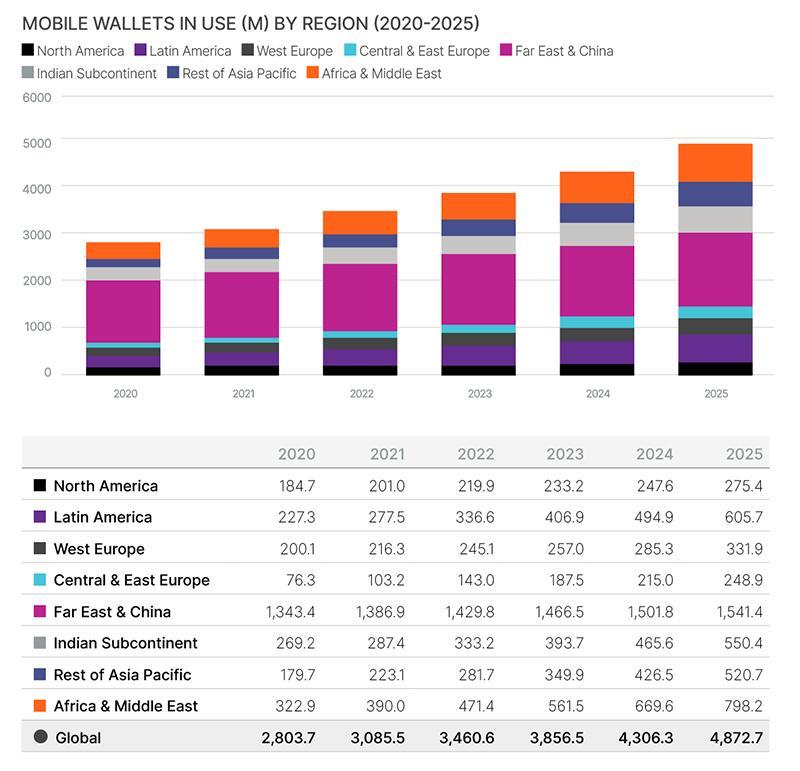

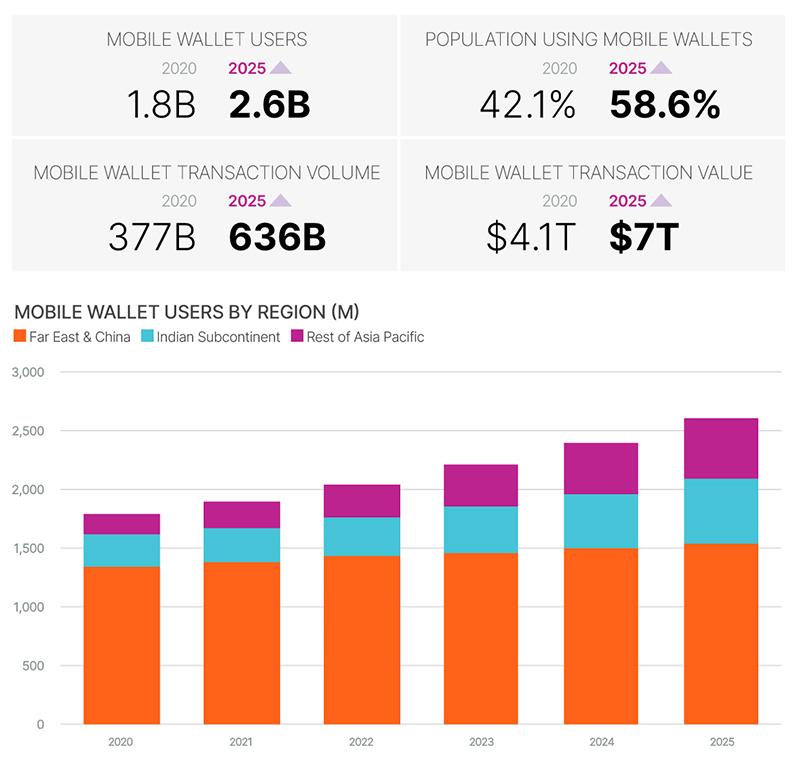

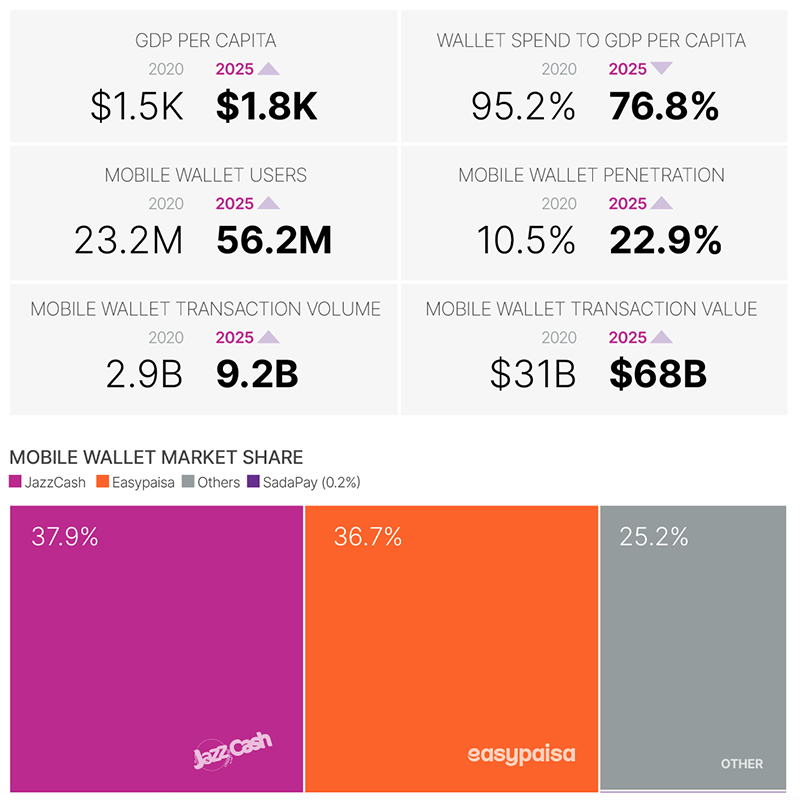

SINGAPORE – By 2025, it’s expected that around 4.8 billion users will be using mobile wallets, marking a substantial leap from the 2.8 billion users at the end of 2020. This upsurge in the usage of e-wallets represents nearly 60% of the global population. It’s especially prominent in developing regions, where digital payments are quickly supplanting traditional cash and card transactions.

Insights from Boku’s ‘Mobile Wallets Report’

Boku, a fintech leader in global mobile payments, released its 2021 “Mobile Wallets Report” in collaboration with Juniper Research. This report highlights that, as of 2019, mobile wallets have surpassed credit cards as the most preferred payment method globally. The shift towards online transactions has led to a rapid increase in mobile wallet usage accelerated by the pandemic.

Key findings:

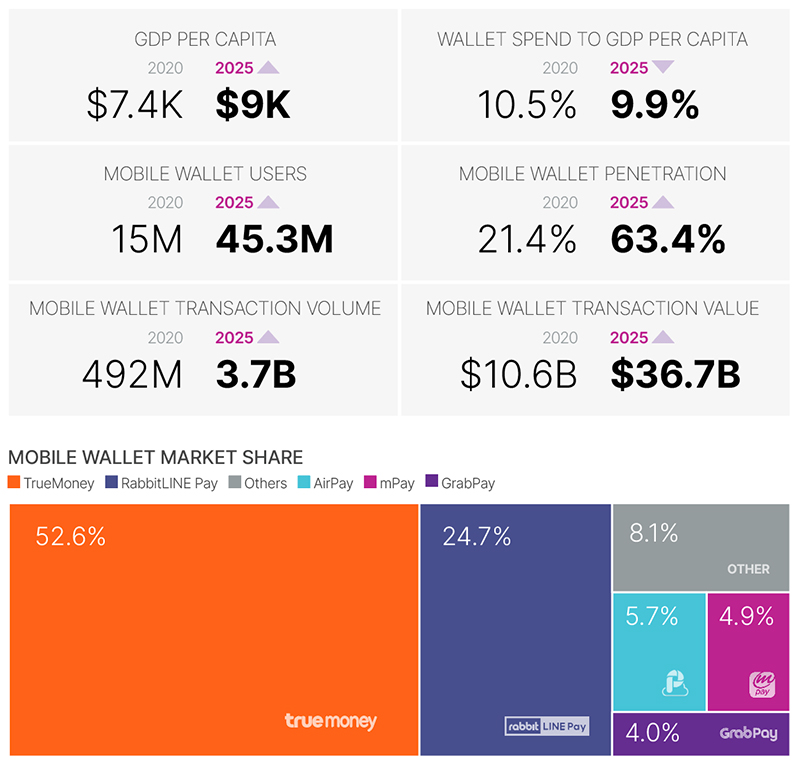

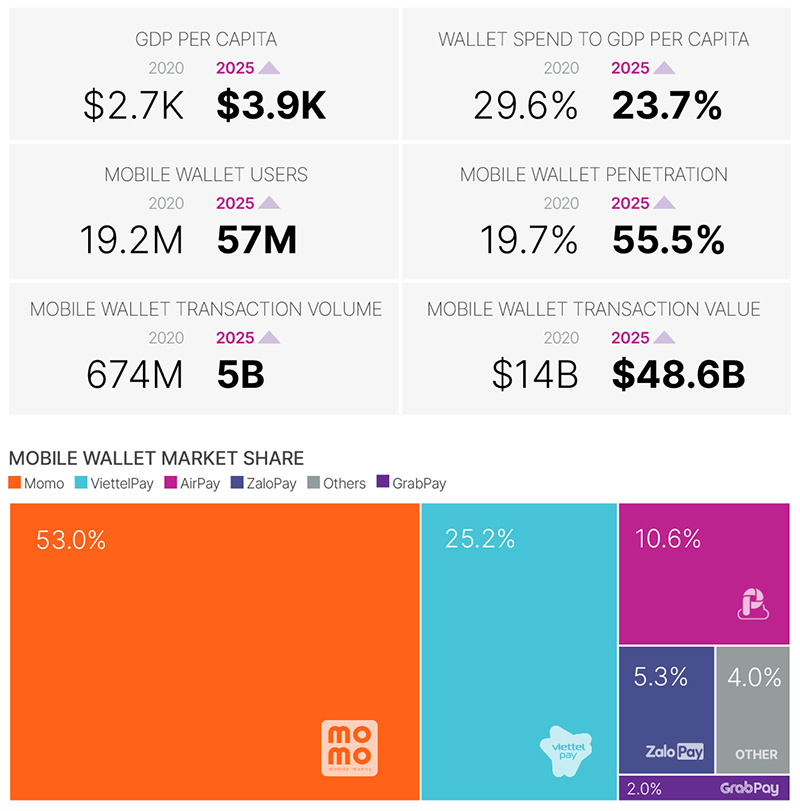

Southeast Asia: Leading in mobile wallet growth

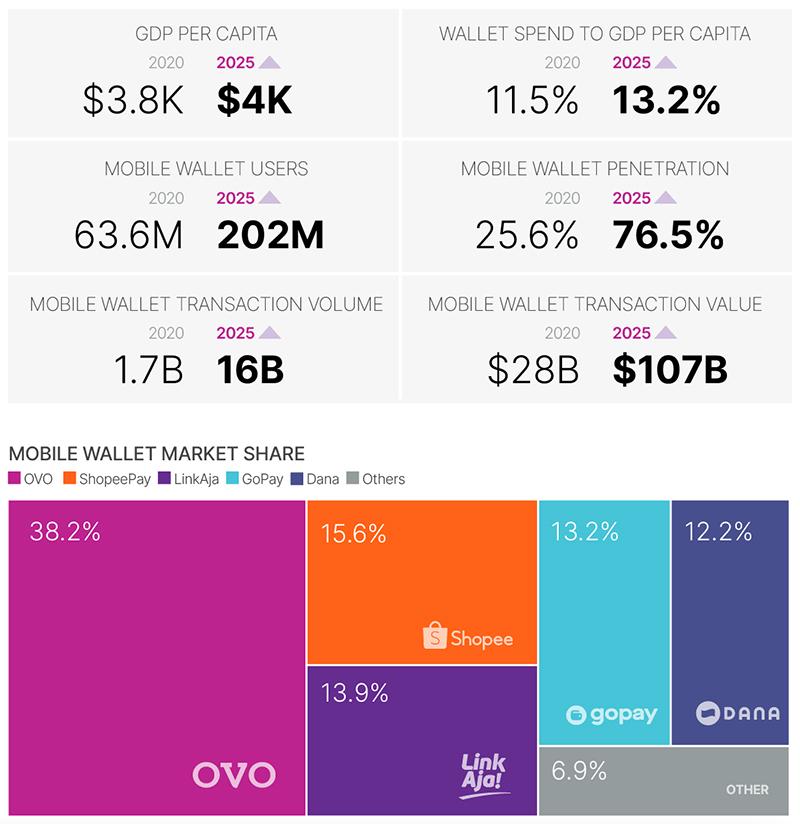

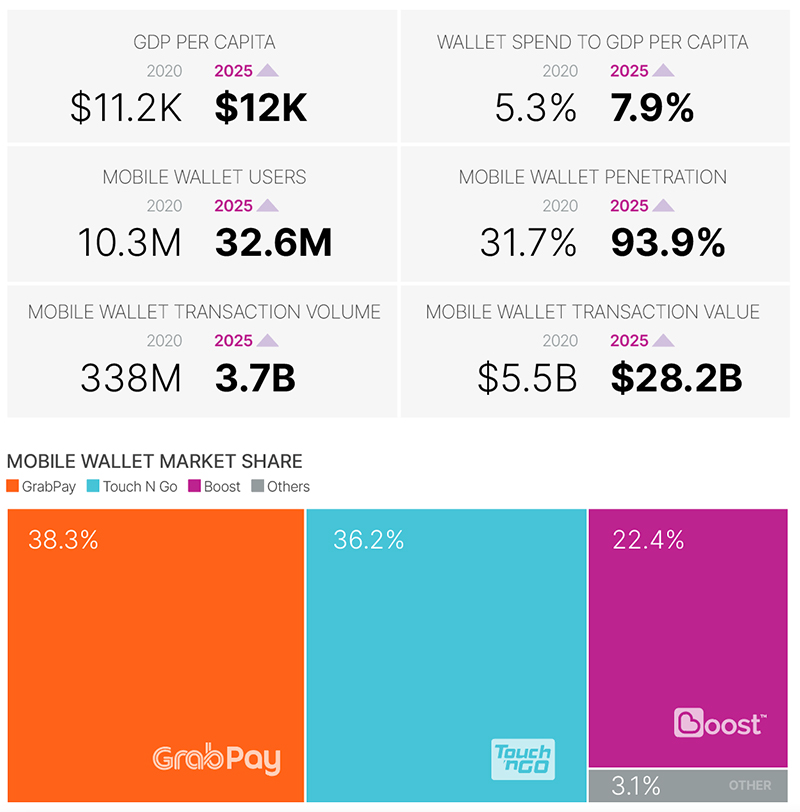

- From 2020 to 2025, mobile wallet use in Southeast Asia is projected to increase by 311%, growing to 439.7 million users.

- Factors such as the rise of ecommerce and the prevalence of well-known mobile wallets like Grab and Gojek are fueling this growth.

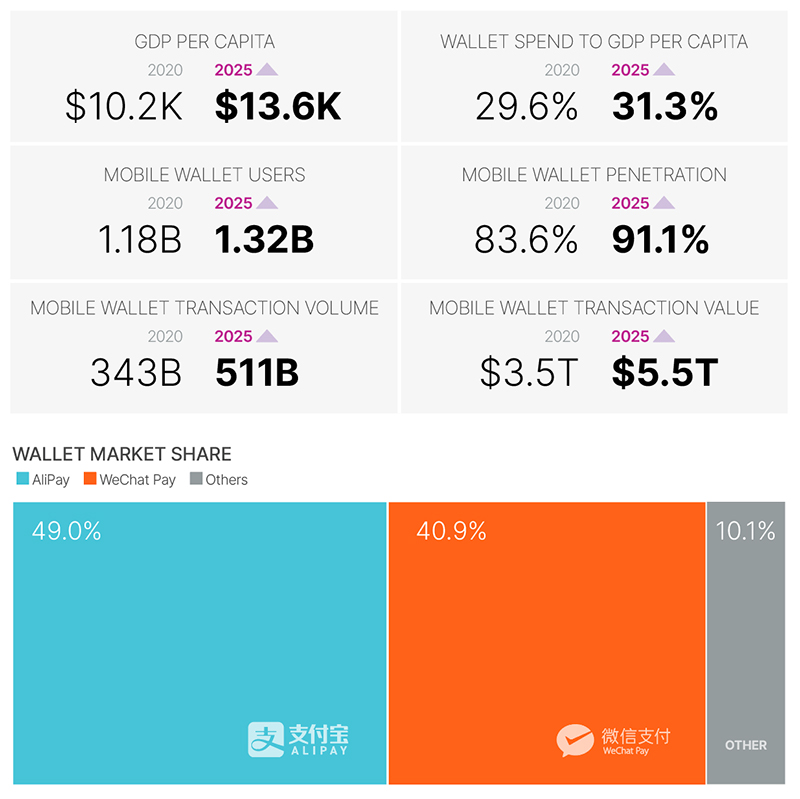

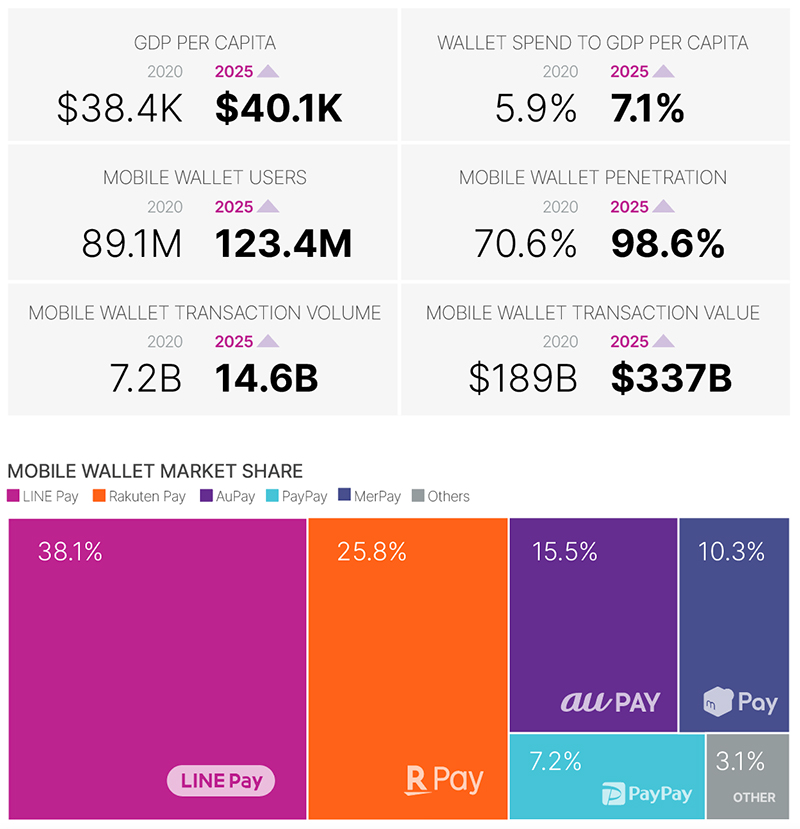

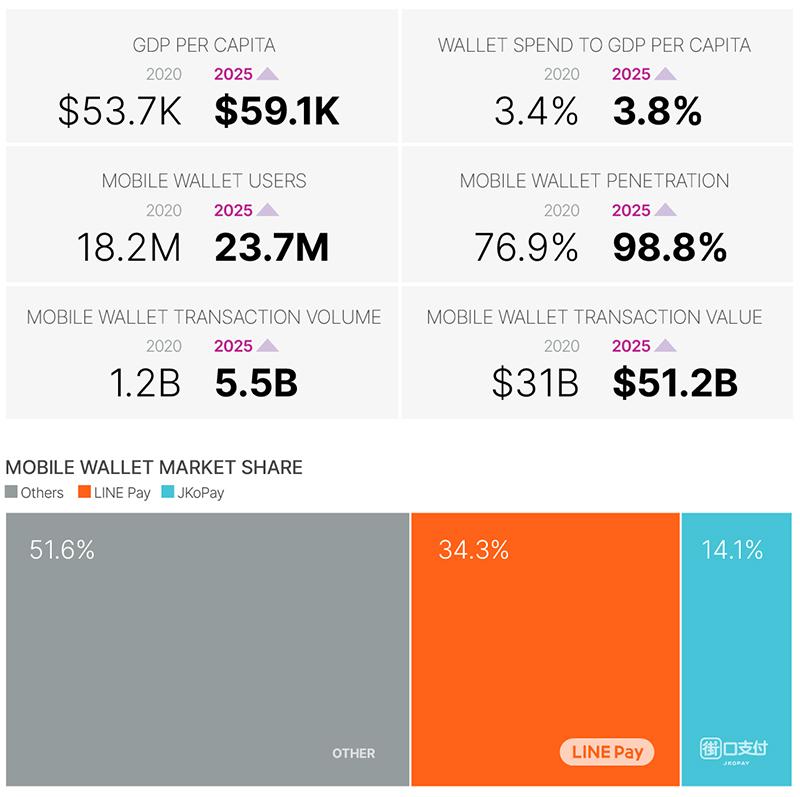

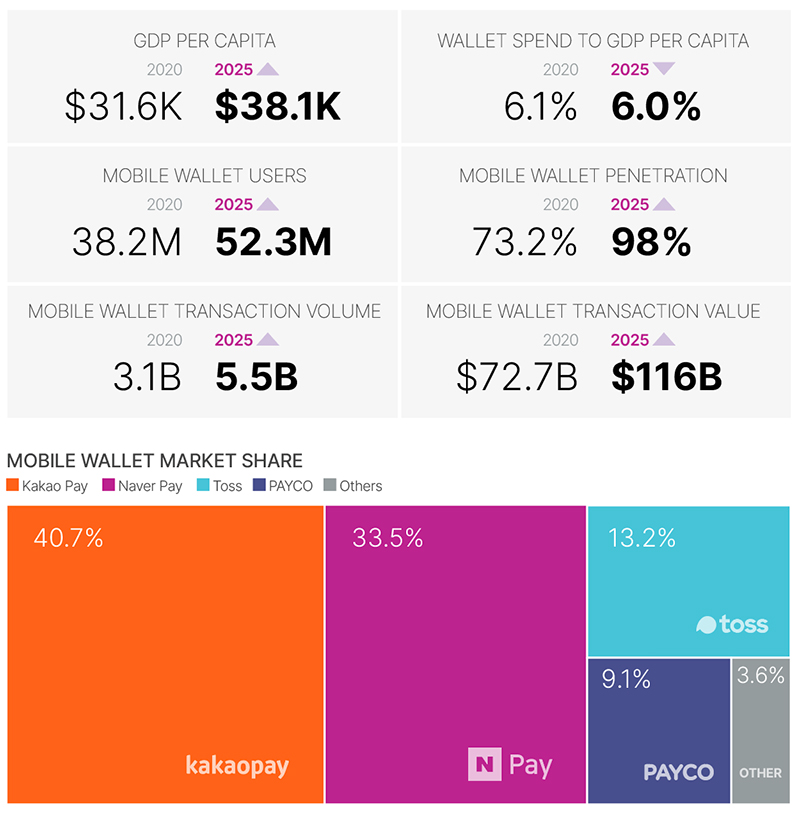

East Asia: Diverse growth patterns

- China is nearing market saturation with 1.34bn users in 2020 and a modest annual growth rate.

- Japan, Korea, and Taiwan are expected to experience rapid increases in mobile wallet adoption, approaching near-total market penetration by 2025.

Africa and the Middle East: Rapid expansion of popular e-wallets

- The second-largest mobile wallet market is projected to grow by 147% from 2020 to 2025, mainly due to increasingly popular mobile wallet services like M-Pesa.

Latin America: Boosted by ecommerce

- In Latin America, the popularity of mobile wallets is expected to surge by 166% from 2020 to 2025, propelled by the growth of ecommerce and a shift away from traditional cash-based payments.

Western Europe and North America: Steady growth

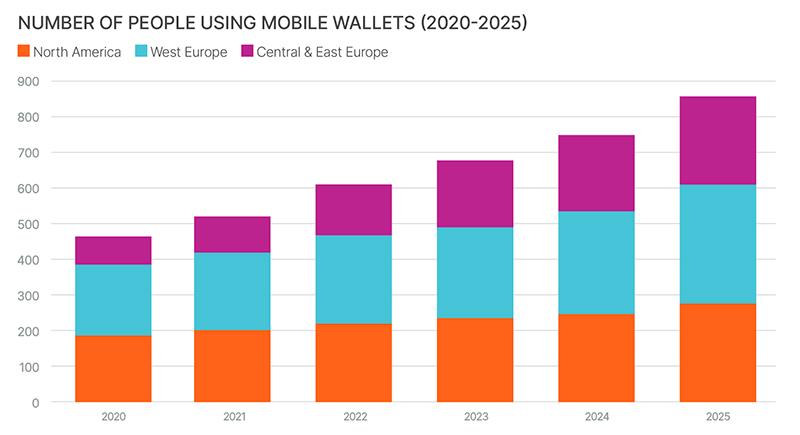

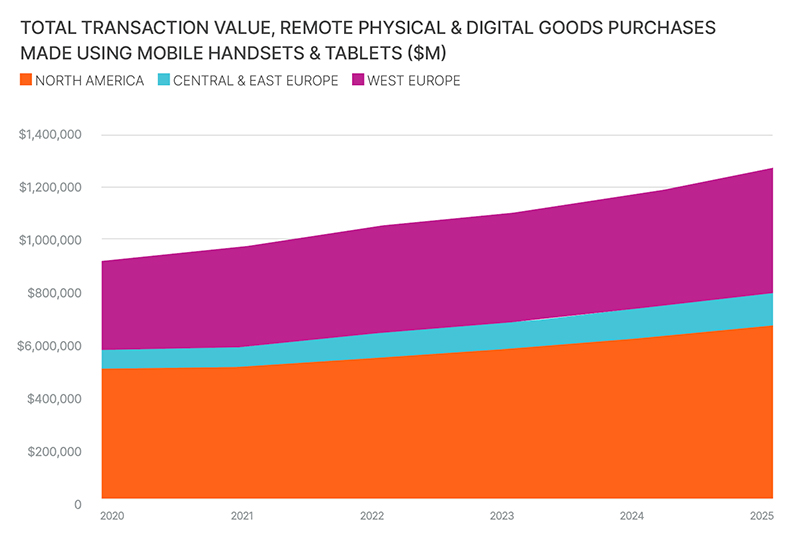

- These regions are anticipated to experience slower growth in mobile wallet adoption, with an expected increase of 65% in Western Europe and 50% in North America by 2025.

- In markets like the UK, there’s a noticeable trend towards card-based mobile wallets, spurred by the increased use of contactless payments during the pandemic.

Revisiting projections: The path to 60% global adoption

The projection that 60% of the global population will use mobile wallets by 2025 appears to be on track. In 2021, the global mobile wallet market was valued at $6.2 billion. This number is projected to grow at a compound annual growth rate (CAGR) of 27.4% from 2022 to 2030.

Regional variations and trends in mobile wallet usage

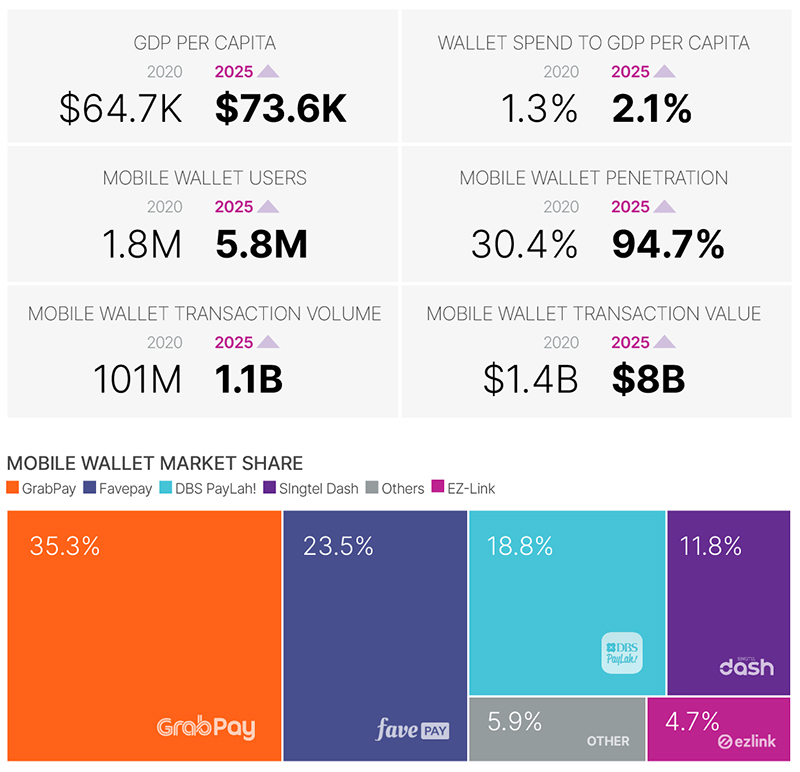

Global e-wallet usage trends are diverse, with Asia Pacific leading the charge. This global embrace of digital wallets is not uniform, with variations across regions. In China, for instance, there is an 87.3% adoption rate for point of-sale (POS) mobile payments, underscoring the country’s leading position in the digital payments space.

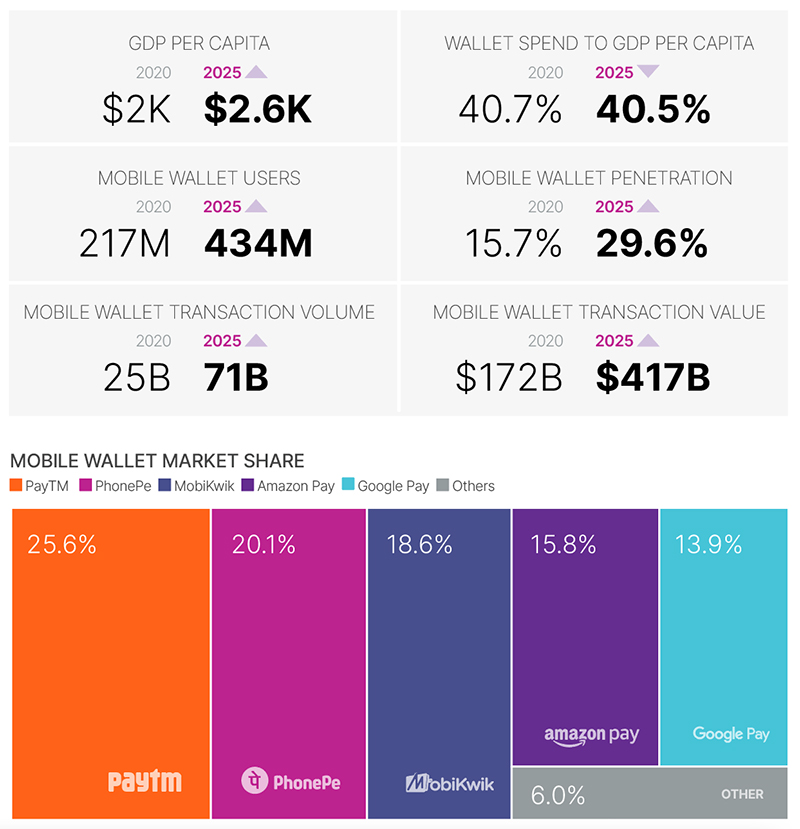

Thailand and India also show substantial mobile wallet adoption, driven by distinct factors unique to their markets. Before the widespread usage of e-wallets, Southeast Asia relied heavily on cash and bank transfers. The convenience and accessibility of mobile wallets, particularly those that store value, are projected to propel the region ahead in the global mobile payment race.

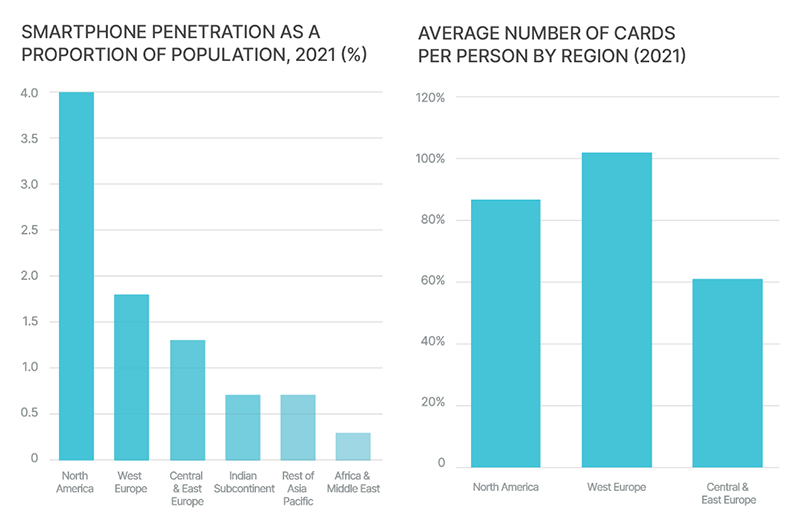

However, according to Adam Lee, Chief Product Officer at Boku, there is a distinct split in the global market. Developed markets are leaning towards card-based mobile wallets, while Asia and other emerging markets are witnessing rapid growth in stored-value mobile wallets. He noted that in regions like North America and Western Europe, where card-based wallets are prevalent, the growth in mobile wallet adoption is more gradual.

Philippines: A microcosm of mobile wallet growth

In the Philippines, adopting mobile wallets indicates a larger trend in Southeast Asia. This region is characterized by a rapid shift towards digital payments, driven by the convenience and efficiency of mobile wallets compared to conventional banking methods.

Specific cases highlight how digital payment solutions are being implemented in various sectors, from small businesses to public services:

Growsari digital payments in traditional retail

The integration of digital payments in sari-sari stores is exemplified by Growsari, a mobile app designed to make digital payments more accessible to micro, small, and medium enterprises (MSMEs). Growsari’s approach addresses the unique challenges faced by these small businesses, providing them with a digital platform to manage sales, inventory, and financial transactions more efficiently.

UnionBank’s support for MSMEs

UnionBank’s digital payment options demonstrate another aspect of supporting MSMEs through events like the Momzilla Fair. By facilitating easier access to e-wallet usage, UnionBank plays a crucial role in helping small enterprises transition into the digital economy. This in turn accelerates the adoption of mobile wallet technologies in the country.

Bayad’s digital payment solutions

By integrating mobile wallets into public services, Bayad helps the public transition to digital payments. Their collaboration with the Metropolitan Manila Development Authority (MMDA) shows the increasing relevance of electronic financial solutions in governmental operations. With that, Bayad is driving efficiency and revolutionizing public service transactions.

Future outlook: Mobile wallets as a mainstream payment method

A global shift towards using e-wallets is reshaping the landscape of digital payments, with projections indicating that nearly 60% of the world’s population is on track to embrace this technology by 2025. This trend is particularly pronounced in developing regions, where digital payments are rapidly supplanting traditional methods.

Boku’s “Mobile Wallets Report” emphasizes the current shift towards digital payments. It specifically highlights substantial growth in Southeast Asia, influenced by the rise of e-commerce and popular e-wallets. As this trend continues, we can expect to see even greater integration of digital payment solutions in various aspects of daily life, reshaping the way we think about and manage money.

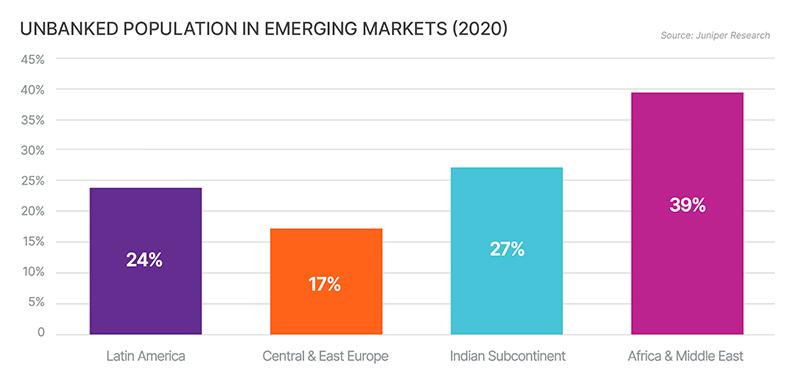

With a widening range of functionalities, mobile wallets are poised to become more embedded in global financial transactions. This shift is significant, not just in terms of convenience and efficiency, but also in terms of financial inclusion. Mobile wallets allow greater access to financial services for those previously underserved by traditional banking systems.

Download the 2021 “Mobile Wallets Report” here: