MANILA, PHILIPPINES– According to a study by Mastercard, the coronavirus pandemic has increased the usage of contactless payment by 40 percent in the first quarter of 2020 in APAC. With this, Philippine-based fintech firm JazzyPay enables essential businesses such as hospitals, schools, clinics and medical suppliers to go cashless efficiently in the time of the global pandemic.

When the coronavirus outbreak hit the Philippines, the medical and educational sectors were greatly affected, and institutions had to adjust to the rapid changes brought about by the global contagion. In addition, there is now a bigger need for hospitals and schools for cashless payments as more people shift away from cash to prevent surface contact and minimise interactions. It is also a faster, safer, and more secured way to keep operations going. However, the current process to adopt cashless payments in the Philippines is tedious and expensive.

Traditional players require merchants to pay deposits of up to half a million pesos as a security deposit. Even if businesses manage to acquire a point of sale (POS) machine, it is still limited to only credit or debit card payments onsite. The process can also take up to several months. As a result, 80% of hospitals, dentists and schools in the Philippines still rely on cash or cheques for big ticket payments.

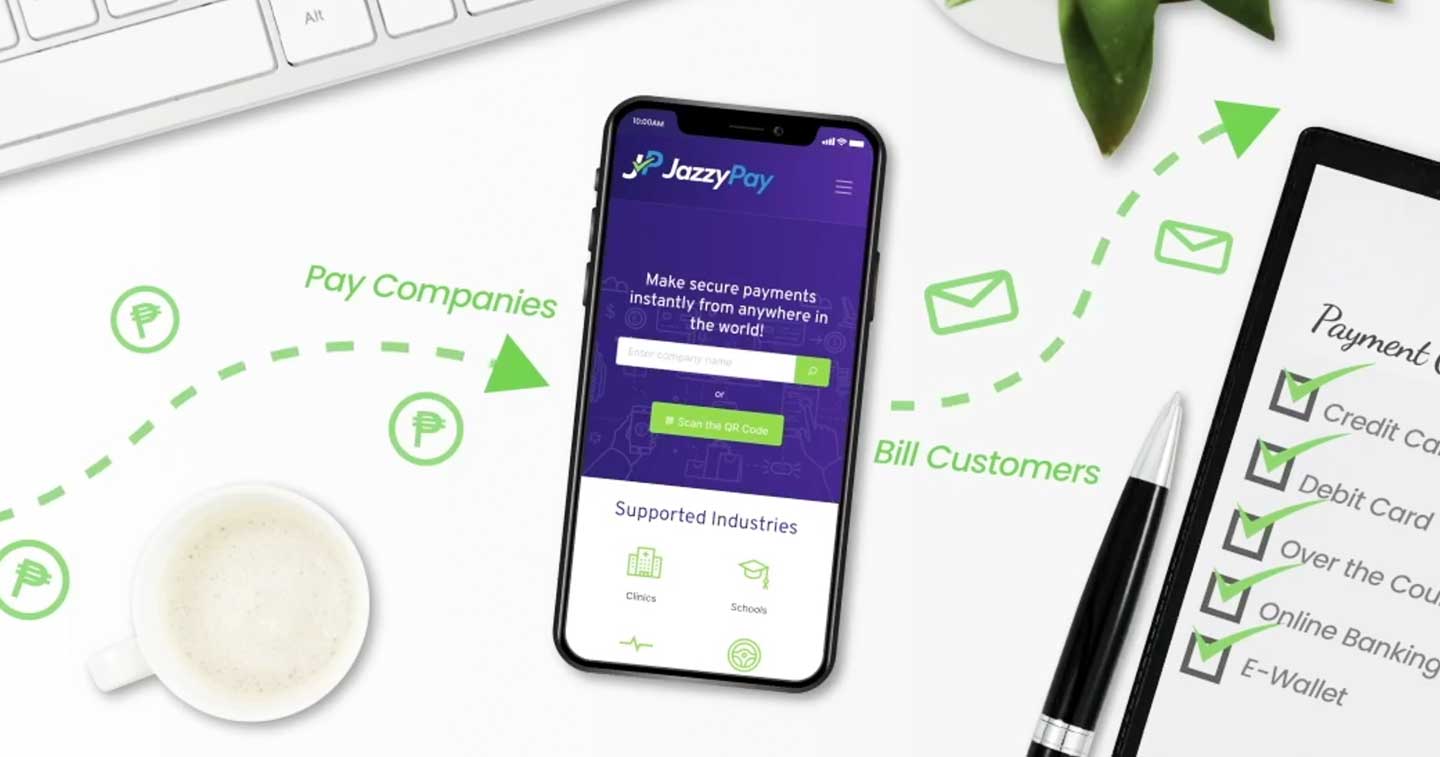

With JazzyPay, merchants can now adopt cashless payments within only one day and without requiring a deposit. JazzyPay’s unified payments platform allow partner merchants to accept payments from anywhere in the world via 27 payment methods, including credit and debit cards (Visa, Mastercard, Amex), online banking, e-wallets (AliPay, CoinsPH, GCash, GrabPay, WeChat Pay) and over-the-counter deposits.

The co-founders of JazzyPay, Kathleen Acosta and Joshua Marindo have experienced the consequences of having limited payment methods in hospitals, where an emergency operation could not be immediately performed on their nephew due to the lack of online payment options. As a result, the payment had to be transferred by a relative from abroad and treatment was delayed.

“Having witnessed first-hand how inefficient payment methods can impede critical treatment in an emergency, we want to ensure that no one else has to undergo a similar experience. This inspired us to start JazzyPay,” said Acosta, Chief Operating Officer and co-founder of JazzyPay. “With JazzyPay, all Filipinos, including overseas Filipino workers, are now empowered to pay for hospital bills and tuition fees for themselves and for their families. Our secure platform gives overseas family members assurance that their funds go directly to the intended recipients.”

Since its launch in January 2018, JazzyPay has established itself as the go-to payment gateway, serving hundreds of merchants including Adventist Medical Center Manila, Adventist Hospital Santiago City, Manila Adventist College, and Dr. Arturo P. Pingoy Medical Center among others.

Lady Mataya-Dapat of Adventist Medical Center Manila shares how JazzyPay helps them power through the challenges brought about by the COVID-19 outbreak, “I cannot enumerate the number of changes we had to go through because of the pandemic. In terms of processes, people, finances, we were really affected. Because of COVID-19, we have to adapt to the new normal where we have to limit face to face transactions, and JazzyPay has enabled us to accept cashless payments to avoid the risk of spreading the virus.”

JazzyPay recently raised a USD 500,000 seed financing round led by Cocoon Capital to accelerate its growth and to help more businesses go cashless during COVID-19. JazzyPay also introduced upgrades with a brand new user interface, enhanced features, and heightened security to help their partners adapt to the new normal.

“Our vision is to provide world-class payments solutions in the Philippines and other developing countries across Southeast Asia and beyond. First focused on essential industries, our team has successfully expanded our network of partner merchants across the country, building on our drive to make a difference.,” Acosta added.