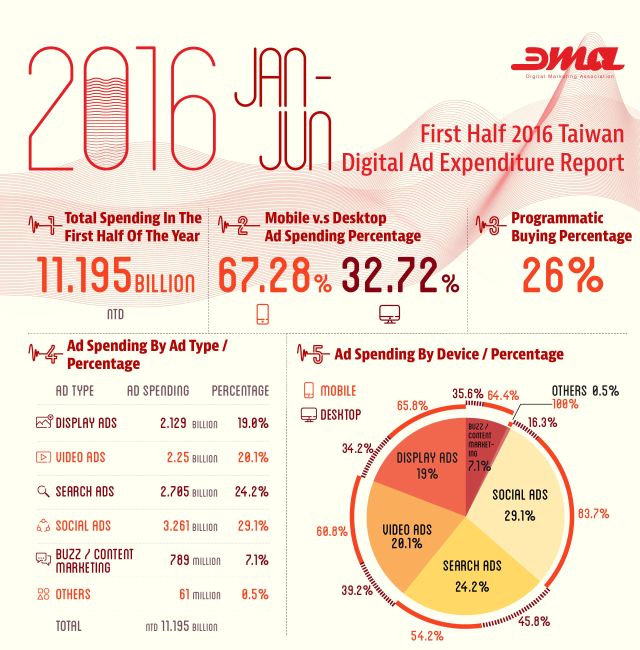

TAIPEI – Digital Marketing Association (DMA) unveils the ”First Half 2016 Taiwan Digital Ad Expenditure Report” and announced that Taiwan digital ad spending in the first half of 2016 has reached NTD 11.1 billion. Due to diversified types of digital marketing campaigns, three survey items are added to this year’s report, including social ads, content marketing (merged with previous “Buzz Marketing”) and others.

Compared to NTD 8.4 billion spent in the first half of 2015, the ad spending increased NTD 2.7 billion and grew by 32% (with new survey items included). Among all, social ads are the most popular choice of marketing method, accounted for 29% of total ad spending. Video ads have grown the most by 66%. Roi Chang, the Advertising Expenditure Survey Coordinator of DMA, has pointed out that according to the ad spending of major five media released by Nielsen Advertising Information Services in the first half of 2016, the ad spending of the major five media decreased by 12.5%. Broadcast television and cable television together made up NTD 11 billion, compared to NTD 11.1 billion surveyed by DMA. Now digital media ad spending has surpassed TV and became the top, making the ranking of ad expenditure reshuffled.

With marketing budgets have been affected by the economic downturn, digital ad spending surpassing TV has demonstrated the fact that digital media has become a key platform to reach the target consumers. Businesses are shifting marketing budgets to digital media accordingly.

Erica Lu, the Secretary-General of DMA, pointed out that “Excluding digital related industries, advertisers from other industries have realized the importance of digital marketing. How to intergrade the enterprise’s internal marketing resources and adjust the organizational structure, allowing creativity, technology and data to be closely incorporated– is the real problem that many advertisers are facing. The association would like to foster relevant communication within the industries by holding various events.”

1. Social Ad + Social Content + Mobile Device = The Golden Triangle of Social Communication

As Internet is widely used and information is more accessible to the public, consumers have more power to take initiative (to spread messages). They turn into active communicators, influencers as well as content providers. Multiple roles of consumers should be leveraged to strengthen the efficiency of social communication. Through content creation and ad placement via various social ad platforms, it will help advertisers reach the target audiences effectively and maximize the result through consumer referrals.

Ad spending on Social Ads and Buzz / Content Marketing accounted for 36.2 percent of the total digital marketing budget; it also reflects the importance of social marketing in the minds of advertisers. However, as the usage of social platforms among Taiwan public is quite concentrated, the marketing budget allocation also showed signs of concentrating on certain social platforms.

It might be worth pointing out that Social Ads being placed on mobile devices accounted for 83.7%, indicating the close correlation between mobile and social media. Not only just Social Ads, in this survey Mobile Ads are listed respectively under every ad category when conducting the analysis, the result showed the percentage of ads being placed on mobile all exceeded 60% in six categories. Ad expenditure that was generated from mobile has reached NTD 7.5 billion, accounted for 67.28 % of the total spending. Regardless of social platform or instant messaging software, nearly 80 % of consumers are using mobile devices to view contents and interact with others. Undoubtedly, mobile devices will become the first screen for consumers in terms of communication.

2. Video Ad Spending Continues, Making Solid Gains and Marketers Shift Ad Budget Away from TV

With millennials are poised to reshape the economy as potent shoppers, media and platforms keep moving forward to optimize their video service. There is a notable increase in the ad spending of Video Ads in the first half of the year, reached NTD 2.2 billion and grew by 66%. Video Ads are also the category among all six categories that grows the most by percent. In contrast with TV media, other than the Top 3 industry with higher investment on ad spending such as online game, Internet and web service, others are seeing a decrease in numbers. Consumer eyeballs shifting away from TV media also evidently spurs the media budget reallocation.

As streaming technology evolves, the quality of video gets improved along with the traceable evaluation mechanism and easy-to-share function. TVC or made-for-web video, as long as it’s creative enough, it can achieve a greater communication effect. The hot trends like–“Live streaming”and “web celebrity”prompt consumers to explore more video content and also open up more possibilities for video marketing campaigns.

Display ads slightly grew by 4% in the first half of the year in 2016. The uptick can be presumably attributed to Programmatic Buying and Native Ads. Programmatic Buying can assist advertiser to increase their ROI since it automates all of the processes and optimize the ad campaigns; Native ads manifest as online editorial content, with precise ad delivery, it helps maximize ad performance too.

According to the statistics DMA compiled, Programmatic Buying made up 26%. The key points of programmatic buying are being automated and real-time. It is not only about getting rid of unsold leftover inventory and earning revenue from click-per-cost (CPC). The other purpose is to filter out unnecessary noise though database, understand the intent of target audiences and improve the value of each ad impression. As Chang observed, performance-driven ad clients such as E-commerce and gaming brands will relatively have more ad budgets allocated for Programmatic Buying. “Don’t overemphasize technology. To dig into what consumers need is way more important.” Chang said.

Digital Market Trends

Looking into the second half of the year, Freda Shao, the Chairman of DMA, said that digital ads will increase 12%-15% for the year of 2016. In contrast with the number released by Strategy Analytics in July this year, digital ad spend globally will rise 12.6% and digital ad spend in Asia-Pacific will rise 18.1% in 2016. It indicated that the development of Taiwan’s digital ads align with the global trend in general.

Digital marketing technologies and applications keep upgrading with global trends. Though data analysis, we could learn more about the customer needs and use data to optimize brand experiences. That is the core value of digital marketing,” said Shao.

Shao also pointed out that with the growing popularity of Internet devices and related applications, messages from media have become quite fragmented. It becomes harder for advertiser to reach consumers by one single medium or device. Ways to reach target audiences and how to identify and connect consumers through the use of technology should be put into consideration when planning for the company’s digital strategy. Utilizing data to solve business problems and achieve marketing goals will be the new challenges to marketers.

*Definitions of Ad Types

1. Display Ads: Banner, Text-Link, Rich Media, and Native Ads

2. Video Ads: Online display advertisements that have video within them.

3. Search Ads: Paid Search and Content Match

4. Buzz / Content Marketing: Blog Marketing, advertorial, PR issue, public agenda and content sponsorship.

5. Social Ads: forms of online advertising with copy and an image that focus on social networking services

6. Others:eDM, SMS、MMS。

7. Programmatic Buying: the process of executing media buys in an automated fashion through ad platform such as Ad Exchange to facilitate the buying and selling of ad inventory across device, media network and ad space with a quicker and more efficient way to target the audiences.