February 12, 2025 – Global podcasting is evolving, breaking past the barriers of audio to embrace video as publishers chase new revenue streams. WARC Media’s latest Global Ad Trends report, Podcast media sets sights on video boom, uncovers the latest shifts in the industry, as video-first strategies take center stage in the fight for advertising dollars.

Alex Brownsell, Head of Content, WARC Media, says: “Podcasts are having a moment. Fresh from seemingly helping Donald Trump to win last year’s ‘podcast election’ in the US, brands are reappraising the medium through fresh eyes.”

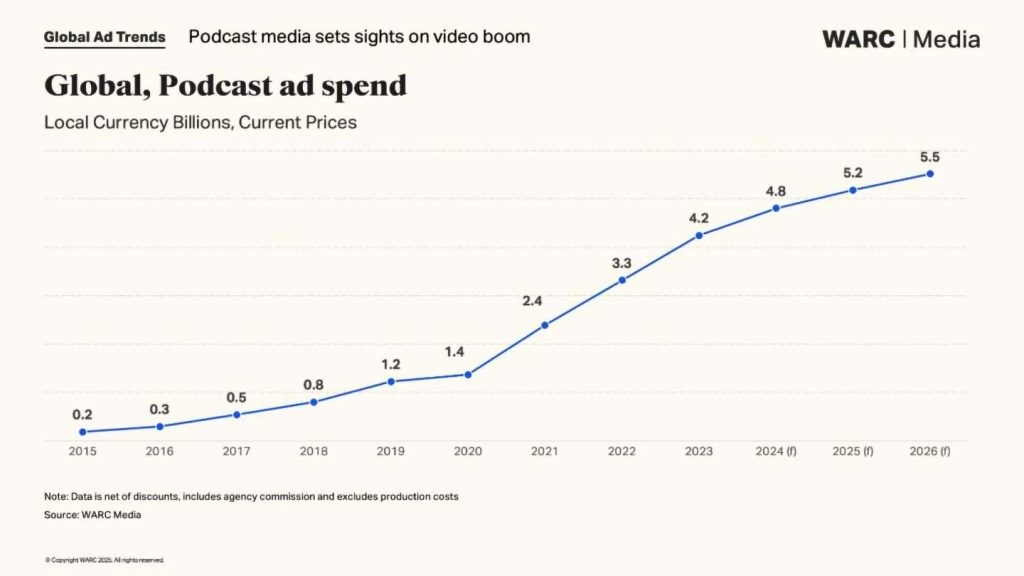

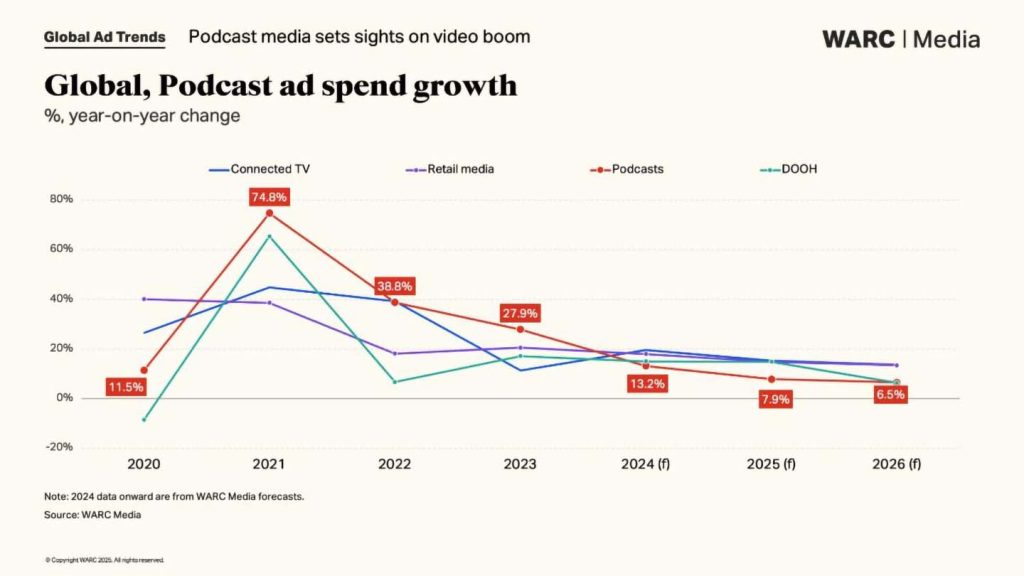

While podcasting continues to gain influence, ad spend growth remains sluggish. WARC Media forecasts show global podcast ad revenue hitting $5 billion in 2025 (+7.9%) and $5.5 billion in 2026 (+6.5%). This pales in comparison to the meteoric rises seen in retail media (+14.8% in 2025), connected TV (+15.4%), and digital out-of-home (+14.9%).

Ad measurement and scalability remain key challenges, yet over half (55%) of global marketers plan to increase podcast ad spend this year, according to WARC’s Marketer’s Toolkit survey. Podcasts rank fifth in investment priority, trailing online video, influencer marketing, and social media.

YouTube has emerged as the most popular platform for podcast video. Viewers watched over 400 million hours of podcasts per month on YouTube’s TV app in 2024. More than 250 million users have streamed a video podcast on Spotify, with consumption most prevalent among Gen Z users: in the first five months of 2024, the younger cohort watched 2.9 billion minutes of video podcast content, up 58% year-on-year. Spotify found a +55% lift in intent for campaigns with an audio and video takeover versus audio-only campaigns.

As brands become more sophisticated in how they incorporate creator content into media plans, it may provide an opportunity for podcast media to escape its audio bubble. However, obstacles include consumers wanting to minimise video and listen to audio only, podcast creators unwilling to embrace video and lose control over monetisation, and perceived deficiency in podcast measurement tools.

WARC Media forecasts that global podcast ad spend reached $4.8bn in 2024, will exceed $5bn in 2025, and amount to $5.5bn in 2026. However, year-on-year growth is set to slow from 13.2% in 2024 to 7.9% in 2025, and only 6.5% in 2026.

This is markedly down on the expanding investment levels in other emerging channels, including retail media (+14.8% in 2025), CTV (+15.4%) and even DOOH (+14.9%).

Difficulties in scaling podcast ad buys is one oft-repeated complaint among brands. Another is a perceived deficiency in podcast measurement tools.

The U.S. remains the world’s largest podcast ad market, capturing nearly half (45.9%) of total spend, with projected revenues reaching $2.4 billion in 2025. Retail remains the top-spending category, though political campaigns and government bodies have also increased investment, especially during election cycles.

In the UK, podcast ad spend is expected to hit £110 million this year, outpacing growth in search, social media, and BVOD. Nearly a quarter (23.6%) of Brits aged 15-24 tune into podcasts weekly, with the 25-34 demographic showing the highest engagement.

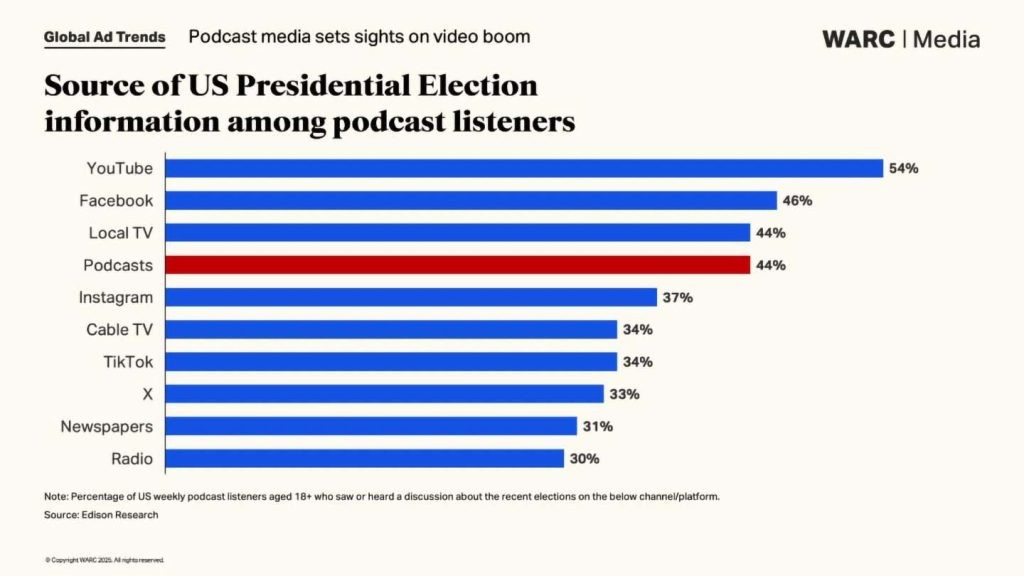

Podcasts played a decisive role in the 2024 U.S. election, with Donald Trump’s strategic podcast appearances proving far more effective than Kamala Harris’. Trump’s reach, 23.5 million average listeners per show – outperformed Harris’ 6.4 million, delivering 2-3x better results for brands in key metrics like site visits and conversions.

This influence is forcing brands to rethink ad placements. While marketers have traditionally approached politically charged content with caution, the results are shifting perceptions. With nearly half (44%) of Americans sourcing election information from podcasts—surpassing cable TV (34%)—brands are recognizing the channel’s power in shaping public discourse.

Nearly 40% of listeners say the medium has become “more relevant” in recent years, according to an Acast study. However, as programmatic trading expands into podcasting and the channel expands beyond baked-in host-read ads, other studies have found that two in five (42%) regular listeners skip podcast ads, as they find them intrusive.

Studies have found that episodic buys – that is, ads placed in a single podcast episode on a specific show – tend to outperform ads dynamically inserted throughout shows across a podcast network. In the case of host-read ads, Podscribe research found that, as ad length increases, visitor rates to advertisers’ sites also increase. On average, a two-minute-plus read outperforms 60-second or shorter reads by about 20%.

Read a complimentary sample report of WARC’s Global Ad Trends – Podcast media sets sights on video boom. WARC Media subscribers can read the report in full. A WARC podcast discussing the findings outlined in the report will be available from 25 February.