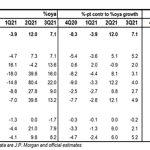

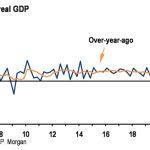

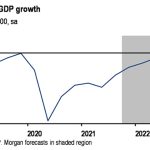

SINGAPORE — The Philippine economy expanded 16.0% in sequential terms last quarter, leaving headline GDP stronger than expected at 7.1% (Figure 1, J.P. Morgan: 5.5%, Consensus: 4.9%).

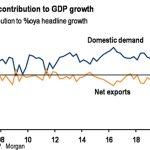

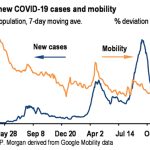

Solid private spending despite tight mobility restrictions. Following the sequential contraction in 2Q, domestic demand added 11.2%-pt. to the overall GDP which more than offset the 2.2%-pt. deduction from net exports last quarter (Figure 2). The source of strength in last quarter’s GDP report is private consumption which expanded a solid 30.9% which mirrors the rebound in services, up 29.3% (Figure 3). This is indeed notable given the tight mobility restrictions and an unemployment rate that hit a record high of 8.9% in September, which would typically imply a curtailment in private spending (Figure 4).

Moreover, we note that the lingering weakness in consumer goods imports in recent months is a growing concern which, in our view, reflects the pandemic-scarring impact on the Philippines vis-à-vis its regional peers. Compositionally, services that recorded firm expansions included wholesale & retail trade, transportation & storage, and business services. All told, we expect this strength to extend into this quarter with the resumption of economic activity. Meanwhile, fixed investment remained sluggish, contracting 40.5% following the solid 61.4% expansion in 2Q21 which could reflect the restrictions of non-essential projects last quarter.

Recovery to extend into 4Q21, BSP to stand pat in the interim. As COVID-19 cases continue to trend down alongside great strides made in the vaccination campaign, we expect higher tolerance for future outbreaks of COVID-19 that likely will pave the way for a gradual path toward recovery, particularly in the nonmanufacturing sector from this quarter onwards with the recent broad relaxation in mobility restrictions. In our view, BSP will likely stand pat in the near term, with a preference to delay monetary policy tightening to support recovery. However, while price pressures have not broadened materially, the gradual reopening of the economy could firm core CPI inflation from next year, which could set the stage for policy normalization, in our view, likely in early 2023, with the risk of an earlier move should recovery be faster than what we have penciled in (Figure 5).