MANILA – The shopping aisles are typically women’s turf, but men’s presence is increasingly being felt. In Nielsen’s latest Shopper Trends report, a substantial 40% of shoppers are men, an increase of six percentage points from last year.

“The perception that buying groceries is only women’s work is now inaccurate,” says Carlo Santos, Nielsen’s Consumer Insights Head in the Philippines. “Females remain the key stakeholder in grocery shopping in many homes, but as more men play an active role, marketing strategies need to reflect a more balanced approach—from product innovations to marketing messages. This will require a deeper understanding of how each gender sees and approaches the task of grocery shopping and where gaps in current offerings may exist.”

Shopper Trends is a syndicated annual report that Nielsen conducts across 54 markets globally. It provides a comprehensive overview of retail environment trends and an understanding of shopping behavior across the different trade channels. It provides insights on where, when, and how often people shop, and their emotional commitment and perceptions about key modern trade retailers.

WHO IS THE FILIPINO MALE SHOPPER?

In examining the male shopper, the report reveals that growth comes from the more affluent Metro Manila residents.

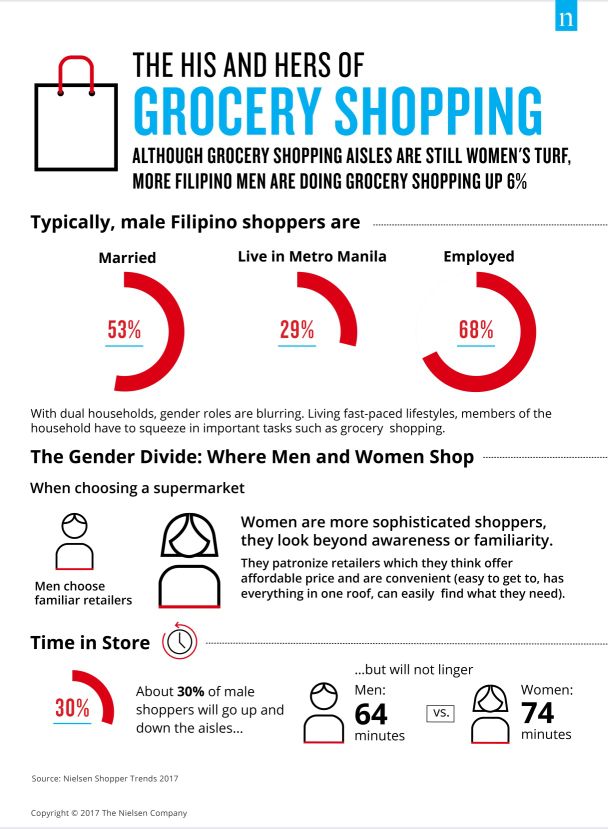

Slightly more than half of urban male shoppers are married (53%). Nearly three in 10 (29%) reside in the Metro Manila area and majority have jobs (68%).

“The highly urbanized environment where the typical male shopper lives encourages him to do his share in running the household. They are more open-minded when it comes to household management,” Santos observes. “In typical dual-income households, perceived gender-assigned roles blur. Living fast-paced lifestyles, members of the household have to squeeze in important tasks such as grocery shopping and it no longer matters who does it. What matters is who has the time to do it and more often than not, males have more flexible schedules.”

WHERE DO MEN SHOP?

In choosing a supermarket, males and females are very different. Being relatively new household shoppers, males prefer to shop in retailer shops that are familiar to them. Hence, if they are not aware of the retailer or do not have an affinity towards the retailer, they are not likely to shop in those stores. Females, on the other hand, are more likely to be persuaded by their perception of a retailer. For instance, female shoppers are more likely to shop in stores which they think offer affordable prices and provide convenience. Convenience means ease in getting to the store, finding everything that they needed in one roof as well as being able to quickly find what is needed.

“Retailers need to make sure that male shoppers are aware of them and are considering them. This may be harder for them to do as retailers traditionally target female shoppers. They have to rethink their strategies especially if this trend continues,” notes Santos.

HOW DO MEN SHOP?

While about a third (30%) of male supermarket shoppers either go up and down the aisles or browse all parts of the store, similar to females, but they are doing it at a quicker pace. Men only spend a little over an hour or 64 minutes in stores on average, about 15 minutes shorter than a year ago. Females on the other hand, tend to linger, averaging about 74 minutes in the store.

“With males spending less time in-store and doing it at a hurried pace, manufacturers should think of ways to disrupt these shoppers to notice their brands in-store. If male shoppers hurry through their shopping experience, they are not likely to spend more. Manufacturers will have to reach to male shoppers before they visit the store which means media advertising,” says Santos.