SINGAPORE — As Southeast Asia grapples with the compounding challenges of inflation reflected by rising energy bills, food prices, and interest rates, a distinct financial landscape is emerging. The impact of these economic factors has far-reaching consequences, particularly on debt vulnerabilities, impacting overall borrowing habits, and the financial well-being of individuals and businesses in the region

Milieu Insight, an award-winning consumer research firm in Southeast Asia has conducted a regional study on the financial realities among individuals in Singapore, Malaysia, Indonesia, Thailand, Vietnam, and the Philippines. Key insights include borrowing habits, debt types, and personal finance awareness. The study found that 62% of Southeast Asia currently holds debt or loans, with Malaysia (79%) and Vietnam (76%) emerging as the nations grappling with the highest prevalence of people who have loans or currently holding debt.

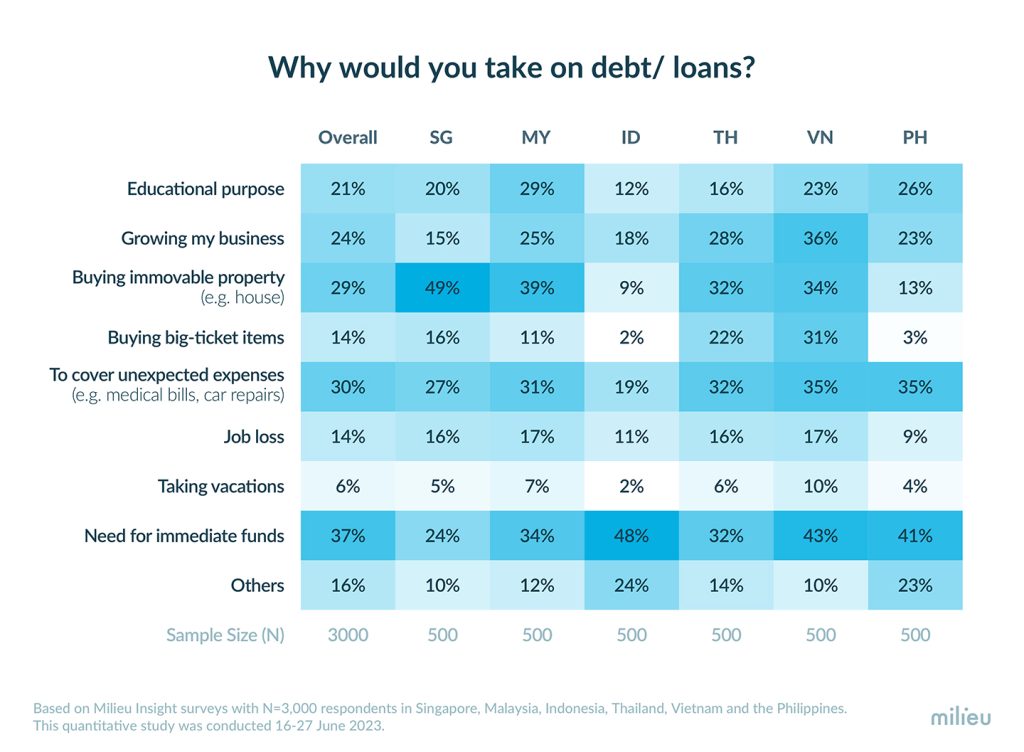

Reasons for taking on debt or loans

Among the various financial obligations faced by Southeast Asians, credit card debt(22%) and debts owed to individuals or moneylenders (18%) emerged as the most prevalent forms. The study also revealed that the majority in Singapore (88%) and six in ten in the Philippines (63%) and Malaysia (62%) consistently pay their monthly credit card bills in full and on time.

Property acquisition emerges as a significant driver of indebtedness in Singapore, while other countries exhibit higher demands for short-term financial assistance. 49% of respondents in Singapore choose to take on debt to purchase property. On the other hand, respondents in Indonesia (48%), Vietnam (43%), and the Philippines (41%) cited an urgent need for immediate funds as their primary motivation for seeking loans.

Financial Strain: 14% report zero savings after debt and expense obligations

Regionally, there is a growing concern about indebtedness, with 14% reporting an inability to save after deducting expenses and debt/loan repayment. The situation in Thailand is even more alarming, with 24% unable to save after covering essential expenses and loan repayment. However, there is a stark contrast in Singapore, where 14% of respondents are saving more than 50% of their income.

Comfort Levels with Loans

Respondents in Indonesia (90%) and Thailand (86%) expressed the highest level of discomfort in taking out loans, while those in Vietnam (46%) and Malaysia (31%) show the highest level of comfort with debt/loans.

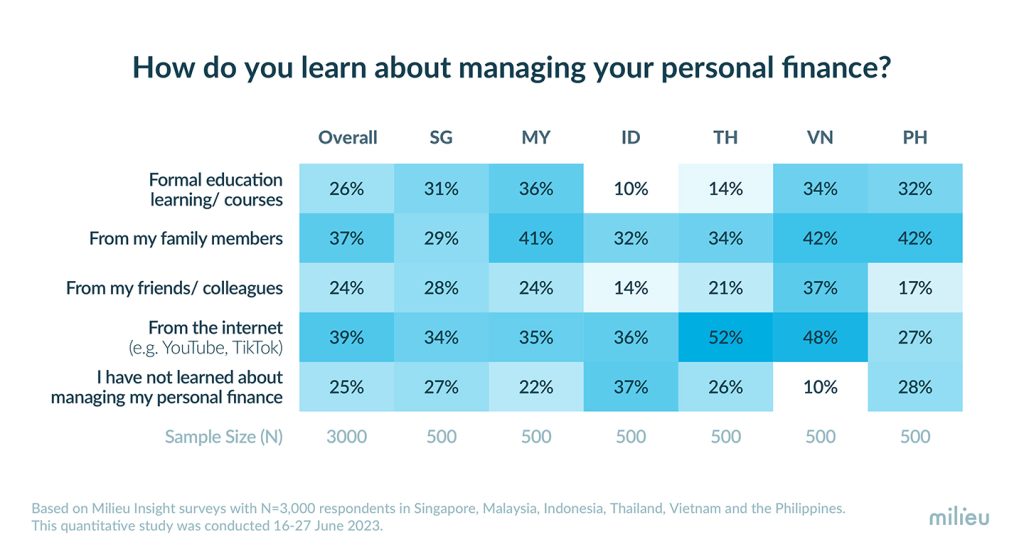

Financial Literacy

The study revealed that 1 in 4 across the region lacked personal finance education, with Indonesia having the highest proportion at 37%. In Singapore, less than 1 in 5 individuals aged 16-34 reported not having learned about personal finance.

The Internet is the primary source of personal finance knowledge for Southeast Asians, with 39% relying on it. In Thailand, more than half of respondents (52%) rely on the Internet to learn about managing their personal finance. In Malaysia, the majority (41%) learned about managing their personal finance from family members, with 36% proactively taking formal education or courses on the topic. Indonesia had the highest percentage of respondents (37%) who indicated that they have not learned about managing their personal finance.

Understanding the debt landscape and personal finance dynamics in Southeast Asia has never been more critical. With rising interest rates, the cost of borrowing will also increase for households and business owners. The risk of debt defaults and financial distress looms larger, which will likely impact economic growth and widen the wealth inequality gap.

As there is no official rule defining good and bad debt, understanding the distinction becomes crucial. Good debt, such as a mortgage, can propel individuals toward their financial objectives and secure their future by generating wealth and producing returns on investment with lower interest rates. On the other hand, bad debt does not increase net worth and involves spending on depreciating purchases, often accompanied by higher interest rates.

Financial education is thus crucial and should be viewed as a lifelong learning process, with continuous efforts to update and adapt programs to align with evolving economic conditions. By fostering a culture of learning and financial awareness, we can equip our communities with the tools to make sound financial decisions and achieve financial security.