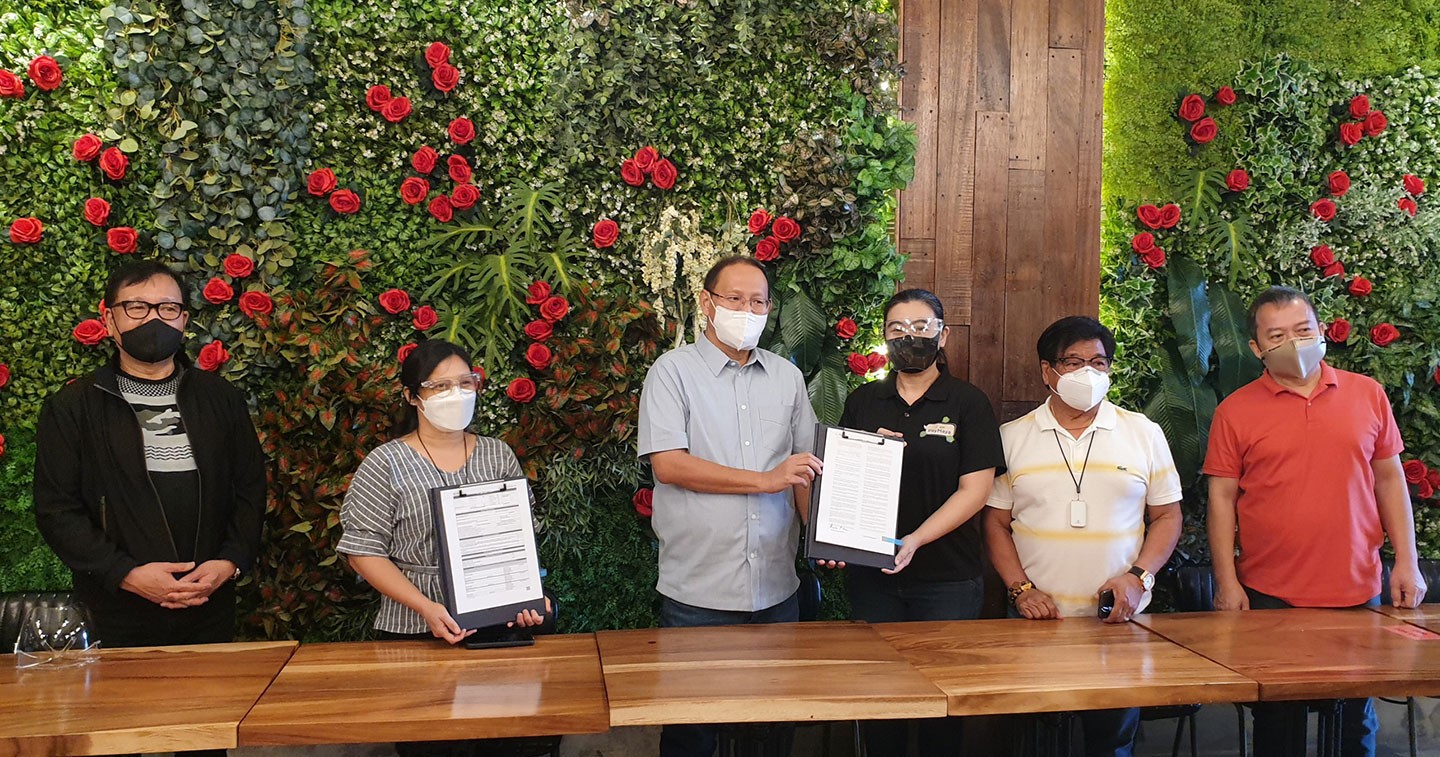

MANILA, PHILIPPINES – The City Government of Marikina has tapped digital financial services leader PayMaya to roll out contactless payments for real property and other business taxes within the city.

Using PayMaya’s payment platform, residents and businesses can now pay for their city government fees online from the safety of their own homes. All they have to do is log-in to Marikina’s online portal powered by PayMaya Checkout and pay using any credit, debit, or prepaid card as well as their PayMaya wallet. This initiative is in collaboration with the Development Bank of the Philippines (DBP).

“Through this cashless initiative with PayMaya and DBP, we are empowering our constituents with a safer way to pay for taxes and other fees online so that they don’t have to physically go to the city hall, especially at this time. This will contribute towards safer and more efficient government transactions during this pandemic. At the same time, this will allow us to continue delivering critical services to the public,” said Marikina City Mayor Marcelino Teodoro.

“We thank Marikina City for being our partner in enabling the public sector with safer cashless payment solutions. Digital payments is a key component of the transformation of our local governments and we are excited to bring this forward with other digital financial services ecosystem initiatives,” added PayMaya Founder and CEO Orlando Vea.

Marikina City is the latest in over 60 national agencies and local units that have already embraced cashless solutions powered by PayMaya, which includes cashless payments acceptance as well as disbursement solutions.

Other national government agencies and local government units that have embraced cashless technologies powered by PayMaya’s platforms include the Bureau of Internal Revenue (BIR), Social Security System (SSS), Home Development Mutual Fund or Pag-IBIG, Department of Trade and Industry (DTI), Securities and Exchange Commission (SEC), Land Transportation Office (LTO), Bureau of Customs (BoC), and the Department of Foreign Affairs (DFA), as well as the cities of Manila, Mandaluyong, Quezon City, Pasig, Caloocan, and Valenzuela, among many others.

PayMaya is the only end-to-end digital payments ecosystem enabler in the Philippines with platforms and services that cut across consumers, merchants, communities, and government. Through its enterprise business, it is the largest digital payments processor for key industries in the country including “everyday” merchants such as the largest retail, food, gas, and eCommerce merchants as well as government agencies and units.

Through its app and wallet, PayMaya provides over 28 million Filipinos with access to financial services. Customers can conveniently pay, add money, cash out or remit through its over 200,000 digital touchpoints nationwide.

Its Smart Padala by PayMaya network of over 37,000 partner agent touchpoints nationwide serves as last-mile digital financial hubs in communities, providing the unbanked and underserved with access to digital services. To know more about PayMaya’s products and services, visit www.PayMaya.com or follow @PayMayaOfficial on Facebook, Twitter, and Instagram