MANILA – A month before the April 15 income tax filing deadline, JWT Philippines launched a public awareness campaign for the Bureau of Internal Revenue on the importance of paying correct taxes, earning the ire of doctors who felt they were unfairly portrayed.

A series of ads launched over the weekend show how not paying correct taxes makes one a burden to those who do. The ads are part of the Know Your Taxes public awareness campaign, which was launched on February 17. According to JWT Philippines, the campaign has two phases – educational and emotional. Its objectives are to educate the target about their tax obligations and get them to care for their fellow countrymen, who fulfill their tax obligations, by paying the right taxes.

“Taxation compliance of citizens is never an easy topic to discuss. A simple dissemination of information is not enough to compel all self-employed professionals and sole proprietors to comply with their tax responsibilities,” explained JWT Philippines.

The ads, which compare individuals from different industries, are part of the second phase of the campaign, which seeks to persuade those who do not pay the right taxes to feel compelled to comply. “The hook discovered by the team was that salaried employees consistently pay the right taxes, however, some self-employed individuals are remiss at it. The campaign for this phase seeks to underline the disparity in the amount of taxes paid by some self-employed individuals versus their annual income,” JWT Philippines said.

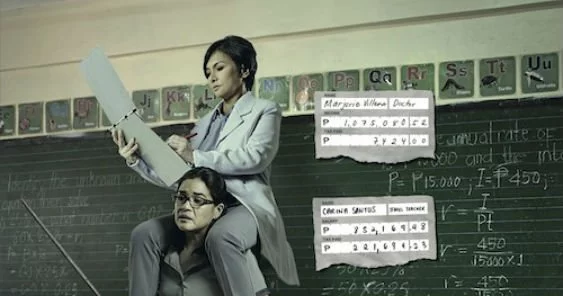

However, one of the ads, which compared different industries based on 2012 BIR data, earned the ire of doctors who felt they were unfairly portrayed. In the ad, a doctor is shown sitting on the shoulders of a teacher with the message, “When you don’t pay your taxes, you’re a burden to those who do.” The ad also shows that the teacher earned P852,169.48 and paid P221,694.23 in taxes, while the doctor earned P1.075 million and remitted only P7,424. In two similar ads, an online seller was depicted sitting on the shoulders of a foreman, and an independent accountant was depicted sitting on the shoulders of a chef.

“We at the PMA, as productive members of the Filipino society, have been working hand in hand with the BIR towards the achievement of this goal. The newspaper advertisement came as a surprise to us mainly because it was not discussed in our various consultations and joint information campaign activities with the BIR,” Philippine Medical Association (PMA) President Dr. Leo Olarte said in a statement. Reacting to the ad, PMA pointed out that not all doctors earn a lot, nor are all doctors tax evaders.

BIR commissioner Kim Henares responded by saying doctors who pay the right taxes should not be hurt by the ad. “If you pay the right taxes, you won’t be alluded to,” Henares was quoted on GMA News Online.

Sponsor

According to JWT Philippines, it was identified that one of the main reasons for non-compliance was the lack of knowledge of self-employed individuals with regard to their tax obligations and its consequences. To address this barrier, the “RFP” (Register. File. Pay.) campaign was created in time for the April 15 tax deadline. It informs and educates self-employed professionals and sole proprietors to register, file, and pay their taxes correctly. A website, Know Your Taxes, and an infographic video were created to guide self-employed individuals through these different steps.

The BIR campaign is supported by the Millennium Challenge Corporation and through the Millennium Challenge Account-Philippines. Last October, MCA-P awarded JWT Philippines a P108.26-million contract for the implementation of a public awareness campaign for the BIR as part of a project funded by the MCC grant from the US government, according to a report on Business World.