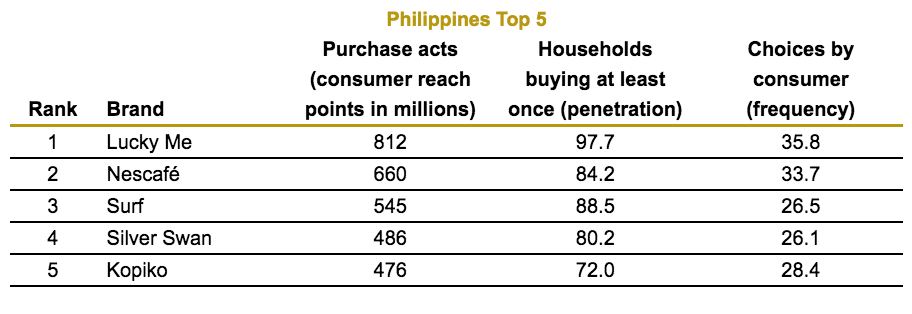

Kantar, through its Worldpanel Division Asia, reveals that local noodle brand Lucky Me is the top most chosen brand in the Philippines for the fourth consecutive year. This is based on the 2019 edition of the Asia Brand Footprint report, which ranks FMCG (Fast Moving Consumer Goods) brands in terms of consumer reach points or CRP in seven (7) Asian markets, namely Philippines, China mainland, Indonesia, Korea, Malaysia, Taiwan and Vietnam.

The Asia Brand Footprint is set apart from other brand rankings by providing information on real consumer behaviour rather than attitude. As basis of the ranking, the CRP is an innovative metric that measures how many households around the world are buying a brand (penetration) and how often (frequency), it provides a true representation of shopper choice.

Lucky Me has emerged on top, reaching 812 million times in CRPs and nearly all of households (97.7%) in 2018. The Philippines remains a coffee-loving nation with two coffee brands in the top 5. Nescafé secured its 2nd place through persistent distribution and promotional efforts. Meanwhile, Kopiko has climbed to 5th place, inching its way up from 9th place in the previous year. Detergent brand Surf managed to hold its 3rd place through playing in diverse sub-categories under home care with 88.5% of consumers having purchased the product at least once last year. Silver Swan is also a staple condiment in the Philippine kitchen and ranked the 4th place in total FMCG market.

Summed up by Marie-Anne Lezoraine, General Manager, Kantar, Worldpanel Division, Philippines: “Filipinos shop multiple times a week, hence a wide number of potential baskets for brands to be featured in. Once again, the highest-ranking brands are beloved household names that not only appeal to a large majority of households, but also consistently make efforts to be the chosen brand as often as possible. Additionally, the fastest growing brands have expanded their reach beyond their original target. They have done so through targeting new shoppers and addressing new needs or consumption occasions – with all of this supported by a strong media presence.”

Recipe for Brand Growth in Asia

In Asia, over the last decade or so, consumer trends and focuses have shifted to reflect the following three needs around health and safety, convenience and happiness.

According to Marcy Kou, CEO Worldpanel Division Asia, Kantar, “Consumers are becoming more discerning, informed and well-travelled. As a result, they are exposed to more options, ideas, products, and perspectives. All these influences, shape and change their perception and demands to where making a purchase is not just about a product, but what else the brand offers, including a complete shopping experience for them as consumers.”

Kantar reveals that Asian consumers are becoming more cautious of their purchasing choices in terms of their health benefits and the concept of health and safety is evolving at stages defined by consumers in accordance to their lifestyle and life stage needs.

For instance, in top tier or urban cities in Asia, consumers are usually looking for non-additive, high quality, organic or plant-based ingredients in foods or beverages they consume or personal care and even household products. An increasing number of millennial and centennial consumers are also looking at the origins or source of the ingredients and products from either an environmental sustainability or personal anti-ageing perspective while the silver or ageing population are looking at whether these products will help with life preservation or to boost immunity to diseases commonly associated with old age.

Consumers also value convenience. Younger people demand for easy to use, purposeful products and packaging that can accommodate their needs, and channels which give them the fastest and easiest access to these products. Across the region, instant foods like snacks, cereal, rice soup or convenient cooking aids like sauces and meal maker, etc. are the products achieving growth when time becomes more precious than money. In terms of channel, thanks to the development of technology and the increase of internet usage across the region, the line between online and offline is getting blurred. Through online, shoppers get easier access to various products with flourishing information and they can also purchase them with just one click anytime, anywhere, which provides greater convenience. As such, many brands are now moving to online and expanding their digital presence to be able to meet consumers wherever they are and whenever they want.

Lastly, often time, shopping is about satisfaction and instant gratification. Thus, consumers are looking for a “feel-good” mentality when they consciously choose one brand over the other. Brands need to cater to their varying needs that arise from different occasions and purposes and give them a compelling reason to choose their products over their competitor’s.

About Kantar

Kantar is the world’s leading data, insights and consulting company. We understand more about how people think, feel, shop, share, vote and view than anyone else. Combining our expertise in human understanding with advanced technologies, Kantar’s 30,000 people help the world’s leading organisations succeed and grow.

For further information, please visit us at www.kantar.com/worldpanel