KUALA LUMPUR, MALAYSIA — AirAsia Group Berhad (“AirAsia” or “the Group”) presents the following operating statistics for its airline business for the Fourth Quarter of the Financial Year 2021 (“4Q2021”) and the full Financial Year Ended 31 December 2021 (“FY2021”).

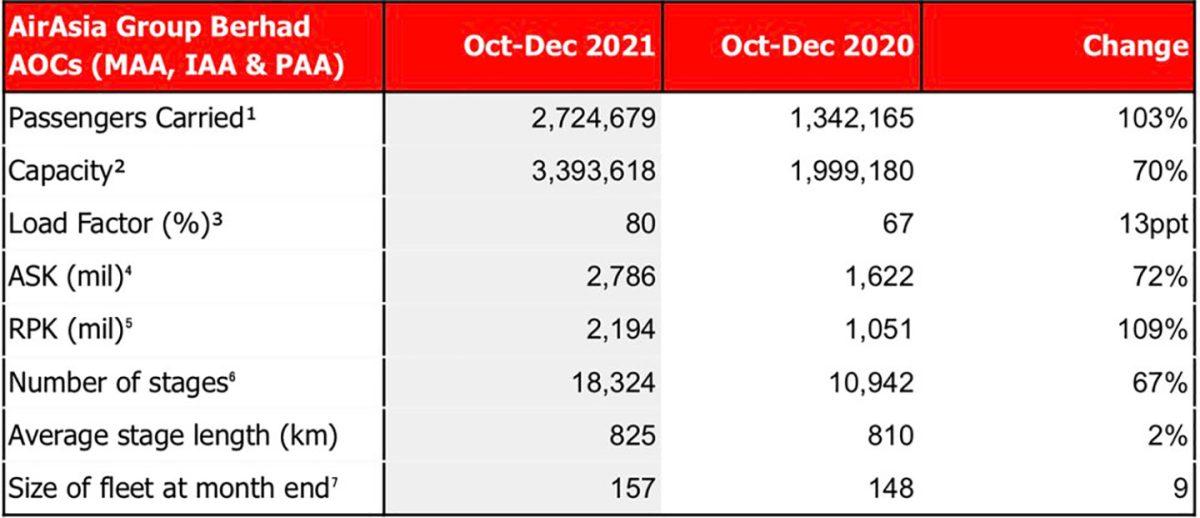

AirAsia Group Berhad Consolidated AOCs¹ has recorded the highest quarterly load factor and capacity at 80% and 3.4million respectively in 4Q2021 since the beginning of the Covid-19 pandemic. Passengers carried increased 103% to 2.7million year-on-year (“YoY”) in 4Q2021 which surpassed the capacity increase of 70%, leading to a 13 percentage points (“ppts”) improvement in load factor to 80%. Available Seat Kilometres (“ASK”) grew by 72% YoY, primarily attributable to strong demand from the introduction of quarantine free travel bubbles for Malaysia and the easing of travel restrictions in 4Q2021.

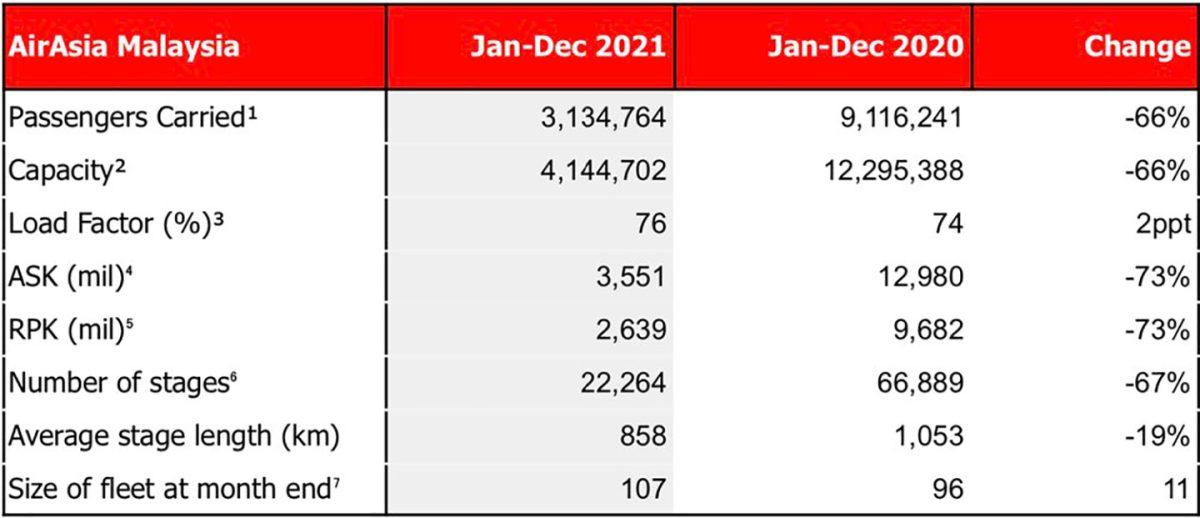

In FY2021, the load factor for the Consolidated AOCs remained healthy at 74% with strategies implemented to manage the multiple disruptive lockdowns imposed by respective governments. The improved monthly performance of passengers carried and additional capacity across the group indicate a V-shaped resumption trend in air travel demand throughout 2021. Additionally, the Group is expecting to see a surge in demand following the recent announcements that the Thai government is resuming its quarantine-free travel scheme from 1st February 2022 and the Malaysia government resumed the Vaccinated Travel Lane (“VTL”) between Malaysia and Singapore, effective 24 January 2022.

AirAsia Malaysia passengers carried and capacity has increased by 164% and 139% respectively as compared to the same quarter in previous year off the back of rising demand after the reopening of state borders announced by the Government of Malaysia. Load factor increased by 7ppts YoY and 19ppts QoQ to 80% in conjunction with the year-end festive season and increased frequencies on high demand routes including between Kuala Lumpur and Langkawi, followed by the Kuala Lumpur to Kota Kinabalu route in November and December 2021. It is the company’s expectation that the uptrend in demand for interstate travel will continue after the government allows fully vaccinated residents to cross state lines.

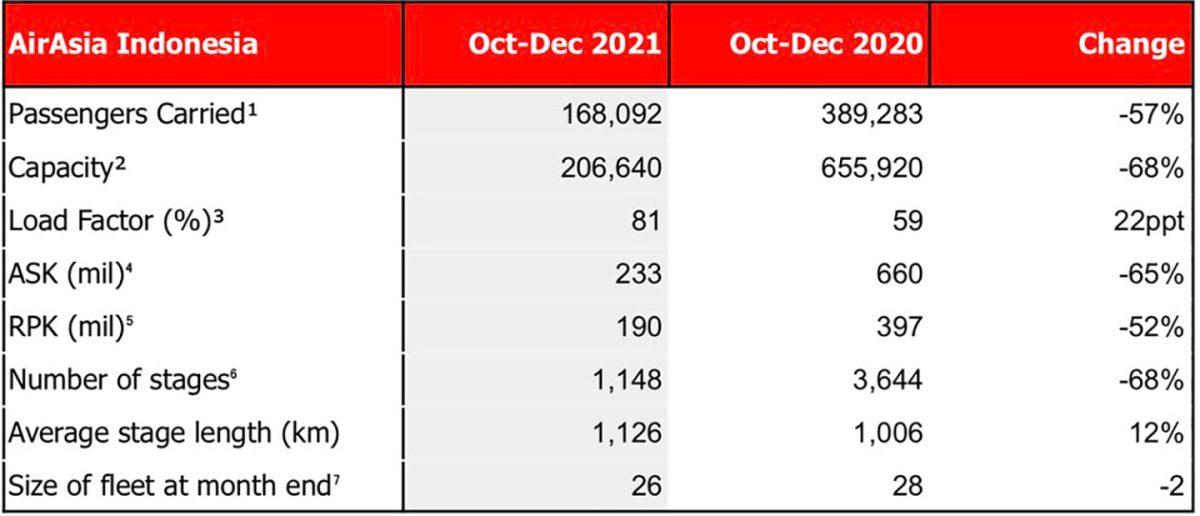

AirAsia Indonesia posted a commendable load factor of 87% in December 2021, 81% for the quarter which grew 22ppts YoY. This was driven by an increased frequency of flights in line with growing demand, particularly in December 2021. Passengers carried in the last month of the year rose nearly seven-fold compared to November 2021.

AirAsia Philippines continued to outperform in 4Q2021 with seats sold in 4Q2021 doubling from 3Q2021. In YoY comparison, capacity increased by 126%. In 4Q21, the load factor reached its highest quarterly performance outcome in 2021 at 85%, jumping by 21 ppts YoY. This was achieved from strong pent-up demand in a number of core destinations including Cebu, Cagayan de Oro, Boracay, and Tacloban. ASK soared 114% YoY to 285 million from 133 million.

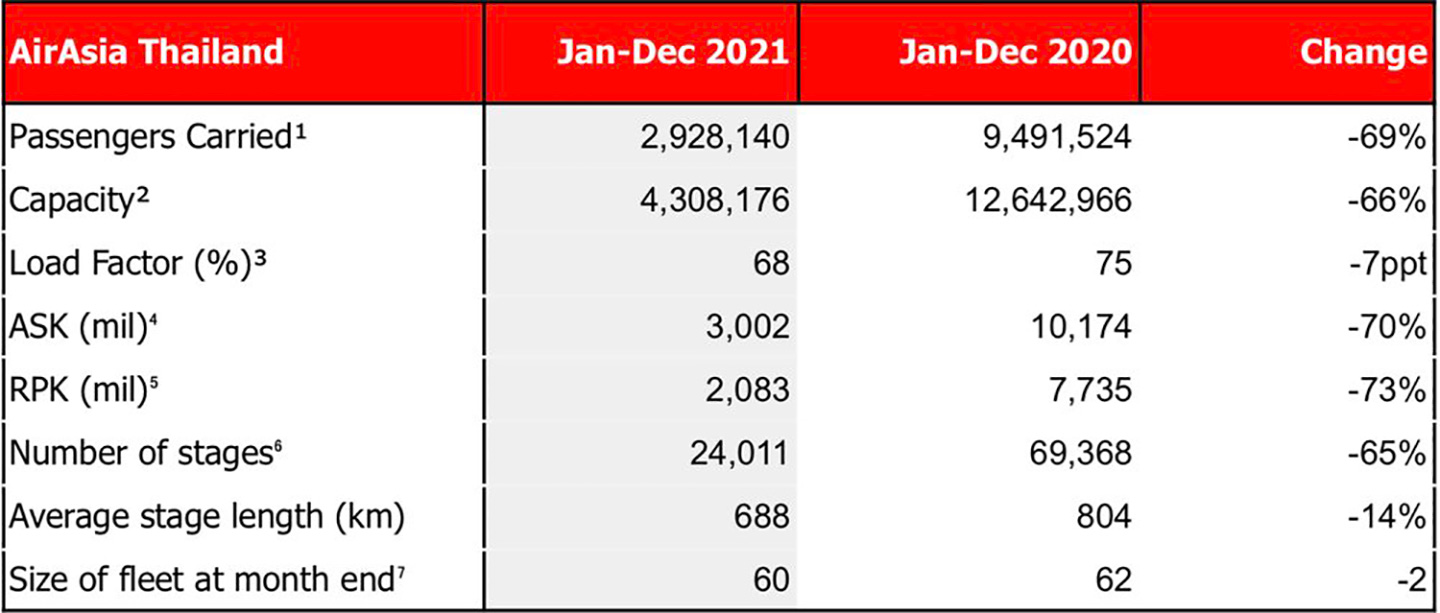

For 4Q2021, AirAsia Thailand operated more domestic capacity than in the previous quarter, on the back of robust demand. AirAsia Thailand carried 1.15million passengers. Load factor rose to 78% in December 2021. AirAsia Thailand has reallocated its capacity and flights to align with the gradual improvement in demand. As a result, the load factor in 4Q2021 was 76%, or increased 2 ppts from the same period last year, despite the spread of the Omicron variant that began in late December. For FY2021, domestic travel demand rebounded in March 2021 after the first vaccination drive was rolled out in Thailand. However, Thailand infection cases rose in July 2021 and in compliance with the state containment effort, AirAsia Thailand announced a temporary suspension of domestic operations between 12 July 2021 and 2 September 2021. For the full year, the total number of passengers carried was 2.93million, declining by 69% YoY, in line with the deduction of ASK and capacity. In FY2021, load factor was reported at 68% with a total fleet of 60 aircraft.

AirAsia Group Berhad Consolidated AOCs – Malaysia, Indonesia & Philippines

4th Quarter 2021 Operating Statistics

Full Year 2021 Operating Statistics

Malaysia

4th Quarter 2021 Operating Statistics

Full Year 2021 Operating Statistics

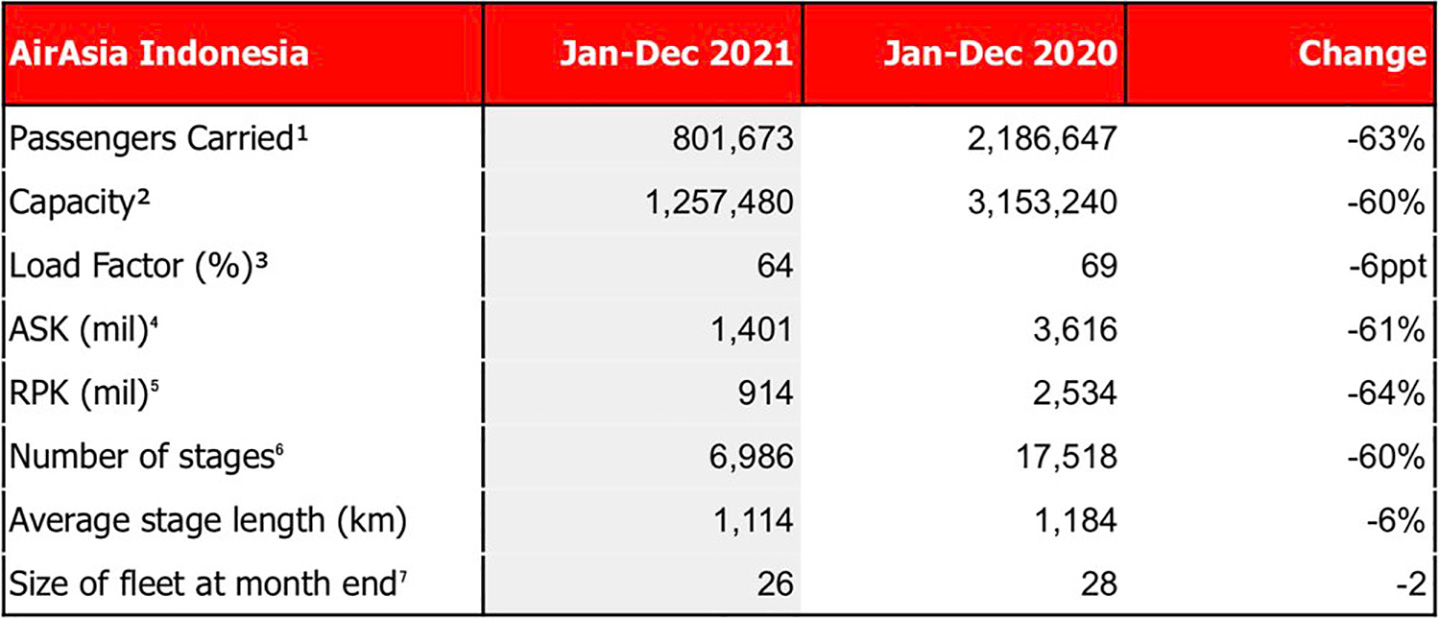

Indonesia

4th Quarter 2021 Operating Statistics

Full Year 2021 Operating Statistics

Philippines

4th Quarter 2021 Operating Statistics

Full Year 2021 Operating Statistics

Thailand

4th Quarter 2021 Operating Statistics

Full Year 2021 Operating Statistics

1. Number of earned seats flown. Earned seats comprise seats sold to passengers (including no-shows)

2. Number of seats flown

3. Number of Passengers Carried as a percentage of Capacity

4. Available Seat Kilometres (ASK) measures an airline’s passenger capacity. Total seats flown multiplied by the number of kilometres flown

5. Revenue Passenger Kilometres (RPK) is a measure of the volume of passengers carried by the airline. Number of passengers multiplied by the number of kilometres these passengers have flown

6. Number of flights flown

7. Number of aircraft including spares

¹AirAsia Group Berhad Consolidated AOCs refers to AOCs whose financial and operational results are consolidated for financial reporting purposes and these are the Malaysian, Indonesian, and Philippines AOCs.