SAN FRANCISCO, USA — Tenjin, a leading mobile measurement platform for indie and mid-sized mobile game publishers, together with Growth FullStack, a platform powering custom business intelligence for mobile advertisers, have released the full report of their revelatory research findings on the state of mobile marketing.

With billions of people shopping, socializing, scrolling and, of course, gaming on mobile for up to a third of their waking moments, it’s hardly surprising that mobile ad spend reached a spectacular $300 billion in 2021. This amount could hit as much as $350 billion in 2022, reflecting the strength of an industry boosted by permanent changes to user behavior brought about by the global Covid-19 pandemic.

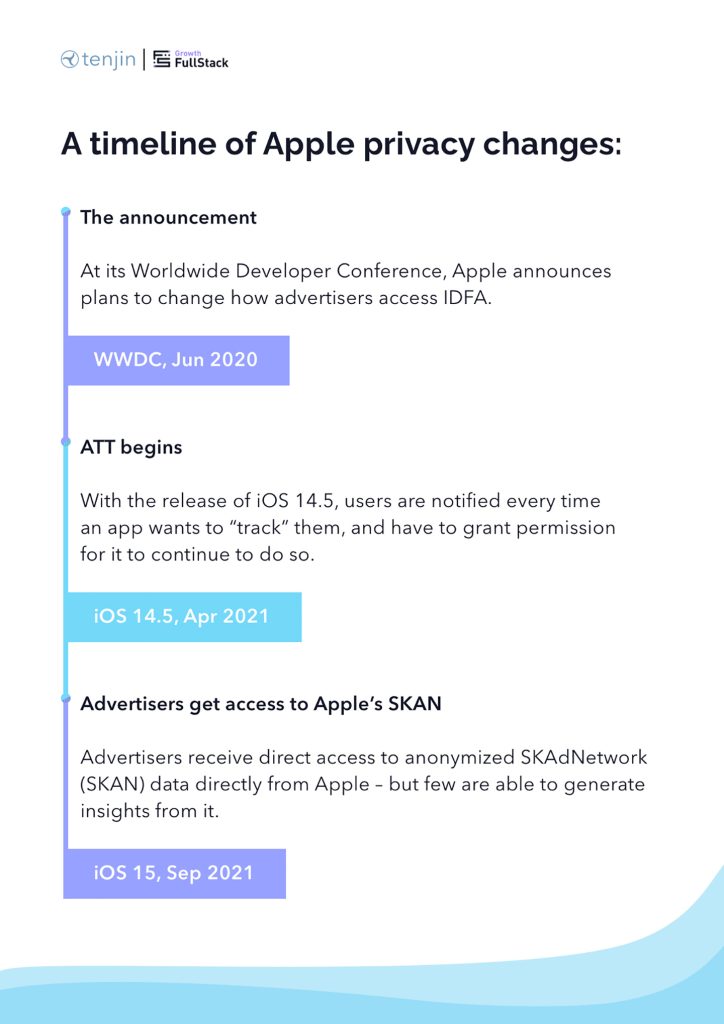

Yet, for an industry that is so accustomed to knowing whom its dollars target and the return on investment they deliver with pinpoint granularity, the last year has been a rude awakening. Privacy-first changes have forever altered familiar ways of targeting and measuring ad performance, particularly on what is often seen as the most lucrative ecosystem of them all: Apple’s iOS.

Between the doomsaying predictions and a picture of booming ad spend, the reality mobile advertisers are operating in is much more nuanced. Tenjin and Growth FullStack wanted to drill deeper, and commissioned market research agency Atomik Research to conduct an online survey of more than 302 mobile advertisers in the UK and US.

Christopher Farm, CEO and co-founder of Tenjin, said, “While the appocalypse may not have materialized as first predicted, our research shows that there are indeed some tectonic shifts underway. The reality is that the full ramifications of privacy-first marketing aren’t yet understood, even by people like us who spend their days entirely focused on deciphering them and coming up with solutions.”

Christopher Farm, CEO and co-founder of Tenjin, said, “While the appocalypse may not have materialized as first predicted, our research shows that there are indeed some tectonic shifts underway. The reality is that the full ramifications of privacy-first marketing aren’t yet understood, even by people like us who spend their days entirely focused on deciphering them and coming up with solutions.”

Key findings:

- Expectations vs reality – Despite feeling reasonably well prepared for Apple’s privacy changes (53% fairly, 15% very), the majority (55%) of mobile advertisers say that mobile advertising became more difficult in 2021. This had a considerable negative impact on advertisers’ revenues – The median estimated revenue loss due to Apple’s privacy changes was 39%.

- Patchwork strategies – Mobile advertisers are using a patchwork of strategies to achieve success. 85% used probabilistic attribution or fingerprinting in 2022, despite more than three-quarters (77%) expecting Apple to clamp down on fingerprinting.

- Teething problems with SKAN – Making the most of Apple’s anonymized SKAdNetwork data is a challenge for mobile advertisers. Few (32%) of companies have access to in-house data science talent, but three-quarters (75%) have implemented some form of marketing automation to gain insight from large, disparate datasets.

- Gaming – Mobile games advertisers felt the impact of Apple’s privacy-first changes most keenly of all. They were more convinced that mobile marketing became more difficult in 2021 (gaming 68% vs 43% non-gaming), more likely to shift budget to Android (63% vs 48%), and use attribution methods such as probabilistic attribution or fingerprinting (91% vs 70%).

- Optimism for 2022 – Despite a tough 2021, mobile advertisers are largely positive and bullish. 85% were optimistic that marketing would be less challenging in 2022, while almost two-thirds (65%) planned to increase rather than decrease their ad spend.

Farm commented on the findings, “Mobile marketing can be best characterized as in a zombified state that’s somewhere between the familiar era of unrestricted targeting and the new, privacy-first one. The sustainability of the current patchwork model remains to be seen. It’s likely that, in the not too distant future, committing to understanding SKAN will become imperative rather than optional. And yet, despite a rough 2021 for mobile advertisers’ bottom lines, and with more change ahead, our research shows that advertisers’ optimism remains strong. After all, one thing is unchanged: the best mobile content and services are in high demand from billions of people the world over, on both iOS and Android.”

The research fieldwork took place with 302 companies with no known affiliation to Tenjin or Growth FullStack and was conducted by Atomik Research, an independent creative market research agency that employs MRS-certified researchers and abides by MRS code.