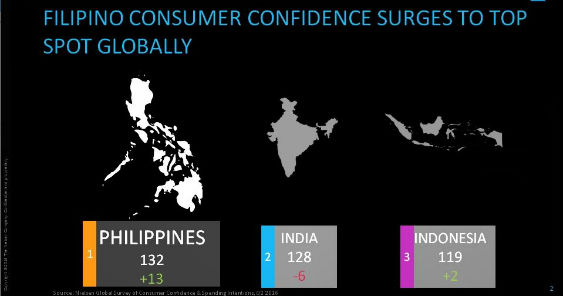

MANILA – Filipino consumers emerged as the most optimistic in the world, posting the highest consumer confidence index score for the country and besting optimism of consumers from around the globe for the first time. In the second quarter of 2016, optimism of Filipino consumers soared to 132, registering the biggest quarter-on-quarter increase among countries included in the survey with a 13-point surge according to the latest Nielsen Global Survey of Consumer Confidence and Spending Intentions released today.

Of the three confidence indicators measured, job optimism increased most, jumping 16 percentage points to 88% in the second quarter. Responses from the Philippines also showed a rise of 10 percentage points in immediate-spending intentions (61%) and five percentage points in favorable sentiment about personal finances (86%).

“Confidence in the Philippines is at an all-time high, and with a 6.9% GDP growth rate in the first quarter, it’s one of the fastest-growing economies in Asia,” said Stuart Jamieson, managing director, Nielsen Philippines. “The Philippine economy relies heavily upon consumption, and with sales of consumer goods growing rapidly at a 7.1% rate in the year ending May 2016, consumer spending remains robust. The promise of greater reforms during the recent presidential elections, which took place during the survey period, likely helped buoy positive consumer sentiment.”

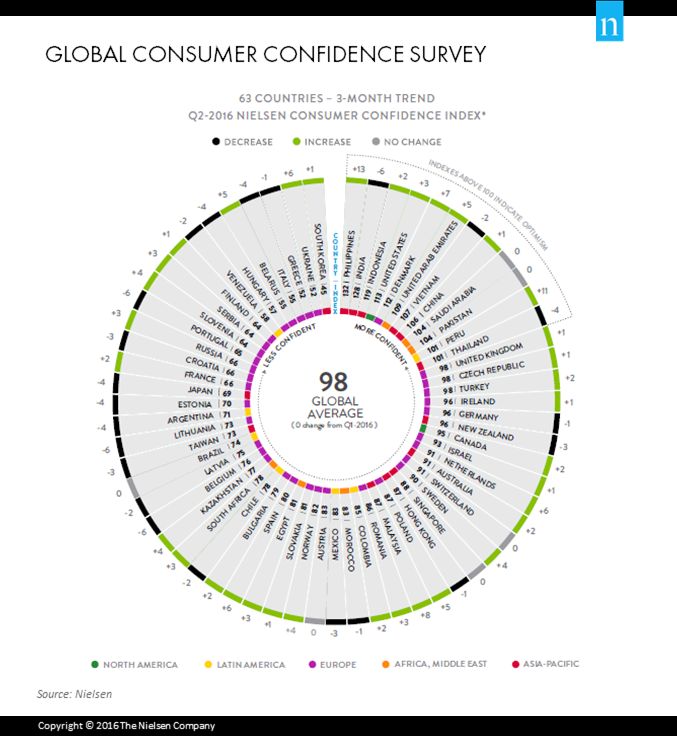

Established in 2005, the Nielsen Consumer Confidence Index is fielded quarterly in 63 countries to measure the perceptions of local job prospects, personal finances, immediate spending intentions and related economic issues of real consumers around the world. Consumer confidence levels above and below a baseline of 100 indicate degrees of optimism and pessimism, respectively.

After the Philippines, India follows as the market with the second most confident consumers, with a score of 128, dropping six points from Q1, while Indonesia has a two-point increase quarter-on-quarter with 119. Consumer confidence in the U.S. maintained a positive momentum in the second quarter, increasing three points to 113 from the previous quarter. Denmark’s score increased seven points to 112—a recovery from the five-point decline in the first quarter. See chart 1.

Vietnam (107,-2), China (106, +1) and Thailand (101,-4) were other high-scoring Asian emerging markets. Malaysia was the only emerging market in the region with a below-the-baseline confidence score of 87, but that score represented an eight point increase in the second quarter.

SAVING IS A TOP PRIORITY BUT OPEN TO ENJOYING HARD-EARNED MONEY

Filipino consumers continue to be among the world’s most ardent savers with 65% of consumers in the Philippines saying they will save their spare cash.

After channeling extra cash to saving, three-in-10 Filipino respondents say they plan to spend spare cash on holidays and vacations (33%, +1), home improvements/decorations (32%, +3), new clothes (30%, -2) and new technology (29%, +3).

Chart 1. Q2 2016 CONSUMER CONFIDENCE INDEX (63 COUNTRIES 3-MONTH TREND)

Source: Nielsen Global Survey of Consumer Confidence & Spending Intentions, Q2 2016

ABOUT THE NIELSEN GLOBAL SURVEY OF CONSUMER CONFIDENCE AND SPENDING INTENTIONS

The second-quarter online survey was conducted May 9–27, 2016. The findings in this survey are based on an online methodology in 63 countries. While an online survey methodology allows for tremendous scale and global reach, it provides a perspective only on the habits of existing internet users, not total populations. In developing markets where online penetration is still growing, audiences may be younger and more affluent than the general population of that country. Three sub-Saharan African countries (Ghana, Kenya and Nigeria) utilize a mobile survey methodology and are not included in the global or Middle East/Africa averages discussed throughout this report. In addition, survey responses are based on claimed behavior, rather than actual metered data. Cultural differences in reporting sentiment are likely factors in the measurement of economic outlook across countries. The reported results do not attempt to control or correct for these differences; therefore, caution should be exercised when comparing across countries and regions, particularly across regional boundaries.