KUALA LUMPUR, MALAYSIA – Two years into the pandemic, Southeast Asia’s digital economy accelerated to new heights. According to Google’s SEA e-Conomy report, there were 40 million new internet users in 2021, boosting internet penetration to 75%.

The report predicts that ample digital consumption will likely continue. That said, how many of these new internet users flocked to e-commerce in the past year? And which categories would they be interested in?

iPrice Group, the region’s leading eCommerce aggregator, has gathered user data from their extensive database of 7+ billion offers from 8+ million sellers across Southeast Asia. They compared data from January 1, 2021 to March 13, 2022 with the same period in 2019 – 2020.

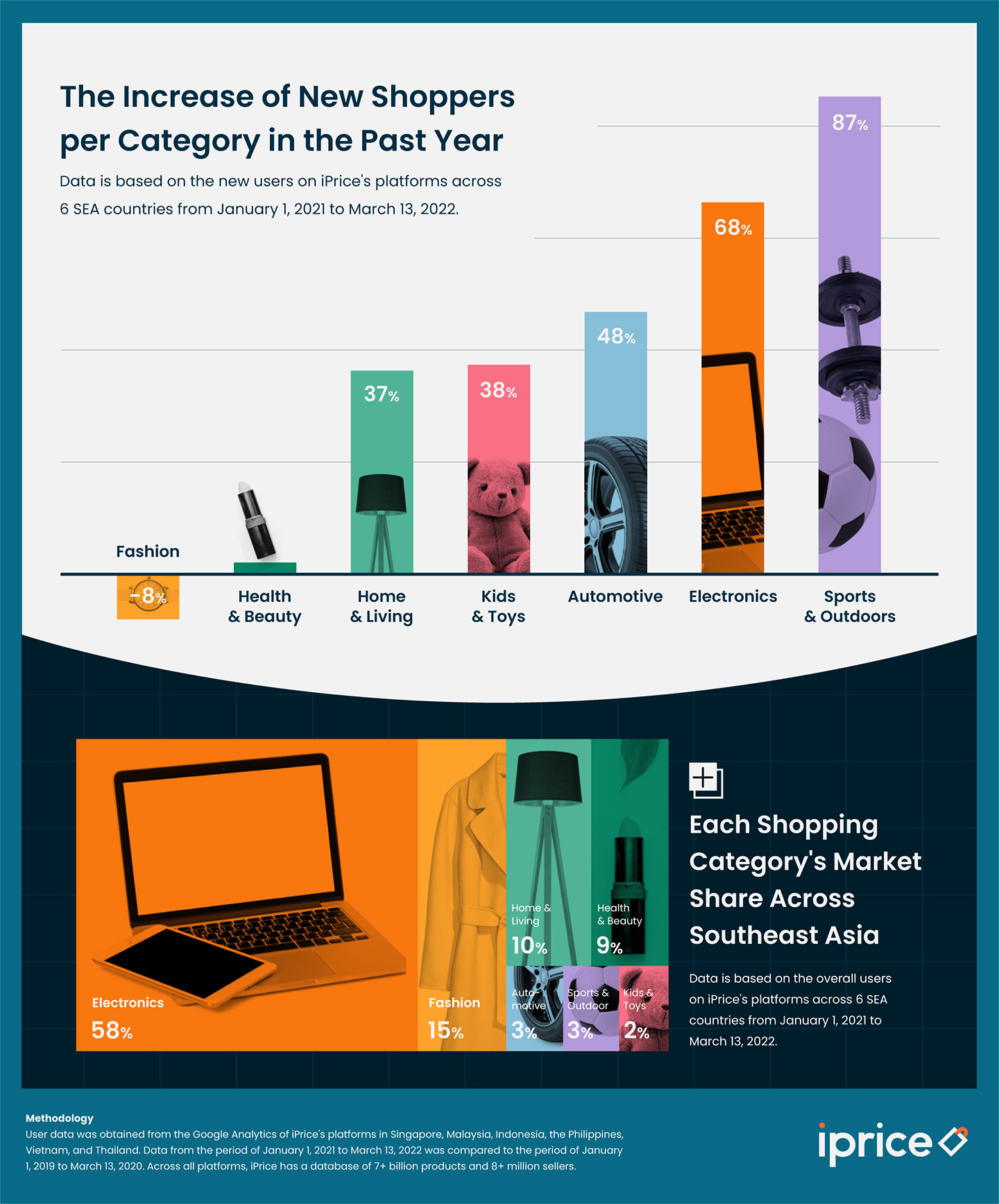

New Shoppers Found in the Electronics and Sports/Outdoor Categories

In 2021-2022, iPrice received 39% more new users across Singapore, the Philippines, Indonesia, Malaysia, Vietnam, and Thailand compared to 2019-2020. Six out of 10 of these new users are found in the electronics category, which received almost two-thirds of the total number of new users.

The electronics category has always received the most users in total, but the volume of new users is also significant. Vietnam, Indonesia, and the Philippines had the most increase of new users in this category, specifically by 292%, 78%, and 71% respectively.

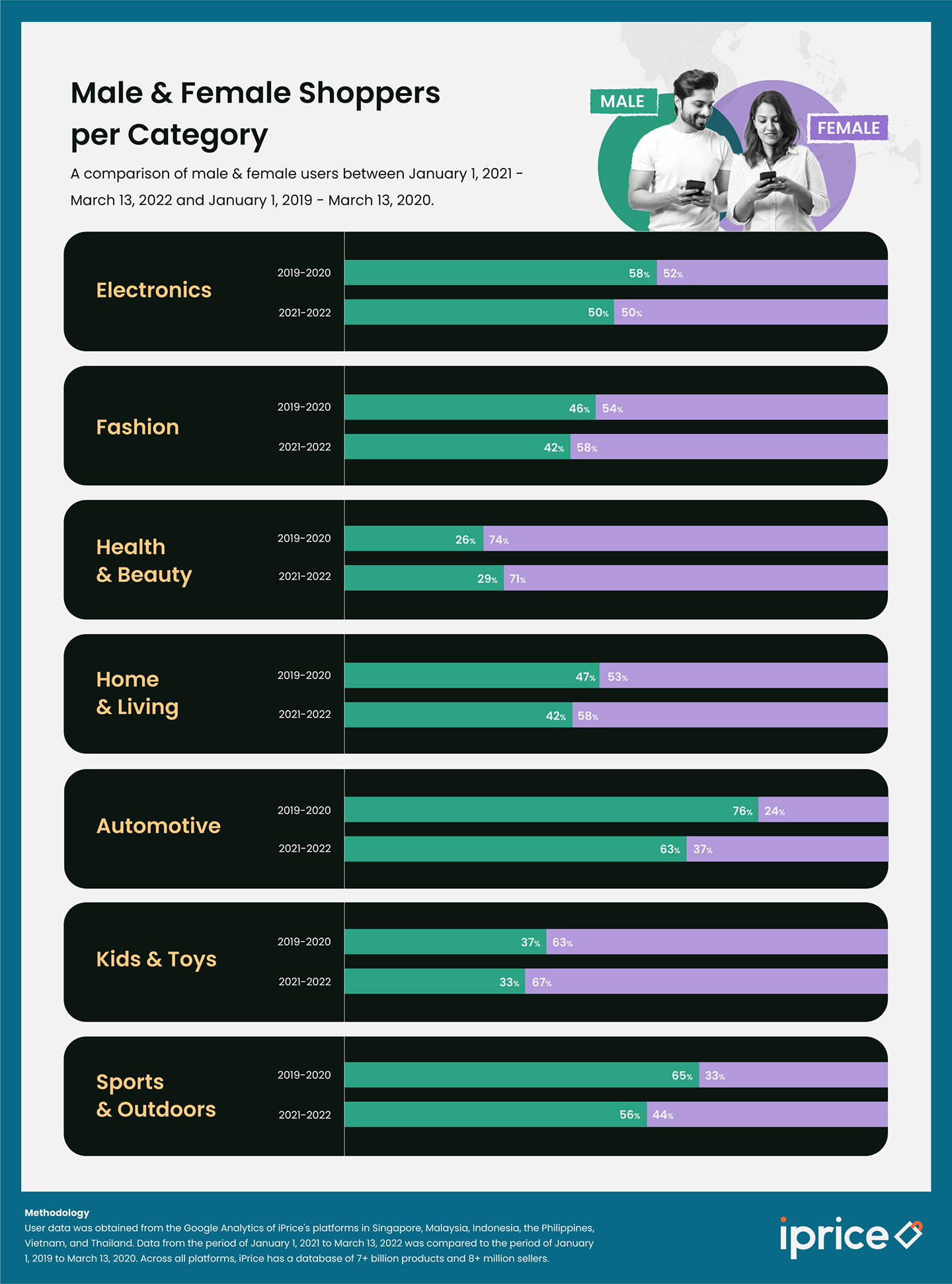

More women are penetrating the electronics category as well, evening out the gender demographics. Overall, female users take half of this category’s market share, rising from 42% in the previous period. In the Philippines, there are now more female users than male users in this category, rising from 49% to 61%.

Meanwhile, the sports & outdoor category received the most increase in new users across the six SEA countries, rising by 87%. With outdoor activities deemed as a safer alternative to indoor gatherings, it makes sense that Southeast Asians would invest in these products more.

Although over half of the shoppers in the sports & outdoors category are men, there was also a significant increase in female users in the past year, rising from 35% to 44%.

The automotive, kids & toys, and home & living categories also had a surge of new shoppers, rising by 48%, 38%, and 37% respectively. Unfortunately, the health & beauty category’s new users increased only by 2%.

Fashion Items Are Losing New Shoppers

Unfortunately for fashion merchants, fashion was the only category with an overall decrease in users in the past year. The fashion category lost both overall users and new users in the past year, dropping by 5% and 8% respectively.

Across most countries, there has been a consistent loss of new users in this category, led by Singapore (40%), followed by Malaysia (37%), the Philippines (35%), and Vietnam (7%). The only countries that received a slight, negligible increase in new users in this category were Thailand (4%) and Indonesia (2%).

More Female Shoppers Online

In 2019-2020, there was about an equal amount of male and female shoppers across all of iPrice’s aggregated products and sellers. In 2021-2022, there were 9% more female shoppers than male shoppers.

The surge of new female shoppers in the past year reached 54% compared to the previous year, while the surge in new male shoppers increased by only less than a quarter.

Interestingly, this trend can blatantly be observed in the Philippines, wherein their female-male ratio is 64-36. There are more Filipina shoppers than male shoppers across the Philippine platforms’ categories except automotive.

A Surge in Parcel Volumes & Improvements in Parcel Delivery Schedules

In a collaboration with Parcel Monitor, iPrice analyzed the change in e-commerce parcel volumes across Singapore, Malaysia, Thailand, and Indonesia during 2021’s peak seasons (Songkran for Thailand and Ramadan for the rest). Turns out Indonesia had the highest increase in parcel volumes (55%) during this period, followed by Singapore (35%), Thailand (34%), and Malaysia (23%).

Meanwhile, a significant increase of 34% in parcel volumes was observed across Asia during the 11.11 sales period in 2021, which is still one of the biggest online sales days in the region.

It initially took some adjustments for logistics companies to address the high volume of parcel deliveries due to the transaction surge during the pandemic. Fortunately, parcel deliveries take less time in the first three months of 2021 compared to the initial COVID-19 lockdown period in 2020 (April to June) in some countries.

Malaysia had the most drastic change in delivery time, wherein it shortened from 4.6 days in 2020 to 2.6 days in 2021. Indonesia’s parcel delivery time was also shortened from 3 days to 1.9 days while Singapore’s delivery time has slightly adjusted from 1.5 days to 1.3 days.

In conclusion, the surge in new online shoppers translates to transactions given the increase in parcel volume over the years, especially during peak season. As we are entering the new normal, it seems that COVID-19 accelerated the necessity of e-commerce across Southeast Asia.