MANILA — Young Filipinos are keen on saving money and are interested in the banking sector, according to a report on the country’s Banking, Financial Services and Insurance (BFSI) industry. The “Young Filipinos and Finance” report, which examined social media chatter, was published today by ThoughtBuzz, the social media analytics arm of TO THE NEW.

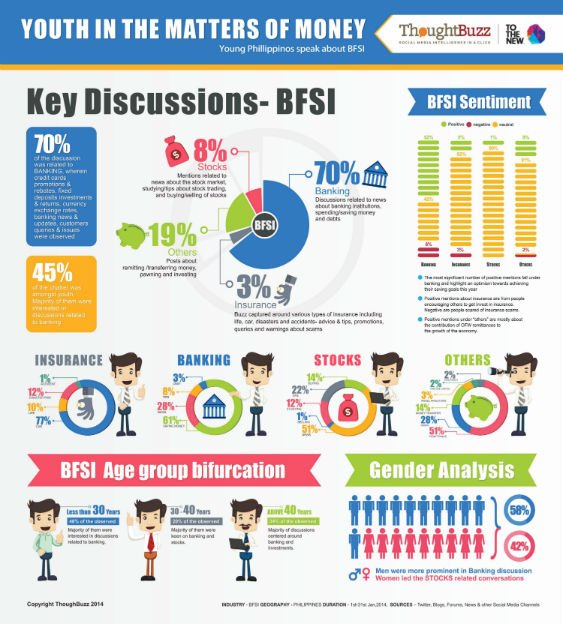

The results of this study showed that the discussion on social media channels and networks centered heavily on banking topics (70%). Conversations also circled around other topics such as remittance and investments in properties, gold, etc. (19%), and stocks (8%) — with insurance (3%) generating the lowest amount of buzz.

Buzz on banking was fueled by New Year resolutions to save money for the year ahead, and news on Bangko Sentral ng Pilipinas (the Central Bank of Philippines) particularly on the growth of the Philippine peso. This led to banking garnering the most significant number of positive mentions by netizens (52% of discussions on banking), with people being optimistic towards achieving their saving goals for the year. In addition, netizens are using social media to crowd source information about bank products, as well as to air grievances about the banking services they receive.

After the occurrence of the recent mega typhoon Haiyan, social media chatter was directed towards the financial losses incurred due to natural disasters and the need for disaster-risk for insurance. However, it was the topic of car insurance that drew in the most discussion (80%).

“Through the BFSI study, we saw netizens reveal how they assess various insurance companies, based on performance, services and reputation,” said Ashok Patro, Chief Operating Officer at ThoughtBuzz. “Consumers also highlighted the companies’ stability as a major deciding factor when selecting the right insurance company. The study also showed the importance of tapping into social media to learn more about the company’s products and services and to listen to customers’ concerns.”

The internet population in the Philippines is expected to grow to 41 million. In 2014, more people are taking to social media sites to voice their opinions and thoughts, including issues concerning the banking and finance industries in the country, ThoughtBuzz noted.

“If companies are not already actively listening, now is definitely the time to start,” he added. With this data, ThoughtBuzz hopes that companies will be able tap on what consumers are saying about services in the BFSI sector, as well as highlight key trends that will allow them to serve customers better. In addition, companies would then also be able to effectively engage consumers and provide real-time solutions via the various social media sites.

The report is based on public chatter on all popular social media platforms in Philippines including Facebook, Twitter, Blogs, Forums, Bulletin boards, news etc. and is prepared using ThoughtBuzz proprietary social media monitoring application Omnio G.