MANILA, PHILIPPINES — Challenges brought by the government’s COVID-19 response for entrepreneurs are far from over, but the pandemic’s not all bad news for some taxpayers, based on recent data of Taxumo’s user base.

In the data collected by Taxumo, the Philippines’ pioneering online web-based tax filing and payment platform, just after this year’s Annual Income Tax Return deadline (extended to May 15 this year), it was revealed 32.9% of taxpayers’ incomes rose by 144%.

Meanwhile, 21% of users upgraded their accounts from Taxumo’s Lifeline plan (a subscription service released by Taxumo last year at the height of the pandemic, which automatically declared zero incomes for businesses on a break)—indicating that they have finally started earning incomes once again after a temporary business setback.

The Bad News: More Taxpayers Saw Their Incomes Going Down

It must be highlighted that a larger percentage of working people saw their incomes go down, with 67.1% of taxpayers on Taxumo declaring a 49% decrease in their incomes.

Collectively, incomes went downhill by 22.8%, with total taxes remitted to the BIR in 2021 capping off at Php 11,313,004 versus 2020’s Php 14,652,924.

Fewer Poor People, More Low-Income & Mid-Middle Income, and No More Rich Professionals and SMEs in 2021

Analyzing the taxpayers’ declared incomes versus the definition set by the Philippine Institute for Development Studies, Taxumo found out that while poor taxpayers (earning less than PHP 9,520 per month) shrank from 28% last year to 23% this year, low-income (earning between PHP 19,040 and PHP 38,080 per month) and mid-middle income (earning between PHP 38,080 and PHP 66,640 per month) taxpayers grew by 9.8% and 5%, respectively.

Meanwhile, rich taxpayers (those who earned at least PHP 190,400 per month), which were 4.5% of Taxumo’s population in 2020, totally disappeared in 2021.

Women’s Incomes are Down, Non-Binary People’s Incomes are Up

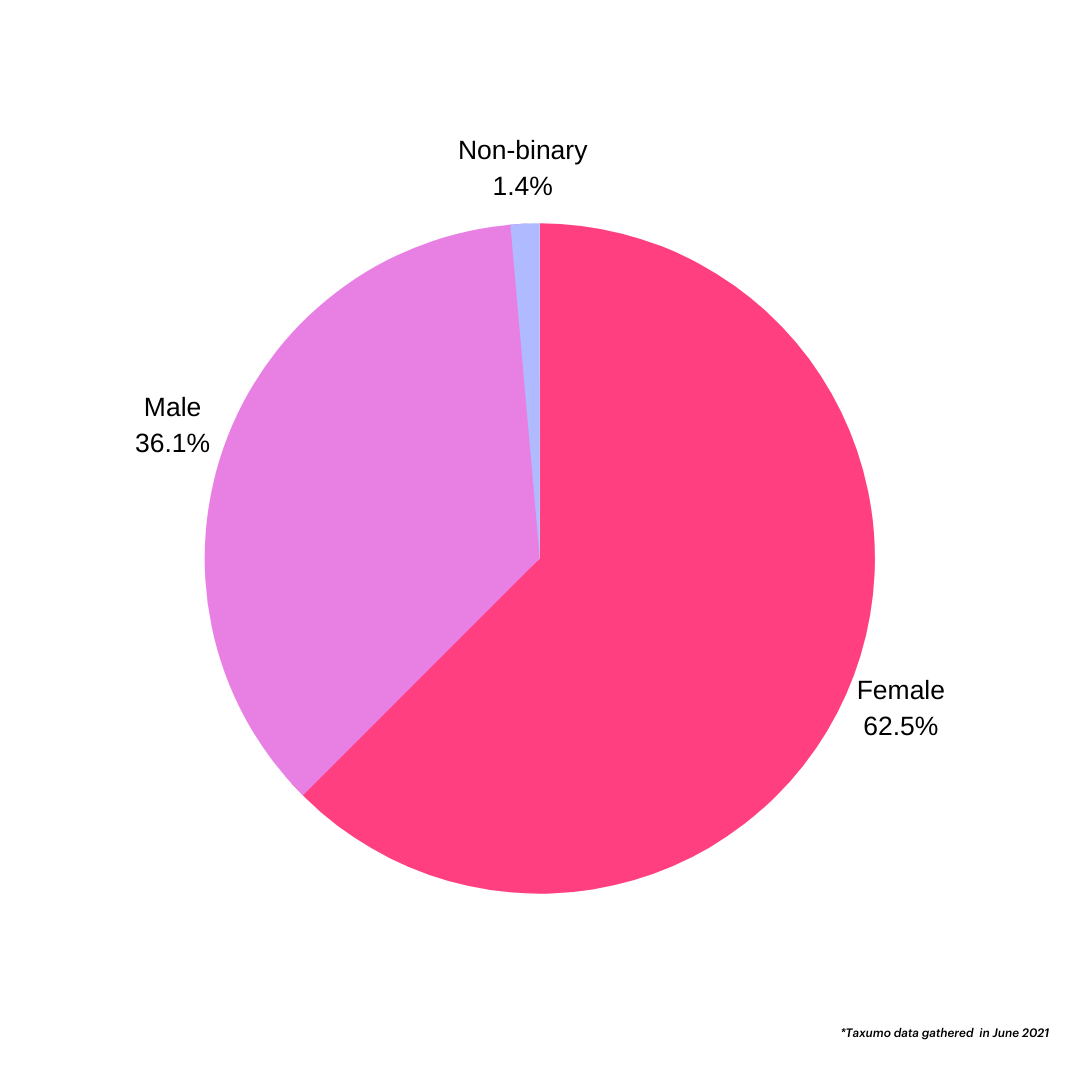

Closely observing the economic status of vulnerable populations, Taxumo looked into the taxes paid by self-identified women and non-binary users on the platforms.

Closely observing the economic status of vulnerable populations, Taxumo looked into the taxes paid by self-identified women and non-binary users on the platforms.

Women taxpayers declared an 86% decrease in income, which may indicate that they have been severely affected by the COVID-19 pandemic and the ensuing lockdowns. Interestingly, non-binary users had a 52% increase in their declared income.

THE CREATE Act, and What Lies Ahead

On April 11, RA 11534—more popularly known as the Corporate Recovery and Tax Incentives for Enterprises (CREATE) Act—took effect.

The new law slashed the 30% corporate income tax rate to 20%, for small and medium corporations with net taxable income not exceeding P5 million.

Non-VAT registered individual taxpayers with gross sales of P3 million and below yearly will also see their percentage taxes reduced from 3% to 1%. This will retroactively take effect from July 2020 until June 2023.

Adapting to the changes that came with the CREATE Act, Taxumo launched CREATE Act-ready tax forms, ensuring that taxpayers would be able to comply with the shift in tax rules.

Says EJ Arboleda, Founder & CEO of Taxumo: “We at Taxumo have been closely monitoring and adapting to the many changes brought by new legislation as well as the pandemic response by the government. Much as we’re happy to see some of our users’ incomes rise during these trying times, we’re still holding our breaths and hoping for the best for every Filipino entrepreneur and self-employed professional. We’re cautiously optimistic about the future.

“What we can assure our users though is that we remain committed to help them focus more on their passion and worry less about their taxes, just as we’ve been since day one.”

See the full illustrated report at https://www.taxumo.com/state-of-online-taxation/