MANILA, PHILIPPINES — Mobile-first life insurer, Singlife Philippines continues to deliver no-fuss protection with the launch of Cash for Income Loss. Available on GCash, it safeguards customers and their families from unexpected loss of income due to disability or death of an income earner.

Just imagine the burden on your family when cancer or an accident makes it impossible for you to earn a living. Even worse is if you pass away. Apart from missing a parent or a spouse, those you leave behind will need to adjust their living standards to cope with the loss of income – from rent, food, transportation, to tuition expenses.

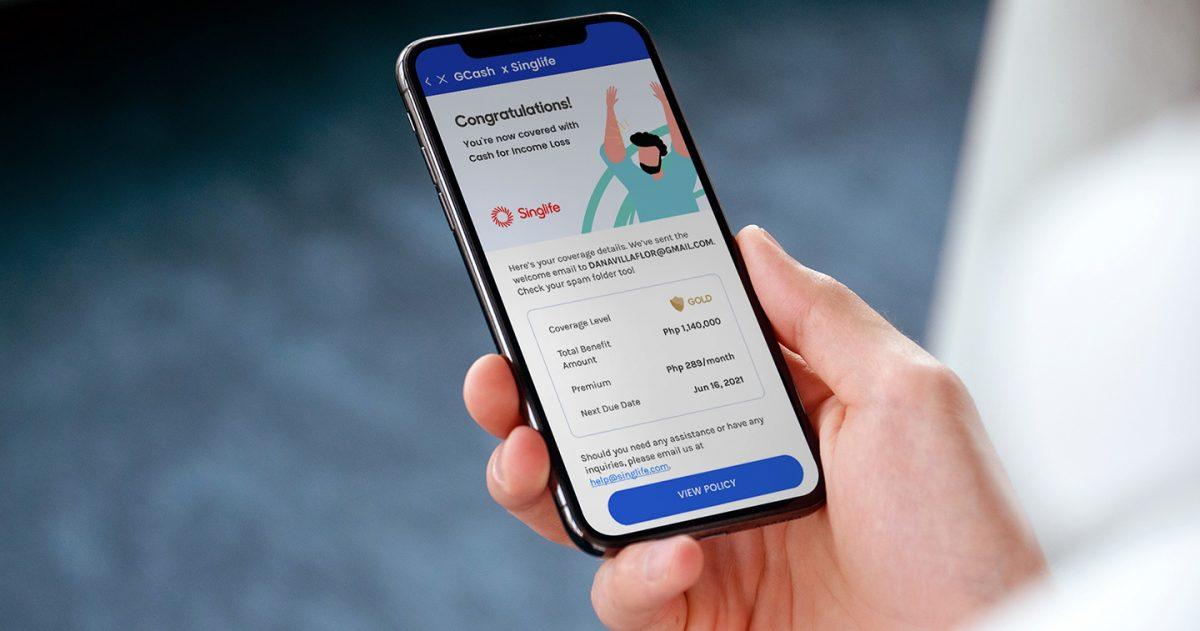

Cash for Income Loss can replace up to 100% of that income for 36 months for only a few hundred pesos per year. A 2-month cash bonus is also given on the 36th policy month to help you and your family bounce back stronger. As an example, if you were a 30-year-old office worker earning PHP 30,000 monthly, you can get PHP 1,140,000 in monthly benefits for only PHP 289 per month.

Cash for Income Loss is tailored to fit your needs. It also comes in Bronze, Silver, and Gold coverage levels for those who feel that securing only a part of their income is enough, or to better fit their budget.

“’What will happen to my family if I can no longer provide?’ is a question breadwinners keep asking themselves,” said Kame Amado-Gomez, Head of Digital Networks at Singlife Philippines. “With Cash for Income Loss, they have a guaranteed source of money to replace lost income at a time when it matters most. Any financial stress will simply be taken care of, so they can just focus on getting back on their feet.”

Also available is Cash for Income Loss (Accidents), an accidents-only plan. A smart alternative for those with tighter budgets or whose age or medical status is ineligible for the full version.

Cash for Income Loss is available via GInsure on the GCash app. You can get a personalized quote and buy a policy in just a few taps.

“Majority of GCash users belong to the workforce, with families solely dependent on their monthly income for daily needs,” said Jerome Lim, Head of Savings and Insurance at GCash. “We are happy to offer them 100% balik-sweldo insurance that is big on coverage and easy on the wallet. Now, they can face each day feeling more confident knowing they have a reliable safety net to fall back on.”