SINGAPORE — Despite Covid-19 restrictions easing somewhat in parts of Southeast Asia, the pace of growth for social commerce shows few signs of slowing. If anything, more people are spending more of their time discovering, considering, and purchasing products within the social media ecosystem.

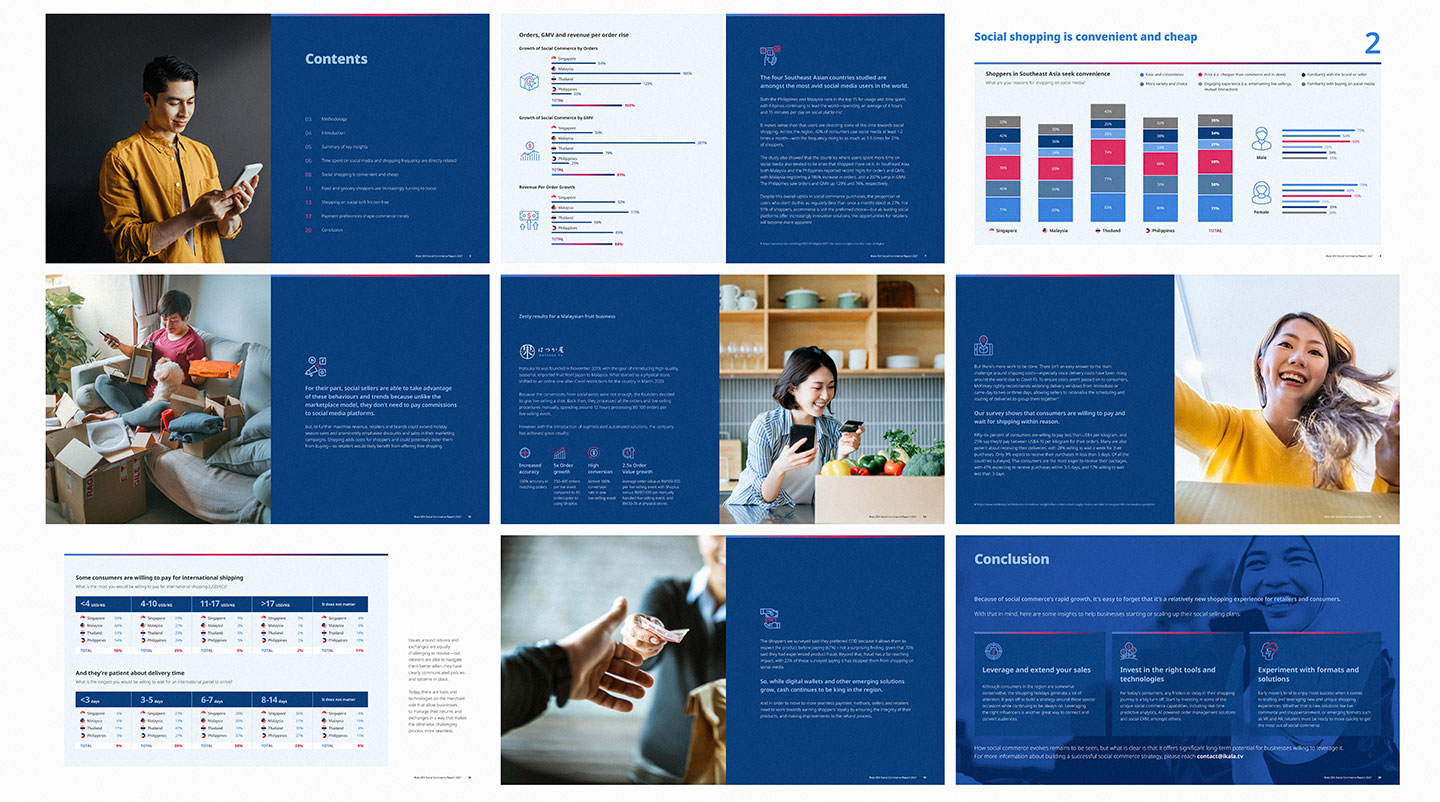

In the first half of 2021, orders and Gross Merchandise Value (GMV) jumped 102% and 91%, respectively over the same period last year, iKala’s annual study titled ‘Riding the Pandemic Wave & Beyond’ found. The report is based on a survey of 1600 social shoppers and more than 23,600 business customers (social sellers) across Thailand, Malaysia, Philippines and Singapore, conducted in Q1 and Q2 2021.

While ecommerce (91%) remains the preferred channel for shoppers in Southeast Asia, social commerce (78%) is emerging hot on its heels, surpassing even traditional retail (35%). In fact, as many as 42% of total shoppers said they use social media to make purchases 1-2 times per month, and 35% use it shop more than 3 times a month.

Social commerce’s success goes beyond frequency, too, with revenue per order up 88% during the period. This means consumers aren’t just shopping more, they’re also spending more on each order.

“Southeast Asia already had some of the most avid social media users in the world, and spurred by the pandemic, they’ve taken to social platforms for their shopping needs at an exhilarating pace. Even as brick-and-mortar reopens, it’s become clear that social commerce is not a phase — the ease, convenience, and accessibility of this format has earned it a permanent place in the way this region shops,” said Sega Cheng, Co-Founder and CEO, iKala.

However, shopping on social platforms is not friction-free. Consumers across the region report expensive shipping (51%), no return and exchange policies (41%) and a lack of customer service (34%) as key points of friction.

Payment preferences also vary wildly across the region, with consumers in Singapore and Malaysia relying much more on credit cards and digital wallets respectively, while those in Thailand and the Philippines prefer cash on delivery (COD). Much of this has to do with the rising levels of scams, and as many as 70% of respondents said they had experienced product fraud at some point in their social shopping journey.

“The beauty of social commerce is that almost anyone with a smartphone and an internet connection can start selling on social media, but it’s not without its challenges. Navigating consumer expectations poses challenges, but more retailers are starting to leverage emerging tools and technologies to make the customer journey seamless. As the landscape matures, sellers who are quick to adopt effective solutions to eliminate pain points will be able to retain engagement and trust in the long run,” Cheng added.

iKala provides a range of AI-driven solutions to help brands, SMBs and retail businesses build a more efficient social commerce strategy. Since the pandemic, the company has witnessed 500% growth in usage of its AI commerce solutions in Southeast Asia, and now supports over 172,000+businesses across the region.

Download the full report here: https://ikala.tv/2021-sea-social-commerce-report/