STOCKHOLM, SWEDEN — Spotify, the world’s most popular audio streaming subscription service, is now turning to opportunities in the video advertising space whilst making it easier for brands to run multi-media campaigns on the platform.

While Spotify is by no means a social platform, it is looking to better facilitate community and connection between fans and artists.

Alex Brownsell, Head of Content, WARC Media, and author of the report, says: “Spotify is looking to expand beyond its sonic roots. The platform is eyeing opportunities in the video ad space, especially with video podcast consumption rising.”

“Moreover, a splurge by Spotify on original podcast content and monetization tools has been replaced with a greater focus on ensuring that rising ad revenue leads to greater business profitability.”

Providing evidence-based insights on the challenges and opportunities Spotify has to offer, this latest Platform Insights report from WARC Media offers an overview of the key data points that advertisers need to know about the platform spanning investment, consumption, and performance.

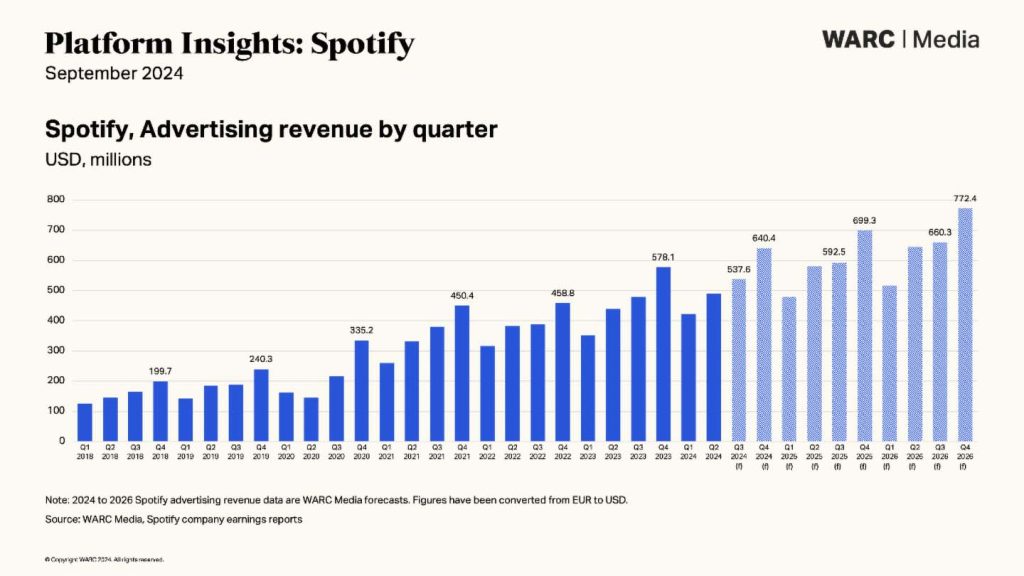

Investment: Spotify’s advertising revenue is forecast to reach $2.1 billion in 2024, up 13.0% year-on-year, with revenue rising to $2.6 billion in 2026

Spotify has consistent advertising revenue growth momentum. The platform has achieved double-digit growth in its advertising business over the last six quarters. WARC Media figures suggest Spotify’s global advertising revenue will surpass $2 billion for the first time in 2024, up 13.0% year-on-year with revenue rising to $2.6 billion in 2026.

Podcast advertising revenue growth has outpaced increases in Spotify’s music advertising monetization, driven by a boost in impressions sold in both original and licensed content via Spotify Audience Network. Spotify is also looking to boost advertising revenue through the launch of generative AI tools such as Quick Audio.

Spotify is looking to enhance its social credentials, enabling comments on podcasts and allowing users to share their listening habits with followers.

Brands in categories such as financial services and automotive are using campaigns on Spotify as a means of building incremental reach with younger buyers. According to an analysis by WARC Media, financial services will be the third highest spending category on the platform in 2024, with investment reaching $339.4 million. While 61% of first-time car buyers on Spotify are under the age of 35, according to GWI.

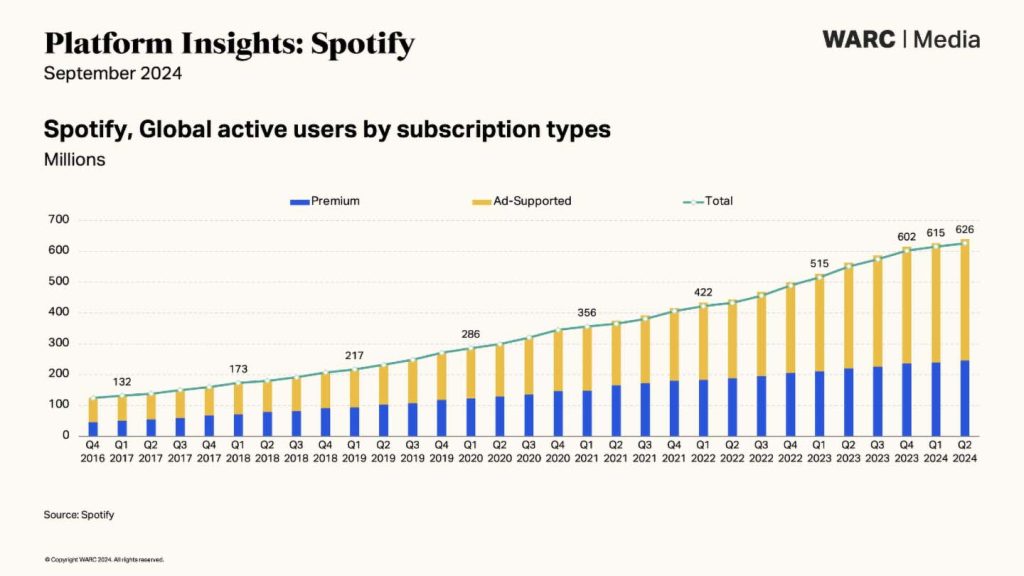

Consumption: Spotify has more than 626 million users globally with the Middle East, Africa, and Asia leading growth

Spotify is the world’s most popular audio streaming subscription service, with more than 626 million users globally. While growth in North America has plateaued, Spotify has made gains in the rest of the world. The Middle East, Africa, and Asia accounted for 205 million users in Q2 2024, up from 165 million a year ago.

According to Spotify, more than 319 million Gen Z users are “actively engaged” with its “most immersive features” with in-app video a key area of focus. The platform claims it has seen an 81% year-on-year increase in video streaming among Gen Z users, they also account for 57% of Spotify’s audiobook listeners and are more likely than others to use its “AI DJ” product, introduced last year.

Spotify wants to help users express their fandom by enabling comments on podcasts and making it easier for artists to share content. This, in turn, is making it easier for brands to target communities on the platform.

User engagement varies over the course of the average day. Audio podcast consumption on Spotify spikes in the morning and music streaming climbs towards lunchtime, whereas video podcast viewing is more likely at night.

In light of YouTube’s growing presence in the podcast space, Spotify is eager to position itself as more than just an audio platform. Spotify claims to have seen a 44% year-on-year increase in video streams over the last 18 months, with a growing number of users watching podcast content. Gen Zs are leading this growth, spending 136% more time with video on Spotify year-on-year.

However, video podcast consumption habits appear to differ by market and region. According to a YouGov study, around a quarter of US adults say they prefer to watch video podcasts. This share drops to around one in eight (13%) adults in the UK.

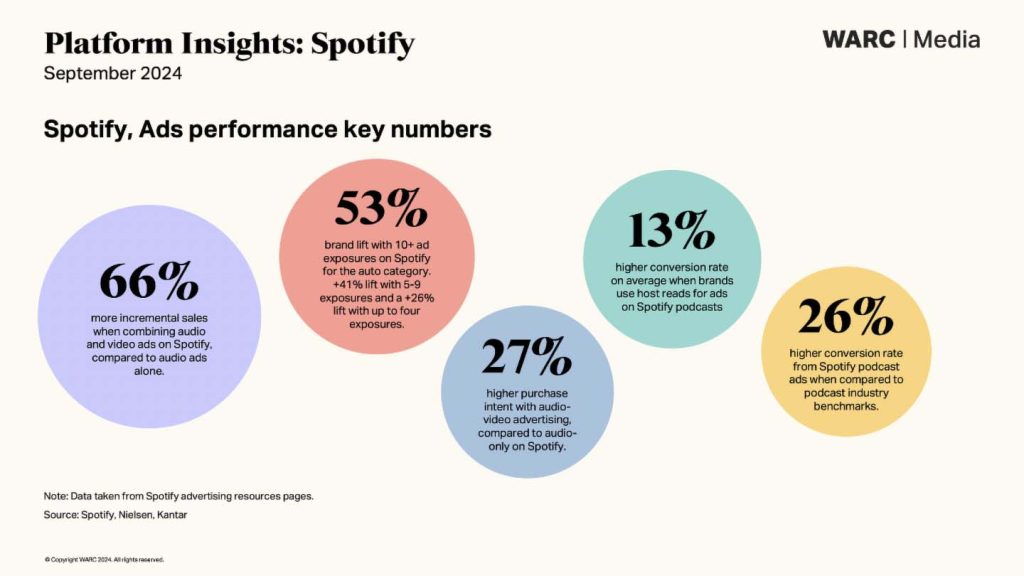

Performance: Combining video and audio advertising formats boosts sales by 66% and purchase intent by 27%

As Spotify looks beyond its roots, the streamer is keen to convey that combining video and audio advertising formats on its platform can enhance campaign effectiveness. Spotify’s own research suggests a 66% boost to incremental sales and 27% higher purchase intent versus audio-only campaigns.

Data from Spotify claims it can deliver a 27% higher average incremental unique weekly reach over commercial TV channels, and 22% incremental unique weekly reach on social platforms.

Audio streaming can have a tangible impact on shopping habits. Spotify argues it is uniquely positioned to be able to do so at all stages of the customer journey, given the role of the app throughout daily routines.

The role of attention in audio advertising effectiveness is only beginning to be explored. Spotify video ads averaged around 58% above Adelaide’s attention benchmark for online video, surpassing platforms including TikTok, Instagram, and Snapchat.

Platform Insights: Spotify is part of a series of reports exclusive to WARC Media subscribers, which include an overview of platform investments, media consumption and performance insights. This latest report follows Platform Insights: Pinterest, TikTok, YouTube, Instagram and Snapchat.