Kantar Worldpanel data reveals that Filipinos are slowly becoming more health conscious in their food and beverage choices, opting for ‘light’ variants or those with more nutritional benefits. Data from Kantar Worldpanel, the global expert in shoppers’ behavior, shows that this healthy eating trend is evident in different categories, ranging from cereals to canned meat and yoghurt to beverages.

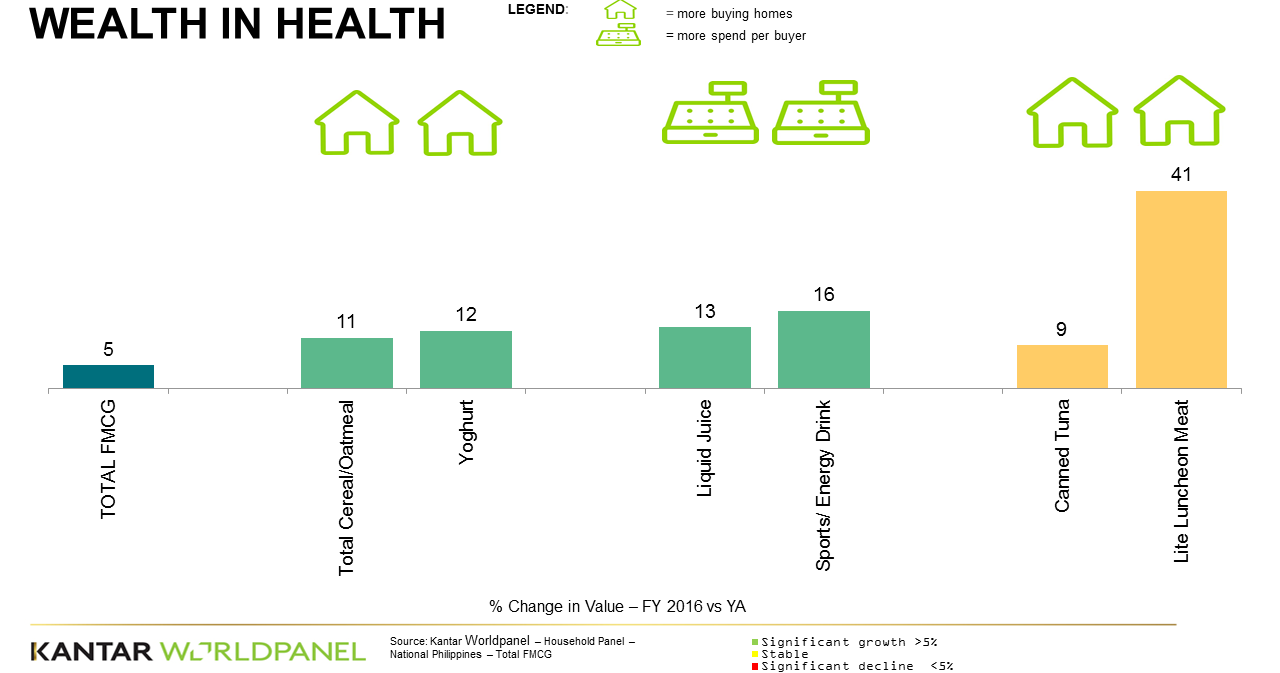

According to Kantar Worldpanel, which tracks the shopping behavior of 3,000 Filipino homes in urban and rural areas across the country for a period of two years, food categories strongly associated with healthier food choice registered notable growth. From January 2015 to December 2016, total cereal and yoghurt categories enjoyed double-digit growth with 11% and 12% value sales, respectively. One in eight homes now buy cereals, representing 19% growth in buyer base from the previous year (2015). A much smaller and niche segment, yoghurts, which consists of drinks and cup formats, were purchased by 28% of Filipino homes during the same period.

Meanwhile, data from Kantar Worldpanel also show that Filipinos are choosing the healthier options in the canned goods category as well, specifically for luncheon meats and canned tuna. Although still a tiny segment, luncheon meat variants that are ‘lite’ or contain ‘less sodium’ are being purchased by more shoppers. From 904,000 homes in 2015, these lite variants have increased by 27%, reaching 1.1 million homes in 2016. Moreover, purchases of canned tuna have also risen by 9%, increasing its reach to 13.9 million homes in 2016.

Drink ‘Lite’

The healthy trend is also evident in sports and energy drinks in the country. With more and more Filipinos engaging in various fitness activities and sports, purchases of energy drinks gained momentum with 16% growth in value sales in 2016. This is driven by more homes buying into the category and increased spending of its buyers. There are 228,000 more homes buying and overall spending has grown by PHP 18 more.

In addition, ready-to-drink juice brands have been aggressively communicating health-related benefits such as cholesterol management, which could have possibly helped accelerate the category’s growth to 13% in 2016. Though steady in terms of buyer base, this category was able to entice higher spend among its buyers, from PHP 288 in 2015 to PHP 320 in 2016.

Filipinos Think Health is Wealth

In the case of yoghurts, the more affluent, class ABC homes, make up 28% of peso sales despite its 10% share in the household population. Surprisingly though, more class DE homes are also buying into the category, contributing to an increase of 12% year-on-year peso sales. Yoghurt buyers are also skewed towards Visayas, smaller sized homes with one to two members only.

Ready-to-drink juice and majority of sports or energy drink buyers also have some commonalities with shoppers who purchase yoghurt, as they also belong to class ABC, smaller-sized homes. However, it is noted that those who purchase the juices and energy drinks belong to the working class, are urban-based and mostly from NCR and North Luzon.

“Though gradual and slow, there are already some notable shifts in the food and beverage preferences of some Filipino consumers,” Lourdes Deocareza, Kantar Worldpanel New Business Development Head said. “Our findings indicate a change in the lifestyle of Filipinos towards health and wellness, which is a key insight that brands can leverage and focus marketing efforts on when introducing their food and beverage products. With summer just around the corner and the fitness trend booming, brands that can contribute to the health goals and complement the healthy lifestyles of this emerging market will have a higher chance of getting into their shopping baskets,” she added.