MANILA – While consumer confidence across a number of Southeast Asia markets has taken a minor decline in Q2 2014, the Philippines remains bullish, jumping four points in the latest quarter, according to the latest Nielsen Global Survey of Consumer Confidence and Spending released today by Nielsen, a global information and measurement company.

“The Philippines is showing quarter-on-quarter increase in consumer confidence which is largely driven by a strong economy and its growing middle class population,” observed Stuart Jamieson, Managing Director of Nielsen Philippines.

The Nielsen Global Survey of Consumer Confidence and Spending Intentions, established in 2005, measures consumer confidence, major concerns, and spending intentions among more than 30,000 respondents with Internet access in 60 countries. Consumer confidence levels above and below a baseline of 100 indicate degrees of optimism and pessimism.

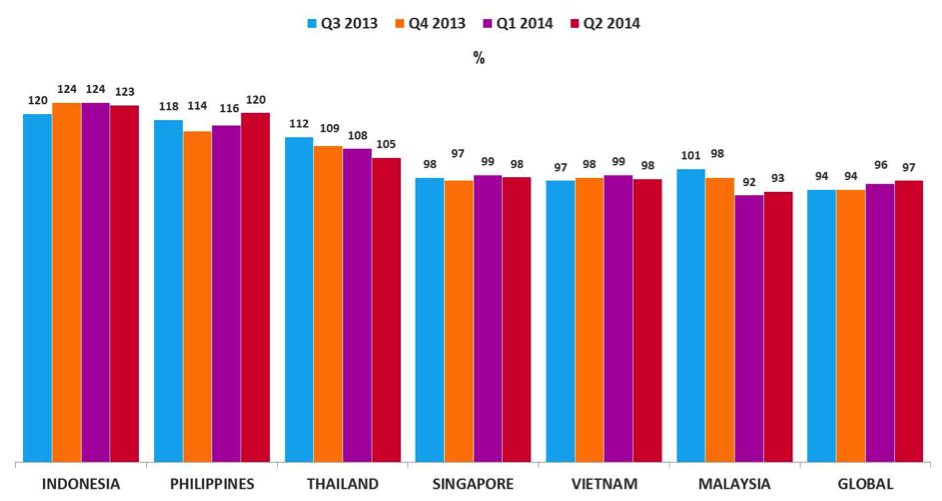

The Nielsen survey revealed that amid escalating political instability and rising food prices around Southeast Asia, only the Philippines and Malaysia saw increases in confidence between Q1 and Q2. The Philippines jumped four points to 120 (the third-highest score globally) and Malaysia was up one point to 93. Four of the six Southeast Asian markets covered in the survey showed confidence levels declining between Q1 and Q2 2014, with Thailand posting the region’s largest decline, down three points quarter-on-quarter to 105. Indonesia’s confidence index score was the second-highest globally despite dropping one point to 123 points in Q2 2014, while Vietnam and Singapore also dropped one point quarter-on-quarter, both posting a score of 98 points. Globally, consumer confidence rose slightly to 97 points in Q2 2014, up one point compared to Q1 2014.

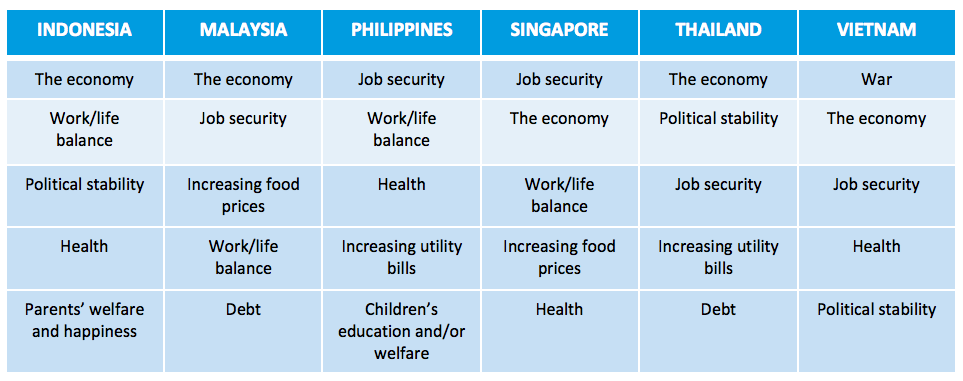

Job security, work life balance, and health are the top concerns for Filipinos while political stability and food prices feature prominently in other Southeast Asian consumers’ list of key concerns in Q2 2014.

Positive outlook, prudent with money

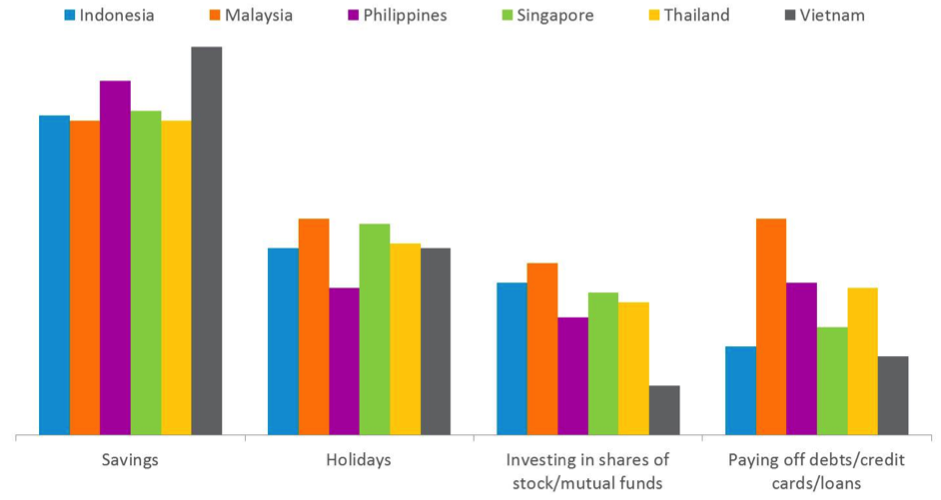

Even if Filipino consumers continue to exhibit a positive outlook, they are consistent with being prudent with their money. Filipino consumers join consumers from other Southeast Asia markets in channelling money into savings when asked how they utilise their spare cash after covering essential living expenses.

Eighty percent of consumers in Philippines perceive the state of their personal finances over the next 12 months as good or excellent, following 85 percent of Indonesian consumers. Consumers in Thailand, Singapore, Vietnam and Malaysia were less optimistic – 62 percent of Thais perceive the state of the personal finances over the next 12 months to be good or excellent, as do 55 percent in Singapore, 53 percent in Vietnam and 50 percent in Malaysia, compared to 56 percent globally.

Eighty percent of consumers in Philippines perceive the state of their personal finances over the next 12 months as good or excellent, following 85 percent of Indonesian consumers. Consumers in Thailand, Singapore, Vietnam and Malaysia were less optimistic – 62 percent of Thais perceive the state of the personal finances over the next 12 months to be good or excellent, as do 55 percent in Singapore, 53 percent in Vietnam and 50 percent in Malaysia, compared to 56 percent globally.

Thai consumers are the most-committed in Southeast Asia to keeping an eye on their household expenses – more than nine in 10 (92%) have changed their spending in the past year to save on household expenses. In Vietnam, 85 percent of consumers have changed their spending to save on household expenses, as have 80 percent in Malaysia and the Philippines, 79 percent in Indonesia and just 58 percent in Singapore, compared to 64 percent globally.

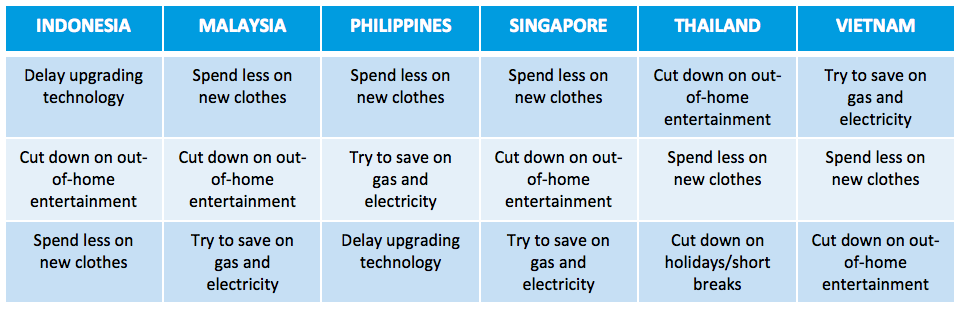

When it comes to keeping household expenses in check, limiting spending on new clothes is the top tactic for Filipino consumers followed by most common focus for Southeast Asian consumers, along with trying to save on gas and electricity and delaying technology upgrade.

“Although more Filipino consumers are joining the ranks of the middle class, these consumers have a strong focus on saving for household emergencies, health issues and the future in general. They are more aware of how they manage their day-to-day and long-term financial goals,” observes Jamieson. “To be able to tap into the expanding but financially-conscious middle class Filipino consumers, marketers should develop a range of products and services which will provide good value for money.”

“Although more Filipino consumers are joining the ranks of the middle class, these consumers have a strong focus on saving for household emergencies, health issues and the future in general. They are more aware of how they manage their day-to-day and long-term financial goals,” observes Jamieson. “To be able to tap into the expanding but financially-conscious middle class Filipino consumers, marketers should develop a range of products and services which will provide good value for money.”