MANILA, Philippines – ING Philippines is adding more customer-centric features that meet customers’ increasingly digital banking behavior since the start of the global pandemic.

Two additional features will be available for its customers on the ING Pay account which is designed to make everyday payments more convenient and secure.

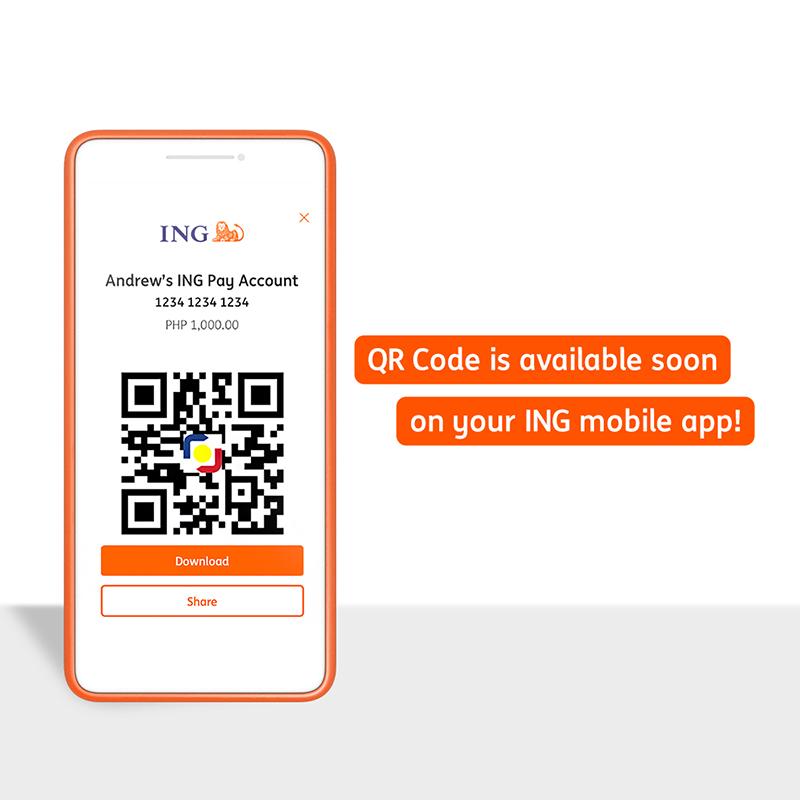

First, by adopting QR Ph – the national QR code standard – ING provides an additional channel for customer to transfer and receive funds instantly with no fees. From the ING Pay account, customers can scan or upload QR codes of other banks/e-wallets, or to generate QR code based on their ING Pay account details. The QR code generated can be saved in the phone for future transactions. With account details securely embedded within the QR code, customers no longer have to worry about keying the wrong account details when making a fund transfer.

“QR code has gained strong traction across Asia Pacific. The ease of use has a huge potential to convert more consumers into adopting cashless transactions and enhance financial inclusion in the country. We support the QR Ph program led by the Bangko Sentral ng Pilipinas (BSP) and the Philippine Payments Management, Inc. (PPMI). And we are confident that the convenience of this peer-to-peer channel will be well-received by ING customers who are early adopters of digital transactions and constantly looking for banking services that fit their digital lifestyle,” said Mohamed Keraine, ING’s head of retail for the Philippines.

Since the launch of its second product, ING Pay account, in November 2020, Mohamed highlighted that ING’s “no-fee” proposition continues to be one of the reasons for customers to advocate for the ING brand. Hence, ING maintains that all transfers from ING via PESONet, InstaPay and QR code will remain free from any transaction fee. ING customers will be notified via in-app message and SMS once the QR code feature is available to them by mid October 2021.

With the goal of empowerment, the second feature allows ING customers to adjust their debit card daily limit by transaction type. This means that customer can choose a different daily limit, up to a maximum of PHP 250K, for point-of-sale payments, online purchases and ATM withdrawals respectively, based on their spending profile and habits. This feature adds a layer of security as customers can also keep their card limits low when they are not planning any big transactions. Customers will also get notified when the card limits have been changed.

“Giving the control and flexibility to our customers for their daily transaction needs is one of many customer-centric banking solutions that ING strives to deliver. As we grow with our customers, we are committed to bring more easy, smart and personal banking services to our customers in the Philippines,” Mohamed added.