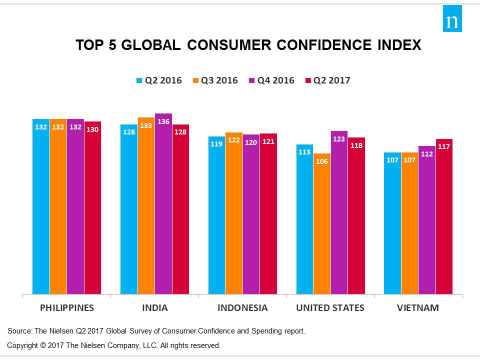

MANILA – Once again, Filipino consumers posted the highest consumer confidence index score among consumers from around the world. In the second quarter of 2017, optimism of Filipino consumers was the most bullish despite a slight dip of two points from Q4 2016 to register a confidence index score of 130, according to the latest Nielsen Global Survey of Consumer Confidence and Spending Intentions.

It was in the same period last year that consumer confidence in the Philippines surged to no. 1 with a 13-point increase to 132 index score. During that time it was the biggest quarter-on-quarter increase among countries included in the survey.

“Consumers in the Philippines have always been in the top three in the past number of years and to be the most optimistic globally for the second time is not surprising given that the economy remains to be one of the strongest in Asia at 6.5% GDP growth rate in Q2,” says Stuart Jamieson, managing director of Nielsen Philippines and Emerging Markets Southeast Asia Cluster leader.

Established in 2005, the Nielsen Consumer Confidence Index is fielded quarterly in 63 countries to measure the perceptions of local job prospects, personal finances, immediate spending intentions and related economic issues of real consumers around the world. Consumer confidence levels above and below a baseline of 100 indicate degrees of optimism and pessimism, respectively

Globally, consumer confidence showed signs of continued improvement with an index score of 104, up three points from quarter four of 2016. After the Philippines, India posted a 128 index score, declining by eight points while Indonesia follows with a 121 index score, gaining a percentage point. The United States slipped by five points to an index score of 118 while confidence level in Vietnam is on the ascent with a five-point percentage gain to 117 index score (See chart 1).

While the three confidence indicators which were measured in the survey remain high, slight decreases are noted. Job optimism dropped two percentage points to 85% in the second quarter compared to quarter four and four points versus quarter two last year. Responses from the Philippines also showed a dip to two percentage points in immediate-spending intentions (58%) from Q4 2016 and a decrease of three points compared to year-ago report. Favorable sentiment about personal finances remains positive at 84%, although it went down when compared to 86% in Q2 2016 and Q4 2016.

Where do they intend to allocate their spare cash?

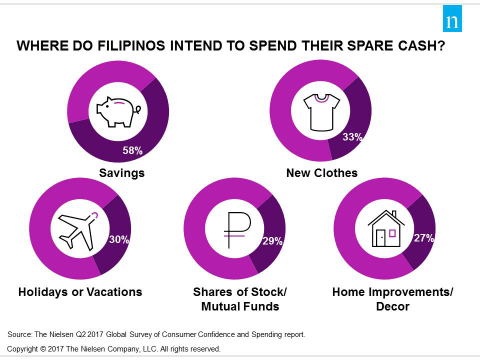

When it comes to having cash to spare after paying for the essential living expenses, saving money still tops the list for Filipino consumers at 58% (a six-point decrease compared to quarter four of 2016). Interestingly, consumers indicated increased willingness to allocate spare cash to new clothes, up nine points to 33%, while holidays or vacations come in next with 30%, a three-point increase compared to the end of the quarter of 2016. Investment in shares of stock (29%, +1) and home improvements (27%, -2) also make it to the list (See chart 2).

“Consumers with a positive outlook about their finances, job prospects, and spending intentions tend to have an open mindset towards indulgences such as clothes and travel,” Jamieson notes.

Filipinos rising concern about terrorism

When asked about their major concerns in Q2, respondents indicated job security (30%) and health (23%) as the two major causes for worry while terrorism moved up the list as the third major concern. “While previously aware of the terrorism on a global level, the Marawi siege brought the threat of terrorism closer to the minds of Filipino consumers,” observes Jamieson.

For more details and insights, download Nielsen’s Global Survey of Consumer Confidence and Spending report.

Chart 1. Q2 2017 Consumer Confidence Index

Chart 2. Where Filipinos intend to channel their spare cash