KUALA LUMPUR, MALAYSIA — TrueMoney, a leading fintech company in Southeast Asia and a subsidiary of Ascend Money, has recently launched in Malaysia. With a focus on providing a seamless payment solution in the digital age, TrueMoney is now the official payment provider for all of retail chain company Lotus’s locations across Malaysia.

Founded in 2003, TrueMoney operates in six countries and has the largest agent network with over 88,000 agents to seamlessly send money both domestically and internationally, as well as an e-wallet that offers a wide range of new financial solutions, such as cashless payments, mobile top-ups, bill payments, international remittances, and many more.

Dale Kim, Ascend Money’s Managing Director of International Business, said “TrueMoney has been a leader in financial solutions for over 9 years with a mission to provide innovative financial services to all. We see so much opportunity for improving the lives of the people in Southeast Asia by providing accessible and easier access to payment solutions in the region. With the launch of TrueMoney in Malaysia, we now offer our e-wallet solution in 7 markets and are excited to extend our goal of improving the lives of everyone in the region.”

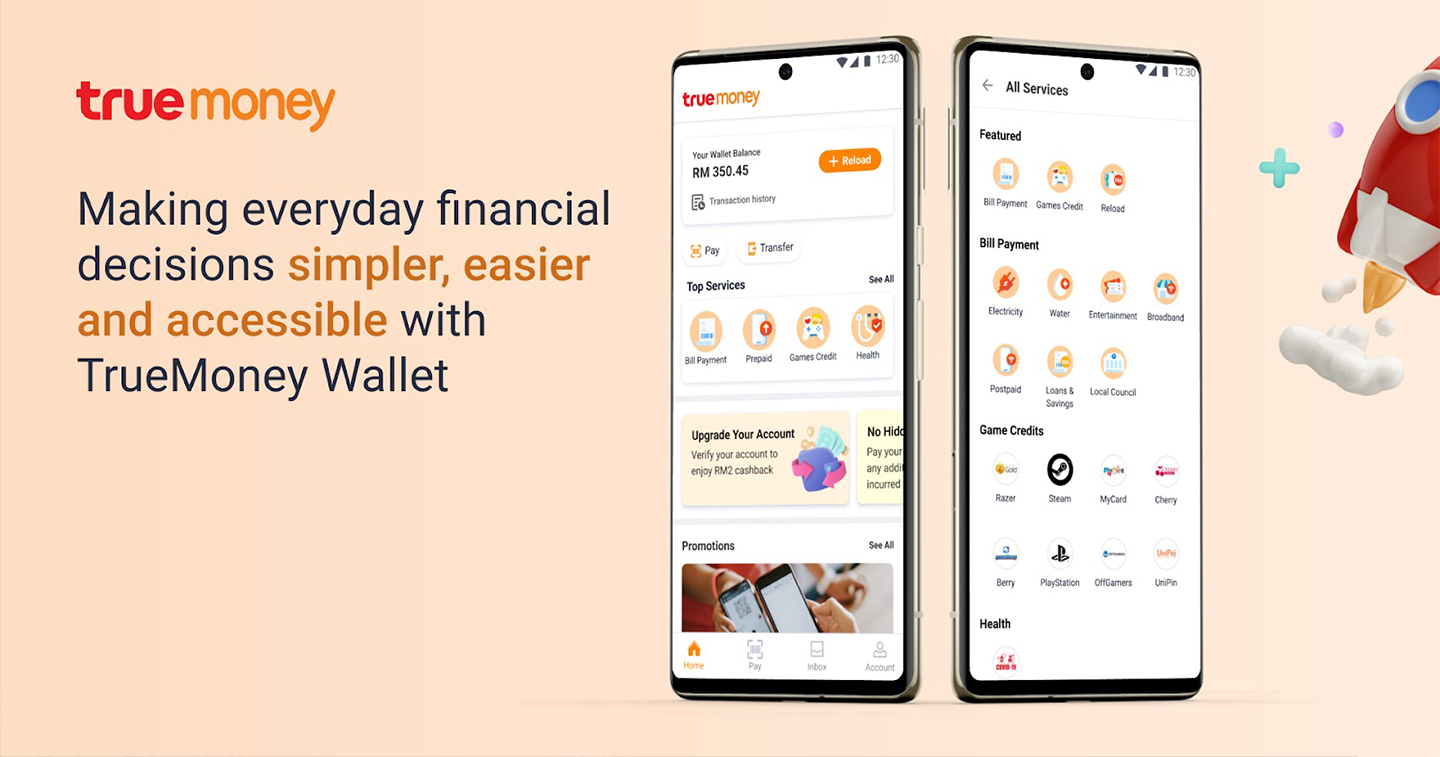

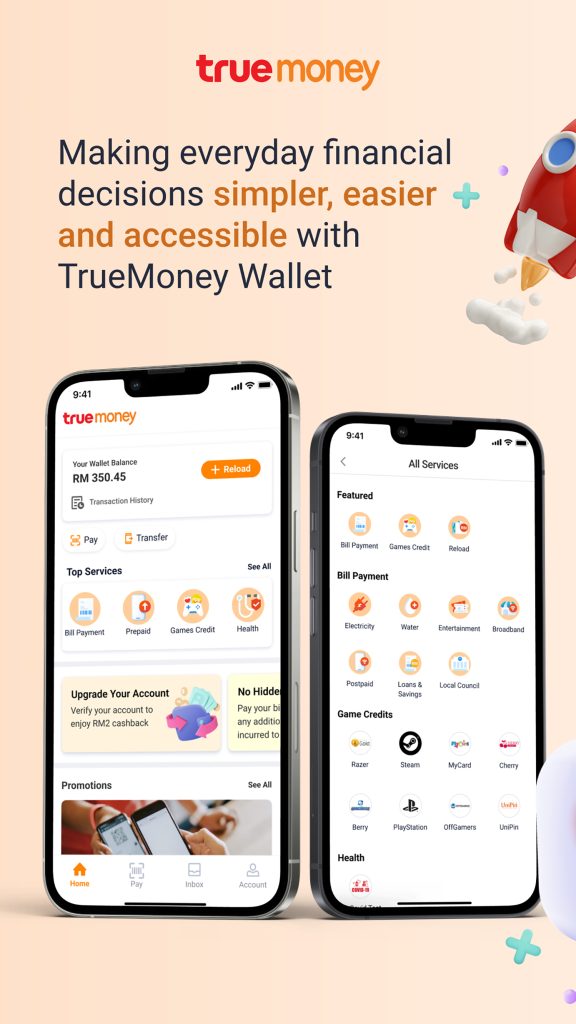

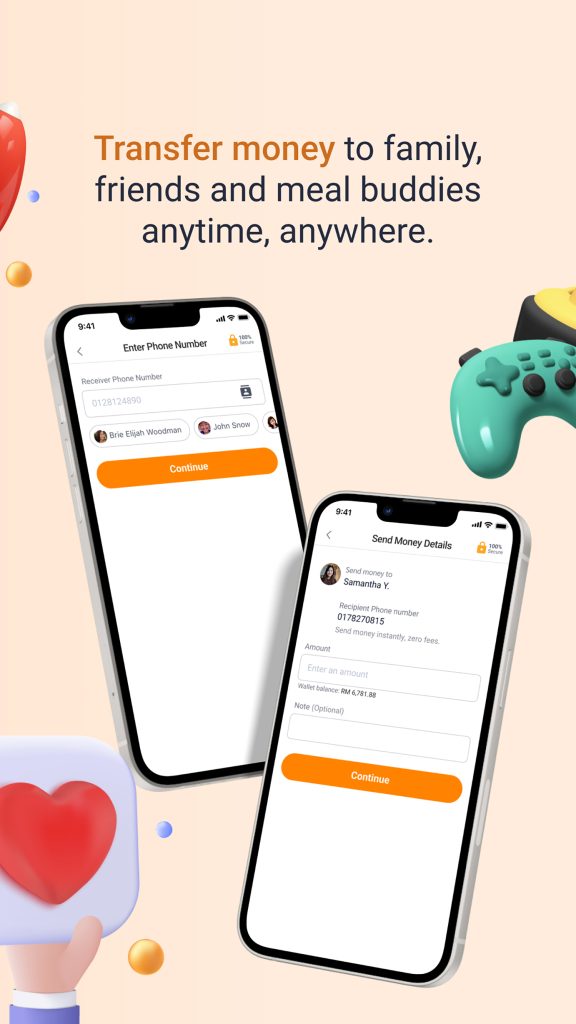

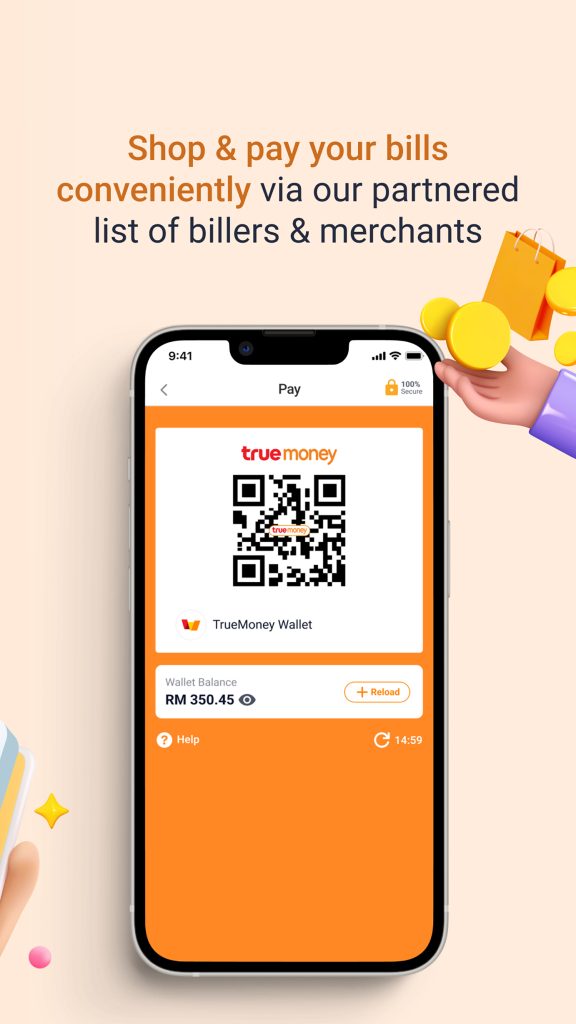

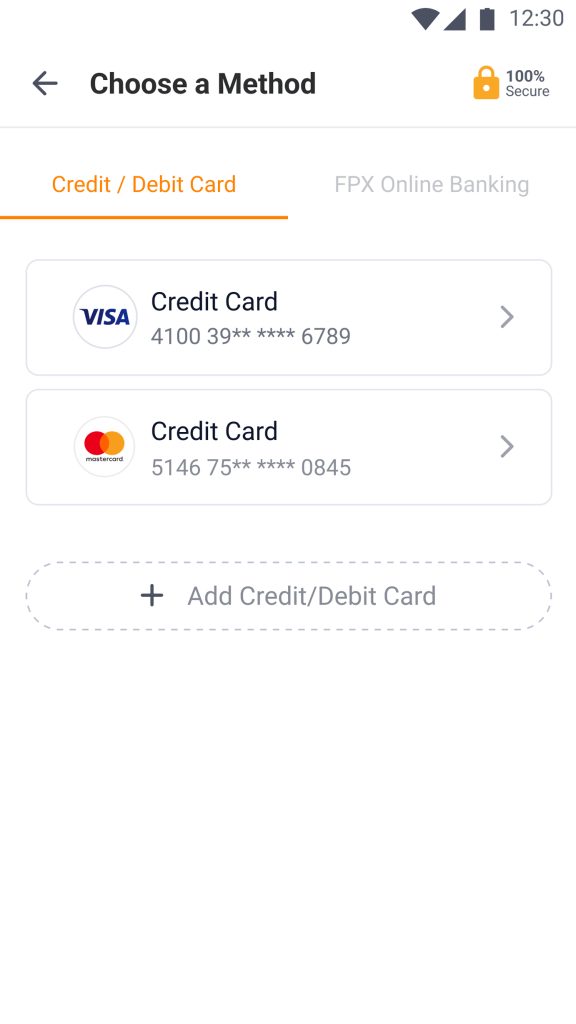

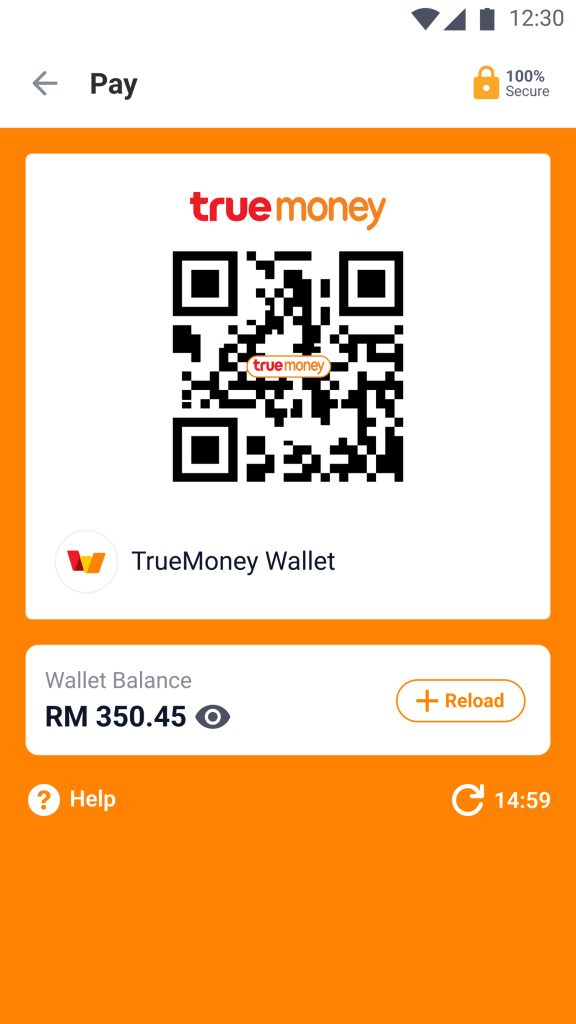

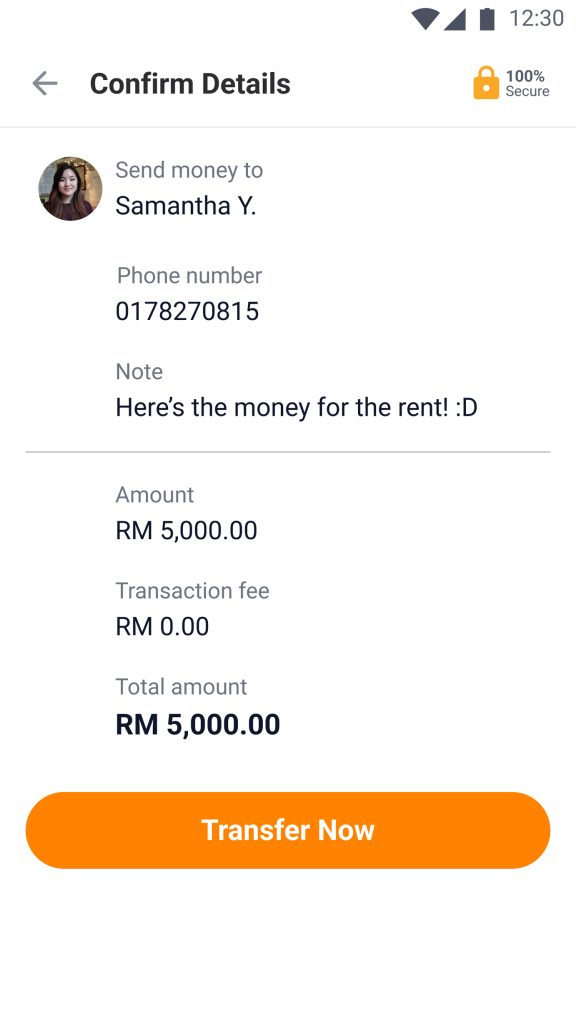

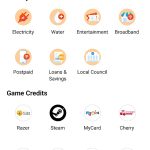

With TrueMoney’s hassle-free e-wallet and contactless QR Code payments, Lotus’s customers can now make prepaid and game credit top-ups, as well as pay utility (eg. electricity, water) and phone bills in addition to their day-to-day expenses with simplicity. Furthermore, customers will be able to make peer-to-peer transactions through the True Money app and trace every transaction they conduct because every action is recorded in real-time.

Jessie Chong, Ascend Group’s Country Managing Director, said “We, TrueMoney, have now expanded into the Malaysian market, marking the company’s 7th Southeast Asian country of operation. Through our e-wallet, we offer seamless payment and convenience to all users, with a wallet size of RM10,000 and the utmost assurance of safe and secure payment. We aim to leverage our international presence to create a holistic and dynamic approach to creating a payment ecosystem within Southeast Asia that benefits individuals and SMEs; which includes cross-border payments in the pipeline. We might be the new kid on the block, but we bring with us a strong tech infrastructure and pre-existing businesses to connect with users in Malaysia.”

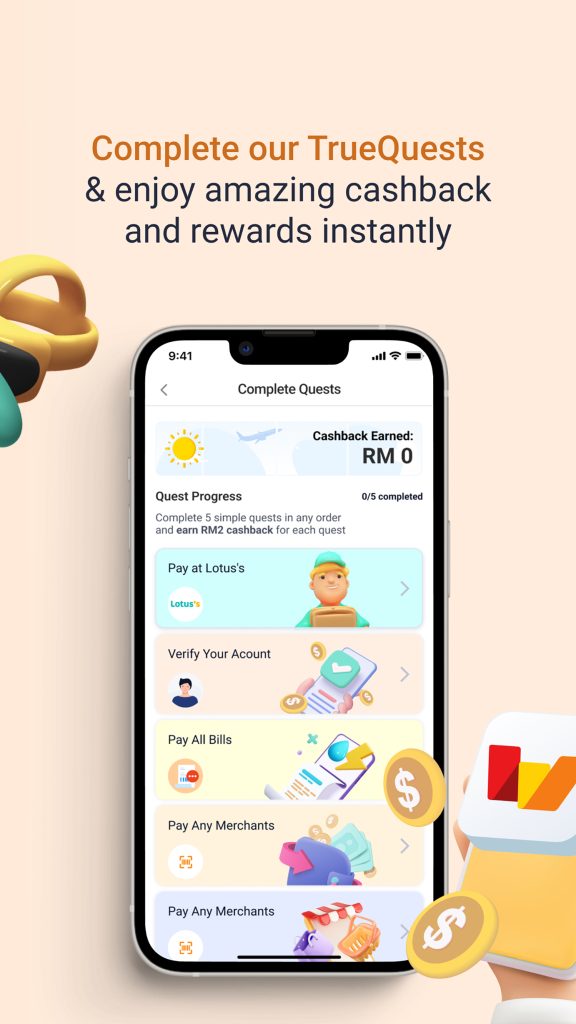

The TrueMoney e-wallet is currently available in Malaysia via both the Apple App store and Google Play store. Users of the TrueMoney e-wallet will also be able to receive instant benefits upon activation, apart from enjoying Lotus’s cashback and points, along with an RM10 TrueQuest reward.

To make its mark in the country, TrueMoney has decided to make everyone’s grocery shopping experience more convenient for Malaysian consumers. By partnering with Lotus’s Malaysia, TrueMoney provides consumers with the convenience they need to effortlessly transact and manage their expenses for their essentials with its app.

Vivian Yap, Executive Director, Customer of Lotus’s Malaysia shared, “Given today’s climate, consumers are more technologically sophisticated, they seek seamless, easy, and convenient shopping experiences all the time. As part of Lotus’s ongoing digital transformation, we are delighted to welcome TrueMoney to Malaysia and to our customers. By incorporating TrueMoney into our e-wallet service portfolio, our customers have more cashless options at all of our 65 stores. Not only will customers have an easy cashless option with TrueMoney, but it will also be very rewarding as TrueMoney Malaysia will reward our customers with My Lotus’s loyalty points. My Lotus’s loyalty points can then be used to pay for purchases, giving them further savings on their shopping.”

As of 2022, more than 50 million people across the SEA region have used TrueMoney’s e-wallet app. TrueMoney Malaysia hopes to form more local partnerships with well-known merchants in the future and build up the whole ecosystem of financial services.