SINGAPORE – As the Covid-19 pandemic continues globally, the ability to return to usual ways of work and play has been indubitably kept out of reach for everyone around the world. Given this, newfound trends have surfaced in response to new regulations, industry standards, and consumer behavior, as humanity adjusts to the “new normal”.

Half a year into the worst pandemic of the decade, Asia Pacific is beginning to find her footing once more. Although most countries have partially reopened, it will take time as economists and governments lay hopeful for a vaccine, and the opportunity to give their economies the boost they need.

Consumers in Asia Pacific are fast adapting to the reality that is the “new normal”. From e-retail emerging as a go-to alternative to brick and mortar stores, to media streaming platforms being used to bridge the gap between brands and audiences. Businesses have had to make a radical leap to transform digitally, so as to not come to a standstill.

With new industry standards and perspectives, what does the future hold for businesses looking to innovate in this unprecedented era of change? What potential successes, opportunities, and risks must businesses face to thrive in a post-lockdown APAC?

A new report from Digimind, the most trusted AI-powered social listening and market intelligence software, analyzed key trends in 653,428 mentions around the Covid-19 pandemic and lifting of lockdown measures, as well as additional data around post-lockdown activities, perspectives, and consumer brands. The report highlights consumer trends, priorities, and purchase intent in a post-lockdown climate, and spotlights marketing and business strategies that can be employed to drive online visibility and public receptiveness in a time of changing needs and behaviors.

Brands studied include: Disney+, Flipkart, Lazada, Netflix, Nike, Puma, Shopee, Taobao, Under Armour, Viu, and more.

Asia Pacific Consumers Still Favor Staying Home Despite Lifting of Lockdown Measures

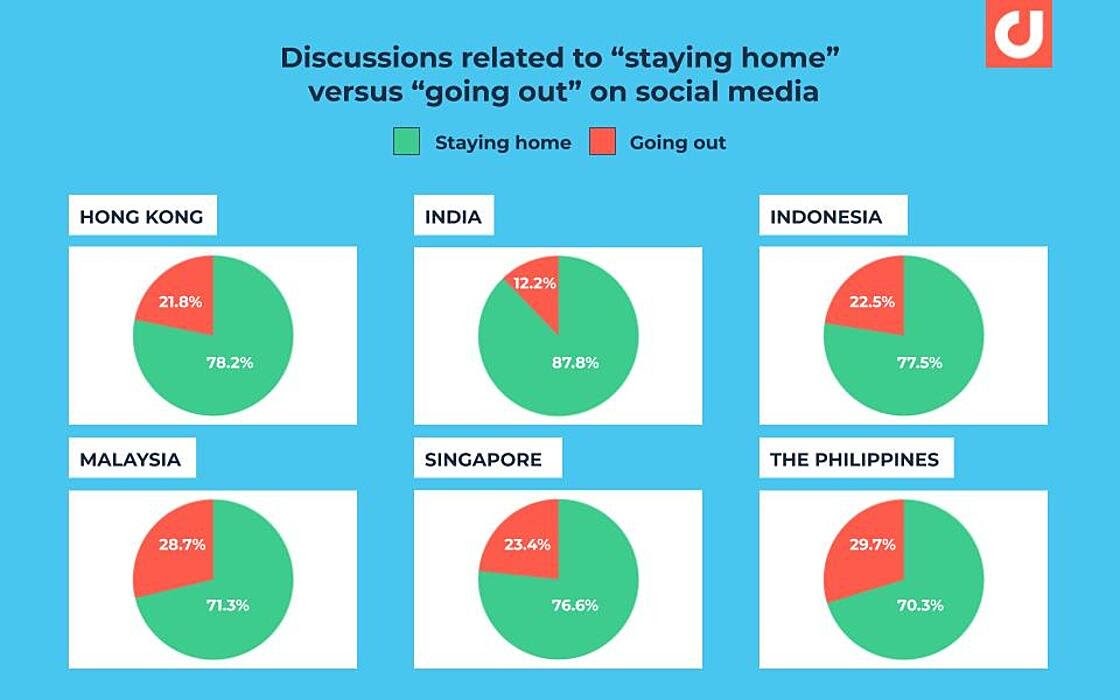

Even when governments began announcing an initial easing of lockdown measures locally, social conversations about “going out” were far outweighed by mentions around “staying home”. Social mentions around “staying home” were boosted by both consumers adjusting to the “new normal”, and brands capitalising on the stay-home trend in APAC.

The majority of mentions related to “staying home” focused on ways to maintain a certain quality of life despite being deprived of the usual routine, while also preserving mental wellbeing during this unique time. With the “new normal” underway, consumers are choosing alternative solutions that allow them to be at home while supplementing their past schedules and fixes, be it shopping, socializing, or seeking entertainment. This trend is speculated to uphold for months to come, as consumers remain wary of a resurgence in Covid-19 cases1.

Likewise, brands have started marketing and repackaging products and experiences as something that can be replicated “at home”, in a bid to stay connected with customers.

Asia Pacific’s Top Consumer Concerns: Safety, Availability, and Price

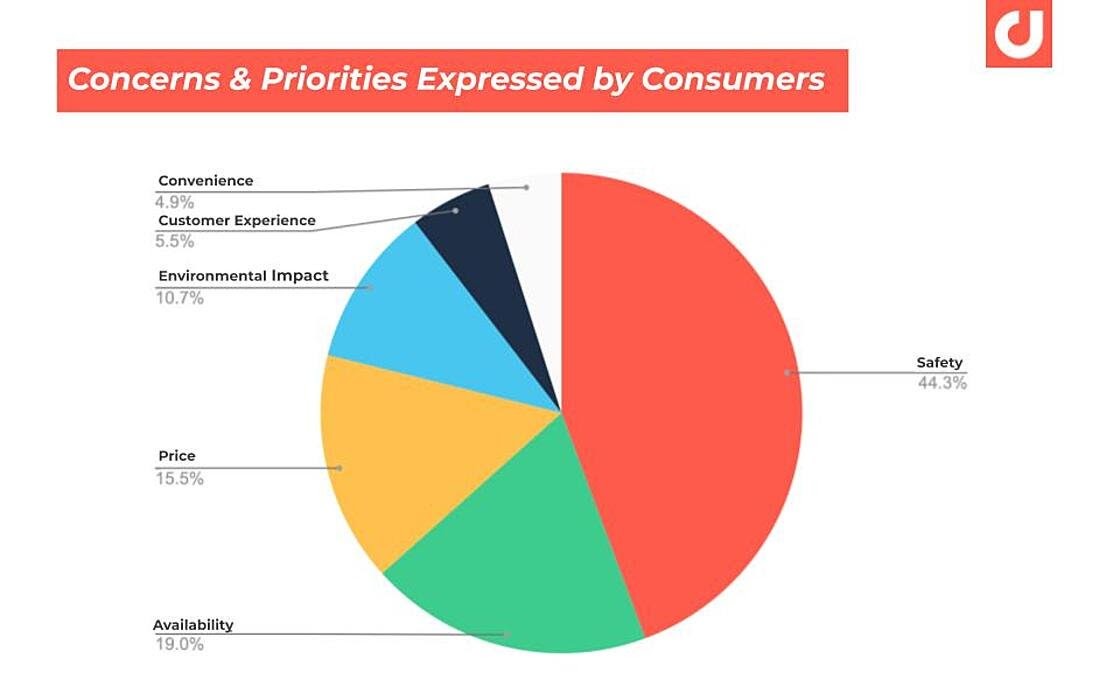

With the threat of the pandemic still looming over the minds of consumers, mentions about safety made up almost 50% of all online conversations related to top concerns and priorities in Asia Pacific.

Overall, news of lockdown restrictions being lifted were met with anticipation at stores reopening, and desire at being able to go out and visit friends again. Internauts actively discussed the fact that governments were lifting restrictions in an attempt to revive local economies, while emphasising the need to remain mindful and continue practising social distancing.

When discussing availability (19.0%) and price (15.5%), consumers still expect a standard in product or experiences that justifies the amount spent, pandemic or no pandemic.

Social Media and Media Streaming Channels Key to Bridging Gaps with Consumers in the New Normal

Analysis of brand-related mentions, as well as posts around online entertainment and media streaming, revealed Flipkart, Lazada, and Shopee as some of the standout brands during the period studied. These are the companies that managed to continue connecting and engaging with their customers in the absence of large-scale, physical events:

Brand | Description |

Motorola’s launch of #TheUltimateOne on 16 June was done exclusively on Flipkart. The tech brand’s announcements on Facebook helped build anticipation among followers, as well as increased reach and mentions on 15 June. | |

G2A, an e-retail site specializing in gaming products, used Twitch, a streaming platform popular with gamers and eSports enthusiasts, to host a “meme” stream which earned over 140,000 views, and around 1,400 likes. | |

Riding on the wave of customers turning to e-retail for their shopping needs, Lazada l aunched the #LazadaSGGreatestSale and #10MillionVouchers to entice more customers to shop on Lazada in the absence of physical sales promotions. | |

Shopee Philippines leveraged two things near and dear to their audiences: K-pop and live streams. The e-commerce platform held a week-long event in partnership with local influencers to feature content based on a K-pop theme. This live stream of content catered specifically towards K-pop fans earned almost 5,000 social interactions on its announcement post on Facebook. |

“The Covid-19 pandemic has accelerated the need for brands to adopt new technologies and strategies to align themselves with evolving consumer needs. As the new normal looks to linger for the foreseeable future, businesses are forced to adapt to new consumer and consumption trends that have emerged. Firms who have lagged with digitalization are now finding themselves struggling to keep up with the pace,” said Olivier Girard, Head of APAC, Digimind. “For example, a newfound emphasis on consumer engagement via live streaming emerged as a way for brands to stay top of mind and sustain interest and drive sales in the absence of brick and mortar stores.”

“Consumers are fast adapting to the reality that is the “new normal”. And businesses worldwide have had to make a radical leap to transform digitally, so as not to come to a standstill. Being extra vigilant in understanding consumer needs, capturing new concerns that have surfaced during the pandemic, and acting swiftly on them, will be key to not only surviving 2020, but thriving beyond it.”