MANILA – Grocery retailers continue their aggressive expansion to extend reach to where busy consumers live and work. While big supermarkets continue to extend their footprint, rapid expansion is being driven by the emergence of small format stores, according to performance management company, Nielsen.

Small format stores are modern trade stores which appeal to today’s modern day, on-the go shopper. Neighborhood supermarkets, mini marts, and convenience stores all fall under the small store category.

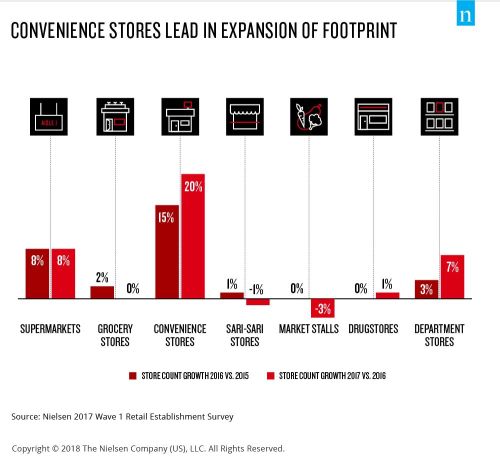

According to Nielsen’s latest Shopper Trends report, while supermarkets increased in store count by 8%, convenience stores are leading the expansion of the small store format concept in the Philippines, showing a growth of 20% in 2017 and 15% the year before that (See table 1). In 2013, there were only more than 1,620 convenience stores in the country versus close to 4,300 convenience stores as of Q1 2018.

Shopper Trends is a syndicated annual report that Nielsen conducts across 54 markets globally. It provides a comprehensive overview of retail environment trends and an understanding of shopping behavior across the different trade channels. It provides insights on where, when, and how often people shop, and their emotional commitment and perceptions about key modern trade retailers.

Big retailers are not far behind in adopting the small store format. In fact, in the last five years, small store formats of supermarket chains have grown close to 220 stores in 2013 to more than 410 stores as of Q1 2018 as these big supermarket chains are focusing on expanding their small format stores.

Bolstering the growth of small format stores is the increasing influence of four global megatrends which are supporting the growing consumer demand for faster and more convenient shopping experiences—urbanization, women joining the workforce, shrinking household size, and the rise of eating out. The robust business process outsourcing (BPO) segment also stimulates the growth of this retail channel.

“Retailers in the past were guided by the paradigm that “bigger is better” but as lifestyles and consumption habits change, a shift in where consumers shop, what they buy, the frequency and amount of spend follow,” states J. Patrick Cua, Nielsen’s managing director in the Philippines. “Small format stores meet a distinct shopper need of convenience as they are often situated near homes or high traffic areas.”

WHAT MAKES SMALL STORE FORMAT STORES UNIQUE?

“It is no surprise that small-store format shoppers value stores that provide convenience-related elements,” Cua shares. In the report, shoppers were asked to rank attributes that influence store loyalty and store choice. These attributes correspond with four key factors:

Convenience

Choice

Shoppability

Price

In the report, five of the top 10 attributes that small store shoppers identified as important pertain to convenience (See table 2). “This makes it critical for retailers in this channel to deliver on the promise of convenience in every way possible, i.e. in terms of location, operation hours, store layout, shelf layout and overall in-store experience,” Cua recommends. “Manufacturers as well play a part in ensuring small store shoppers are satisfied, by working with the retailer to create a seamless, pleasant shopping experience for shoppers.”

The report also debunks the myth that price doesn’t matter to small store format shoppers. In other markets, shoppers trade off higher price for convenience but it is not the case in the Philippines. Small store shoppers in the Philippines have ranked price-related attributes high in the list. To address this shopper preference, Cua advises that retailers and manufacturers should price products close to the prices of bigger stores. Carrying products that sit on lower-priced tier and offering value through promotions can also woo shoppers to visit more and increase their spend.