MANILA, PHILIPPINES — The Philippine economy expanded 13.0%q/q, saar, in sequential terms last quarter, leaving headline GDP growth lower than our expectations at 7.7% (J.P. Morgan: 8.4%, consensus: 6.3%, first chart). With the 4Q21 GDP print, overall FY21 GDP growth reached 5.6%y/y, beating the official target range of 5.0-5.5% (J.P. Morgan: 5.8%, consensus: 5.1%).

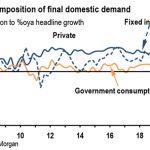

Another quarter of solid private consumption alongside loosening in mobility restrictions. Following the double-digit sequential expansion in 3Q, domestic demand added 9.2%-pt to the overall GDP which more than offset the 2.5%-pt deduction from net exports last quarter (second chart). Similar to 3Q21, the source of strength in the GDP report is private consumption which expanded a further 8.1%q/q, saar, last quarter on the back of the 32.1%q/q, saar, solid expansion in the previous quarter, which mirrors the sustained recovery in services, up 11.9%q/q, saar (third chart).

The strength in private consumption coincided with the declining mobility restrictions in 4Q21 (fourth chart). That said, we expect the private consumption strength to abate in the current quarter given the reimposition of mobility restrictions in response to the spread of the Omicron variant in the Philippines which has led to a spike in cases in recent weeks. Meanwhile, other domestic demand categories recorded small contractions in 4Q21, with fixed investment activity in particular down 3.8%q/q, saar, which was mainly due to slowdowns in construction-related investment (fifth chart). Alongside the contraction in fixed investment activity is the 8.6%q/q, saar, decline in headline imports.

Expect monetary policy normalization in 3Q22. In our view, the broader domestic economic recovery will likely move ahead despite the near-term downside risk posed by the Omicron variant. We continue to expect a narrowing in the S-I gap, with the second order effects from a growth-led currency weakness and impact on financial and price stability, particularly against the quicker pace of tightening in external financial conditions, to set the stage for policy normalization in 3Q22, with 25bp hikes in subsequent quarters through to 2023. That said, a pace of recovery quicker than our expectations in the coming months could warrant a sooner policy tightening action by the central bank.

| %oya | %-pt contr to %oya growth | %q/q, saar | ||||||||||||

| 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q21 | 2Q21 | 3Q21 | 4Q21 | 1Q21 | 2Q21 | 3Q21 | 4Q21 | |||

| GDP | -3.9 | 12.0 | 6.9 | 7.7 | -3.9 | 12.0 | 6.9 | 7.7 | 8.5 | -4.3 | 12.9 | 13.0 | ||

| By Expenditure | ||||||||||||||

| Private Cons. | -4.7 | 7.3 | 7.1 | 7.5 | -3.6 | 5.1 | 5.2 | 5.7 | 5.9 | -11.2 | 32.1 | 8.1 | ||

| Govt. Cons. | 16.1 | -4.2 | 13.8 | 7.4 | 2.0 | -0.9 | 2.0 | 1.0 | 0.2 | -6.7 | 39.6 | -0.8 | ||

| Fixed Asset Inv. | -18.0 | 39.8 | 15.5 | 9.5 | -4.4 | 8.1 | 3.1 | 2.0 | 55.5 | 57.0 | -40.2 | -3.8 | ||

| Gross investment | -14.8 | 80.4 | 20.8 | 12.6 | -3.3 | 12.2 | 3.8 | 2.6 | 57.5 | 90.2 | -46.4 | -2.6 | ||

| Exports | -8.8 | 27.8 | 9.1 | 8.3 | -2.7 | 6.8 | 2.7 | 2.0 | -6.4 | 16.7 | 21.3 | 3.7 | ||

| Imports | -7.0 | 39.8 | 13.0 | 13.7 | -2.8 | 12.1 | 4.8 | 4.5 | 26.4 | 26.0 | 13.7 | -8.6 | ||

| By Industry | ||||||||||||||

| Agriculture | -1.3 | 0.0 | -1.7 | 1.4 | -0.1 | 0.0 | -0.2 | 0.2 | 2.2 | 6.3 | -5.9 | 5.2 | ||

| Industry | -4.4 | 21.0 | 8.1 | 9.5 | -1.3 | 6.0 | 2.2 | 2.9 | 11.1 | 3.5 | 2.1 | 18.2 | ||

| Service | -4.1 | 9.8 | 7.7 | 7.9 | -2.4 | 6.0 | 4.9 | 4.6 | 8.4 | -9.5 | 22.3 | 11.9 | ||

| Source: PSA, Seasonally adjusted data are J.P. Morgan and official estimates | ||||||||||||||