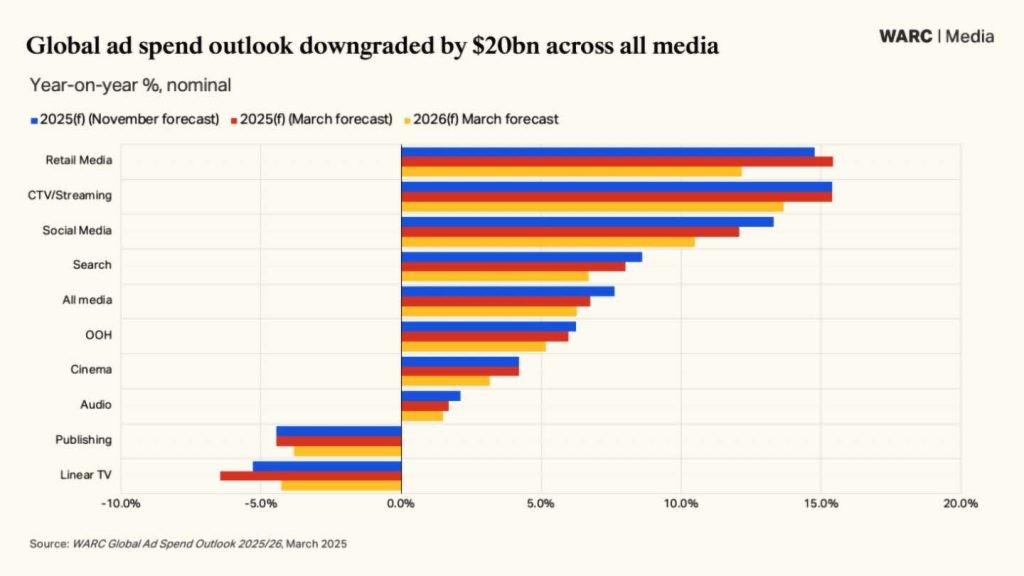

LONDON, UK – The global advertising landscape is bracing for impact as fresh forecasts slash growth expectations by nearly $20 billion over the next two years. WARC’s latest Global Ad Spend Outlook 2025/26 – Q1 2025 update reveals a significant downgrade, attributing the shift to escalating trade tariffs, regulatory headwinds, and growing economic uncertainty.

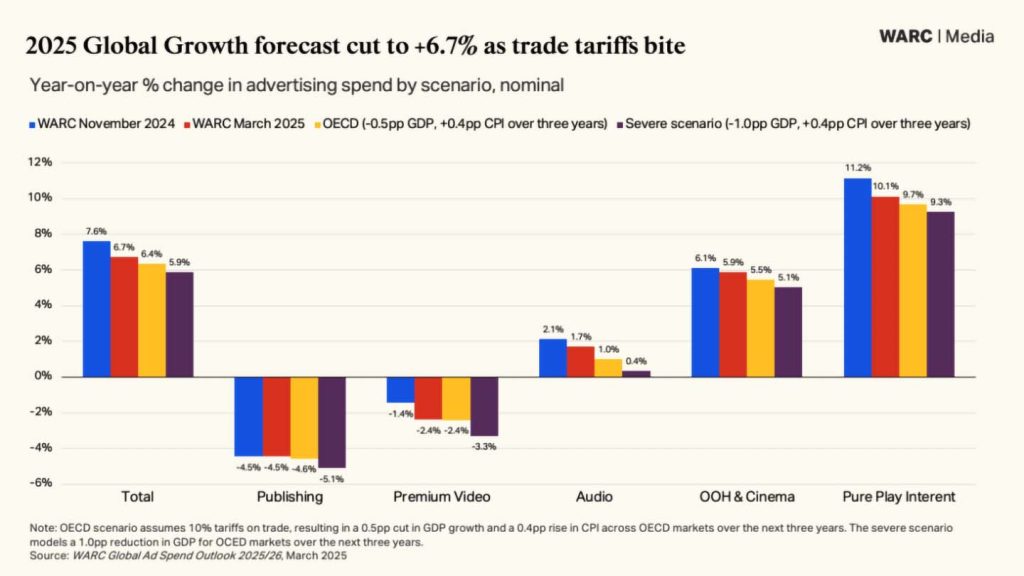

Global ad spend is now projected to grow 6.7% this year to $1.15 trillion, marking a 0.9 percentage point downgrade from WARC’s previous forecast. 2026 projections have also been lowered by 0.7 percentage points to 6.3%.

Key Points

- Trade Turmoil: New US tariffs, set to take effect in H2 2025, are inflating costs and disrupting key sectors such as automotive, retail, and tech.

- Regulatory Pressure: The EU is tightening its grip on Google and Apple, while ongoing US antitrust cases against Google and TikTok add further instability.

- Economic Uncertainty: A looming stagflation risk, compounded by weaker consumer and business confidence, is stalling market momentum.

James McDonald, Director of Data, Intelligence & Forecasting, WARC, and author of the report, says: “The global ad market faces mounting uncertainty as trade tariffs, economic stagnation, and tightening regulation disrupt key sectors – leading us to cut growth prospects by $20bn over the next two years. Automakers, retailers, and tech brands in particular are now reigning in ad spend amid rising manufacturing costs and mounting supply chain pressures.

“Despite the growing volatility, digital advertising remains strong, led by three companies – Alphabet, Amazon and Meta – on course to control over half of the market in 2029. Regulatory scrutiny and uncertainty around TikTok’s future in the US further compound risks to growth, however, advertisers must be nimble in order to seize initiative in this shifting landscape.”

WARC’s latest findings leverage a proprietary neural network model, analyzing data from over 100 global markets to chart three potential trajectories:

- Baseline forecast – Reflecting current economic and market conditions.

- OECD scenario – Predicting 10% universal trade tariffs, cutting 0.5pp from GDP over three years.

- Severe scenario – Assuming a full percentage point cut in global growth, with further inflationary pressures.

Applying the OECD’s scenario to the advertising sector further trims growth by 0.3pp, shaving $4 billion from the global ad market. Meanwhile, the severe case scenario predicts an 0.8pp downgrade, equating to an additional $9.5 billion loss.

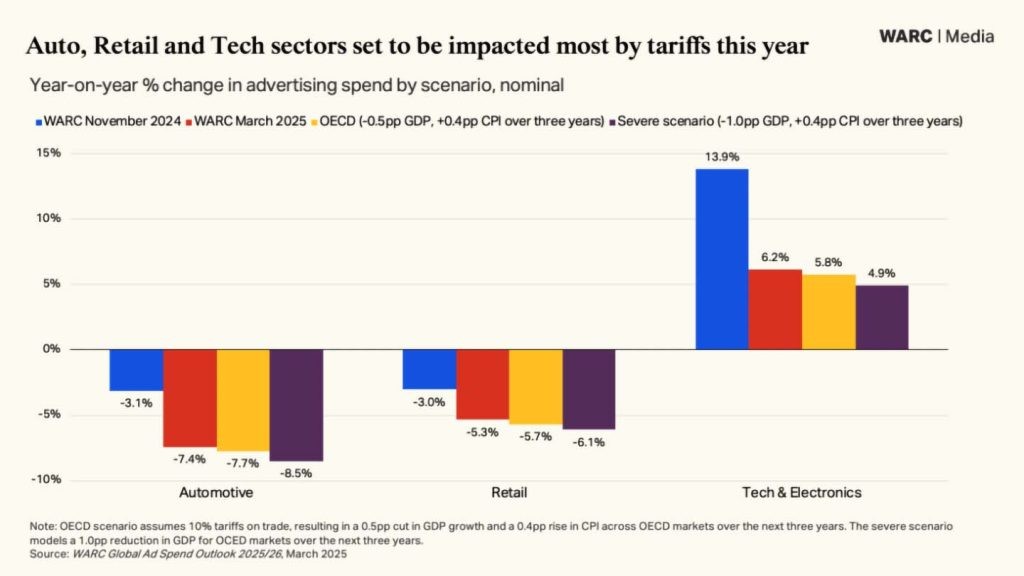

Automotive: Shifting Gears

- Ad spend is set to decline 7.4% as manufacturers scale back on branding and production stalls.

- Major US automakers, including GM and Ford, have been steadily reducing ad budgets, now allocating as little as 1.2% of sales revenue to marketing.

- Video ad formats are expected to take the hardest hit as brands move spend toward digital platforms.

Retail: A Tightening Grip

- With supply chain disruptions and price pressures mounting, ad spend is projected to drop 5.3%.

- Western retailers like Walmart and Costco are already urging Chinese suppliers to lower prices to offset tariffs.

- The fast-rising e-commerce giants Shein and Temu are expected to pull back on aggressive ad spending strategies.

Tech & Electronics: Cooling Off

- The sector is set to grow 6.2% this year, a marked downgrade from WARC’s previous 13.9% forecast.

- Semiconductor tariffs are a key factor limiting expansion, with alternative scenarios predicting even slower growth at +5.8% (OECD) and +4.9% (severe case).

Despite mounting regulatory scrutiny, digital advertising remains dominant. Search and social media continue to command massive spend:

- Search advertising is projected to grow 8.0% to $250 billion, despite the EU’s pushback against Google and Apple.

- Social media ad revenue will rise 12.1% to $286.2 billion, with TikTok (+23.6%), Instagram (+17.0%), and Facebook (+8.6%) leading the charge.

- Retail media is forecasted to be the joint-fastest growing ad sector this year at 15.4% growth, though supply chain instability could dampen further expansion.

The advertising industry is no stranger to disruption, but the convergence of trade wars, economic slowdowns, and regulatory shifts creates a unique challenge for marketers worldwide. While digital-first platforms remain a bright spot, brands will need to stay agile and adaptive to navigate the evolving global landscape.

WARC members can read the full report here. A sample of the report can be found here.