SINGAPORE — Integral Ad Science (Nasdaq: IAS), a global leader in digital media quality, today released its 2022 Industry Pulse Report – India Edition. Surveying digital media experts across India, IAS found that improving mobile experiences, measuring quality for social media campaigns, and the emergence of digital video and audio are top considerations in the year ahead.

“As the ongoing pandemic has driven consumers to embrace hybrid lifestyles and digital experiences, digital advertisers pivoted their strategies globally to emphasize mobile, social media, CTV, and digital audio. This scenario is similar in India. However, in a market as large and dynamic as India, brands are becoming more conscious of the importance of quality impressions and safe brand environments. As a result, the role of verification partners is gaining prominence in creating a safe and transparent setting for brands,” said Saurabh Khattar, Commercial Lead, India, IAS.

Based on the India edition of the IAS 2022 Industry Pulse Report, these key priorities will guide the year ahead:

- Marketers bet on mobile and social media: India continues to be a mobile-first market, with 77% of respondents making it a top priority in 2022. Mobile internet users in the country are expected to surpass 600 million this year. Mobile ad spend in India is set to grow 27% to surpass US$2 billion in 2022, representing nearly two-thirds of overall digital ad spend in the country.

71% of media experts in India will prioritise social platforms. With over 450 million social media users in India, the medium is rife with opportunities for marketers. YouTube ranks as the top choice for 82% of respondents, closely followed by Facebook (80%), and Instagram (77%).

- Increased focus on mobile video and ad fraud: As consumers gain faster 5G mobile connections, nearly eight-in-ten (78%) media experts bet on mobile video streaming being one of the biggest opportunities. However, with this growth, the threat of ad fraud looms large; 78% of respondents agree that ad fraud will be a greater concern across mobile environments this year. 26% of respondents also agreed that mobile web video environments will be among the most vulnerable in terms of brand risk. As a result, respondents believe contextual targeting solutions (74%) and third-party verification (72%) will be important to ensure brand safety in mobile environments.

- Quality matters for social media campaigns: 86% of marketers are concerned about the vulnerability of social channels to ad fraud. Experts also pointed to insufficient transparency and eroding consumer trust, with 65% and 62% of respondents, respectively, citing these key factors as cause for adjusting their spending in 2022.

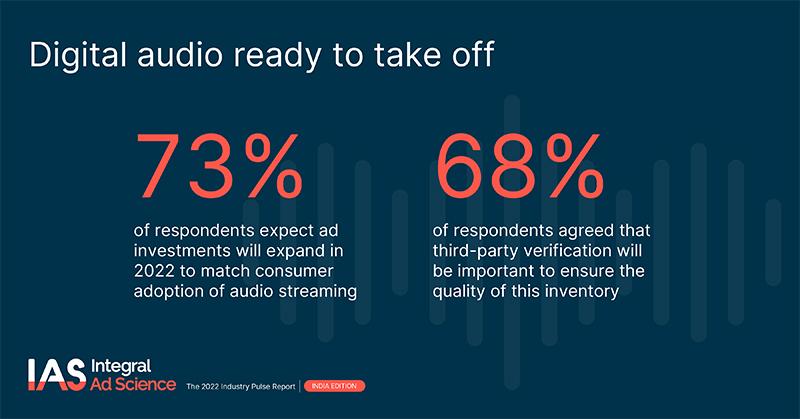

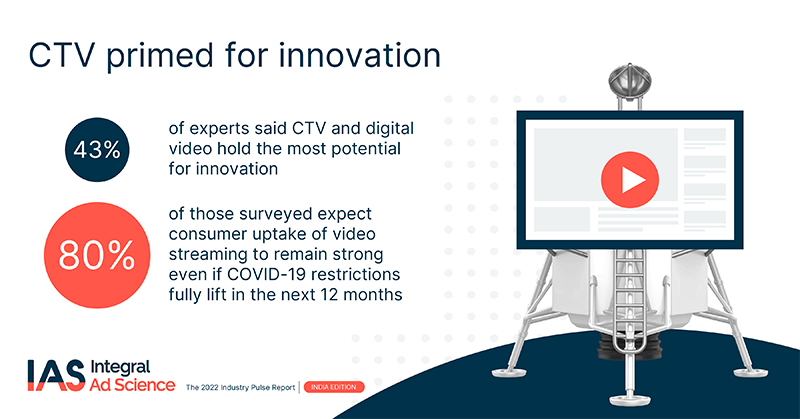

- Digital video and audio ready to take off: The Indian audience continues to transition from linear TV and terrestrial radio to digital streaming channels such as CTV, OTT, and podcasts. As new consumer habits developed during the pandemic, 80% of respondents anticipate an accelerating transition from linear TV consumption to digital video streaming this year, while over 7 in 10 agreed that audio listeners will shift towards digital alternatives. However, 68% of media experts anticipate higher brand risk with audio streaming content as more inventory becomes available. Ultimately, 68% of respondents agreed that third-party verification will be important to ensure the quality of audio streaming inventory.

- Media quality takes a team effort: With ad budgets at stake, brands and verification tech providers play a pivotal role in mitigating ad fraud and brand risk. 45% of respondents noted that verification tech providers are responsible for ad fraud mitigation, while 38% say brands should lead these efforts.

The IAS Industry Pulse Report provides insights into the emerging trends and priorities that will drive change in digital advertising across India in 2022. The results are based on the responses of 151 Indian digital advertising professionals representing brands, agencies, publishers, and ad tech vendors in November 2021.