SINGAPORE — In the face of the current pandemic, what did 2021 look like for different brands and enterprises, and what have they done to keep up with an ever-changing business climate? The profound impact of the pandemic has certainly given rise to new consumer behavior, in which brands have responded with product offerings, key messaging, and industry standards.

2021 was not all gloom and doom even with COVID-19 persisting to have a stranglehold on business activities, as significant brands and enterprises have shown their resilience and adaptability in serving consumers and imparting new experiences in the purchasing journey.

With consumers desiring fresh and alternative ways of spending their money, brands at the forefront of innovation and technology have a strong incentive to be the leaders of their industry. Having top visibility in the online landscape is an outcome of brands doing well to make the right message land and engage with consumers. In this social media age, using virality to organically push marketing strategies is an added advantage that cannot be underestimated.

In the age of the customer, brands have realigned their offerings to meet values that matter to their consumers, namely health and safety, convenience, and transparency. Insights into new customer behavior are increasingly essential for brands to thrive, as consumers would often now be able to know a brand before they experience one online.

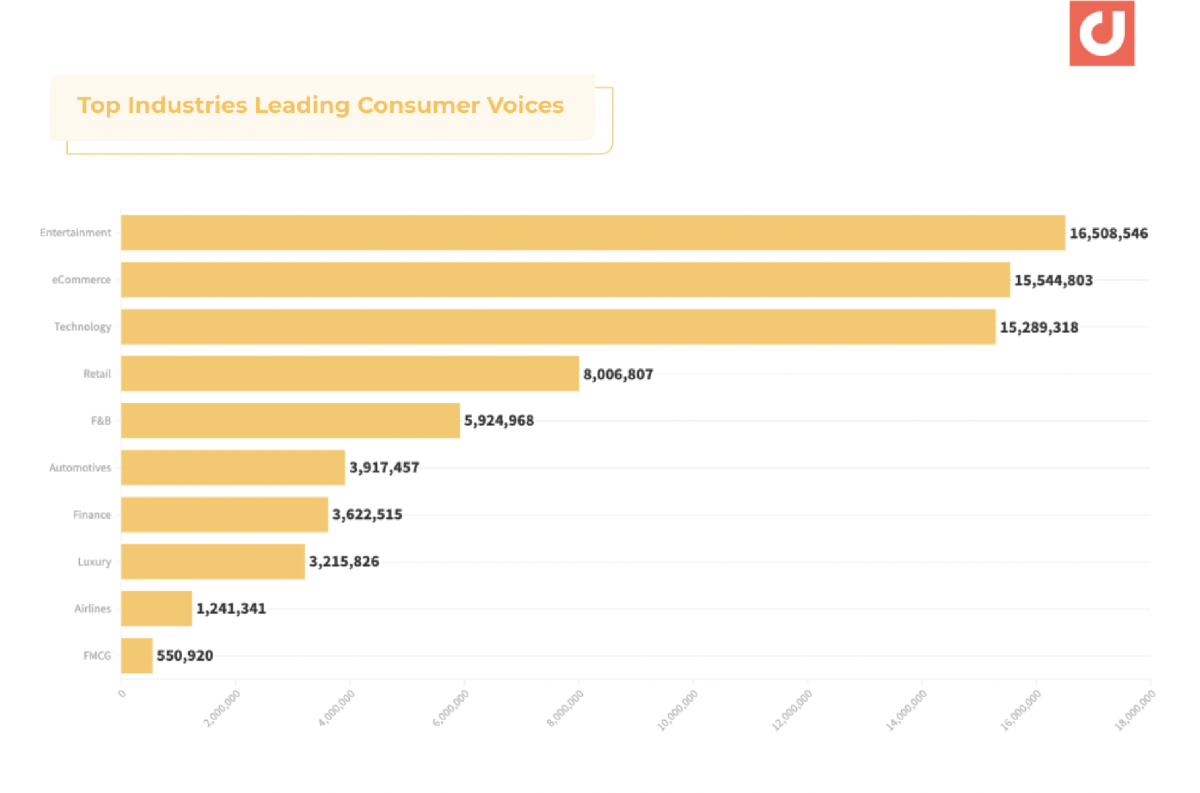

A new report from Digimind, the most trusted AI-powered social listening and market intelligence software, analyzed key trends in 73,822,501 mentions around 200 selected brands across 10 consumer-centric industries, namely Airlines, Automotive, eCommerce, Entertainment, Finance, FMCG, F&B, Luxury, Retail, and Technology. The report highlights a topline analysis of key mentions, brands’ Share of Voice, and unique positionings that can be gleaned from to understand the online visibility of brands in the marketplace.

Brands studied include: Airasia, L’Oréal, Honda, KFC, Lazada, LVMH, and more.

Top Industries Leading Consumer Voices

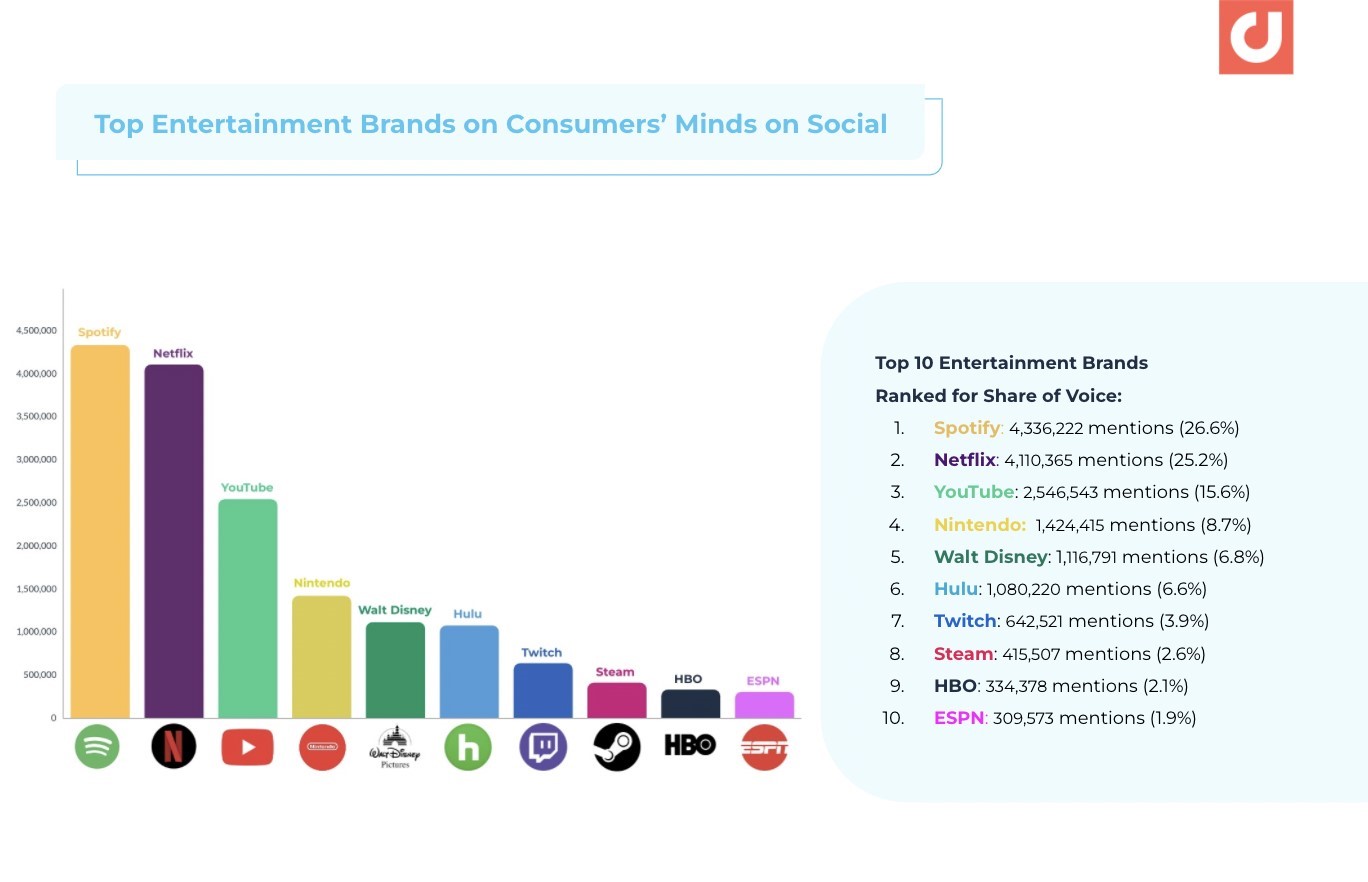

Entertainment Trumps All Else

Entertainment brands are highly valued in the consumers’ eyes. They form a significant basis for how people generally relieve mental stresses in everyday life, weighed down further from the Covid-19 pandemic. Overall, when it comes down to what consumers discussed the most online, entertainment brands hold the biggest share of voice (22.4%) among the other 200 brands analyzed, followed by eCommerce (21.1%) and technology brands (20.1%).

Entertainment brands like Disney, Netflix, and Nintendo are oriented towards the stay-home lifestyle, where consumers need not worry about being exposed to the virus. As a result, a majority of consumers frequently discuss brands of over-the-top (OTT) media services, be it for music, video, and gaming. The key topics of the entertainment industry are commonly tied to recommendations or what is currently trending, which are popular among consumers mainly because of their interest in certain brands, offerings, celebrity fandom.

Most-Discussed Brands in Industry

Analysis of brand-related mentions around the 10 key industries, revealed Shopee, Sony, and Spotify as some of the more prominent brands during the period studied. These are the companies that remained top of mind with consumers throughout the year and continued to have a lasting presence online through their marketing efforts.

Entertainment

Entertainment brands continue to remain highly resonant with consumers online as 4/5 of the brands analyzed were in the bracket of the top 100 brands in the report.

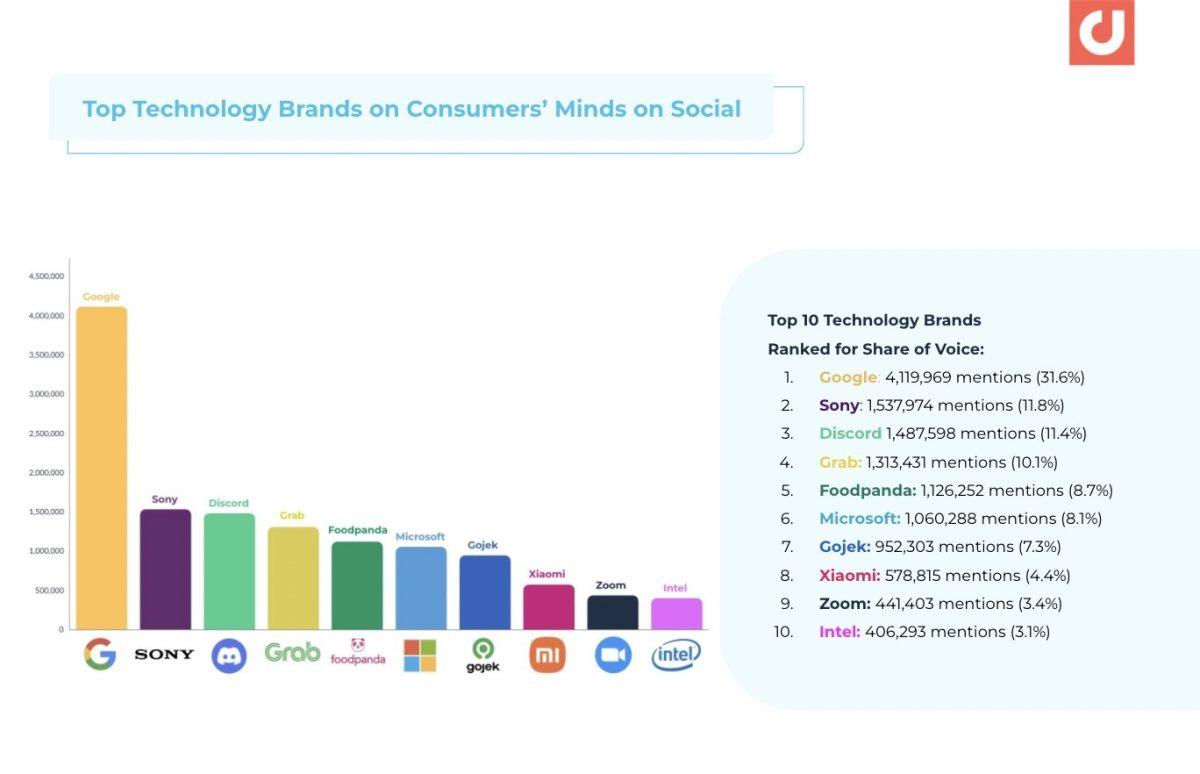

Technology

When it comes to consumer technology, software and hardware have a primary footprint in consumer purchases. Notable brands that have surfaced to the top of the list have offerings that include computing and gaming, video-streaming, and super apps that do everything from digital payments, transportation, and food delivery.

Finance

Financial service brands looking to grab a larger slice of the pie are building their very own digital ecosystem to retain and reward consumers, such as collaborating with non-financial partners and merchants to integrate payments, insurance, and lending all under one roof.

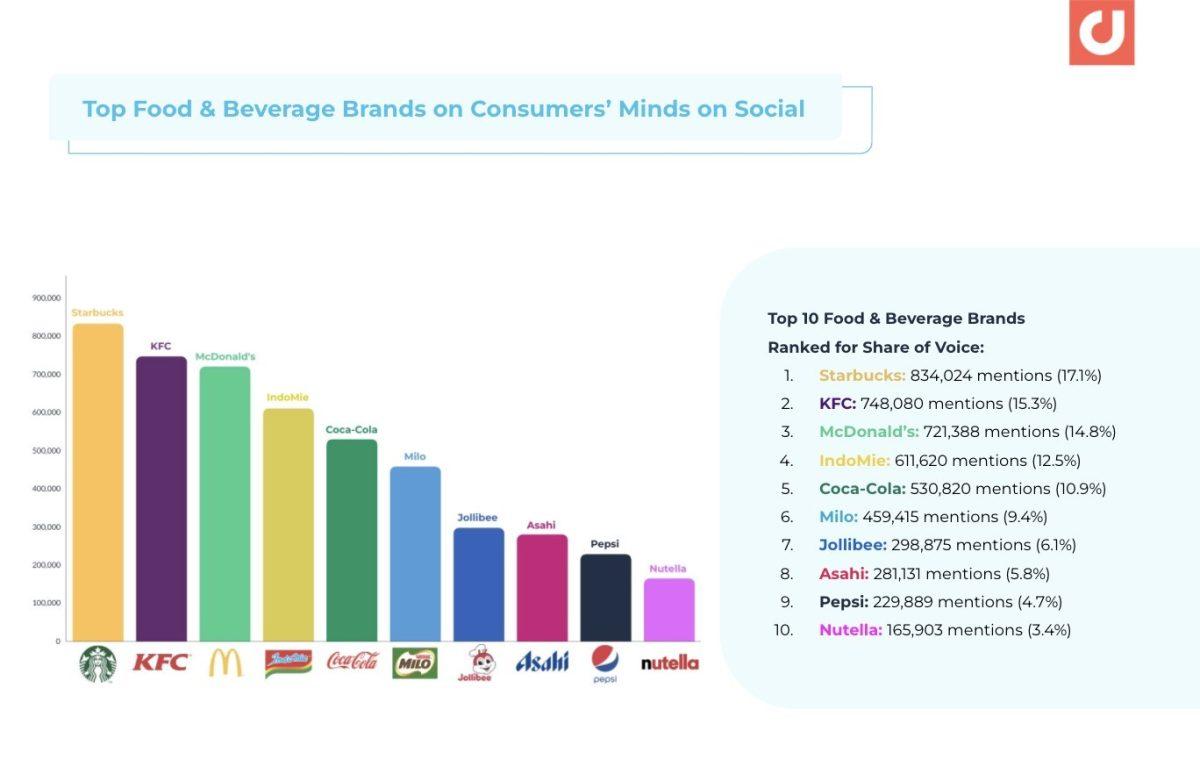

Food & Beverage

Food manufacturers and conglomerates have also been largely discussed among APAC consumers, including brands like IndoMie, Coca-Cola, and Milo which all made to the top 50 brands of the entire report. With the threat of exposure to Covid-19 still prevalent outside of the home, brands are reporting that with in-home consumption rising, consumers want the convenience of big-bulk purchases at one go, which includes small-item foods like snacks and yogurts.

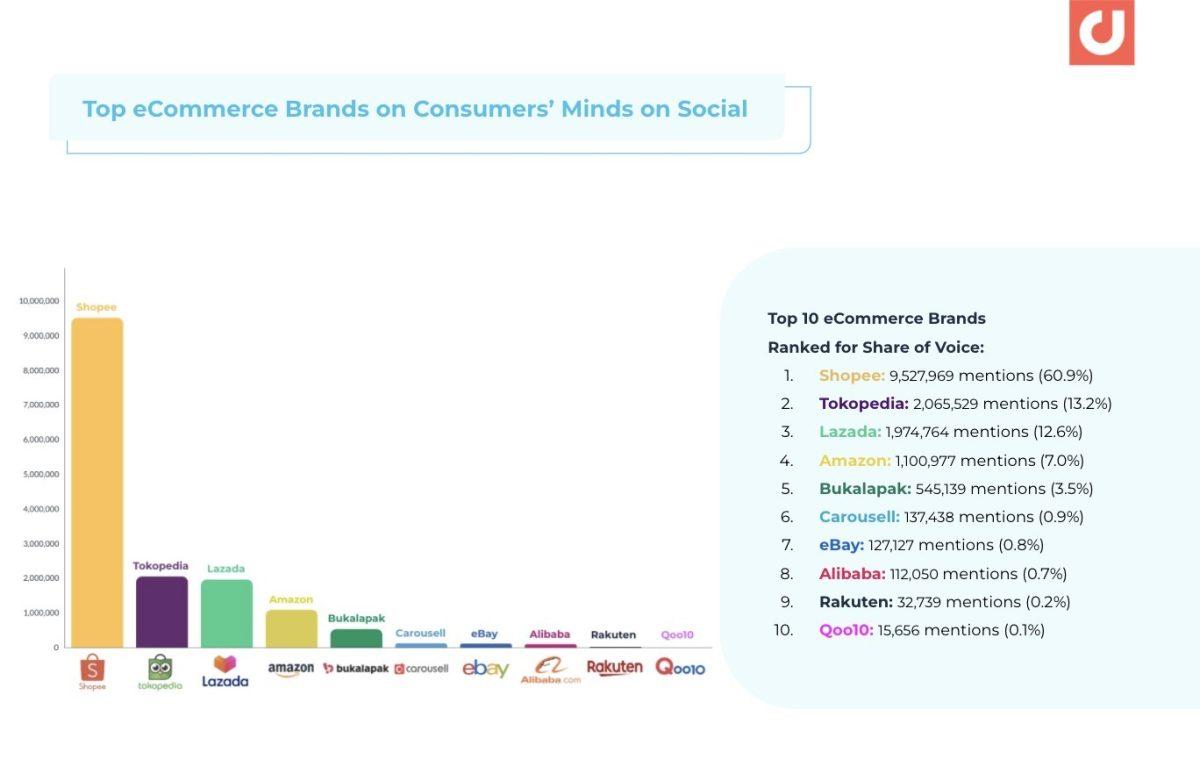

eCommerce

With the rise of online shopping and virtual transactions in APAC, the eCommerce market here is projected to grow by 14.3% annually with a market cap of $352 trillion within the next decade. The volume of online discussions mentioning eCommerce brands, like Shopee, Tokopedia, and Lazada has cemented the industry at the top spot for the overall share of voice.

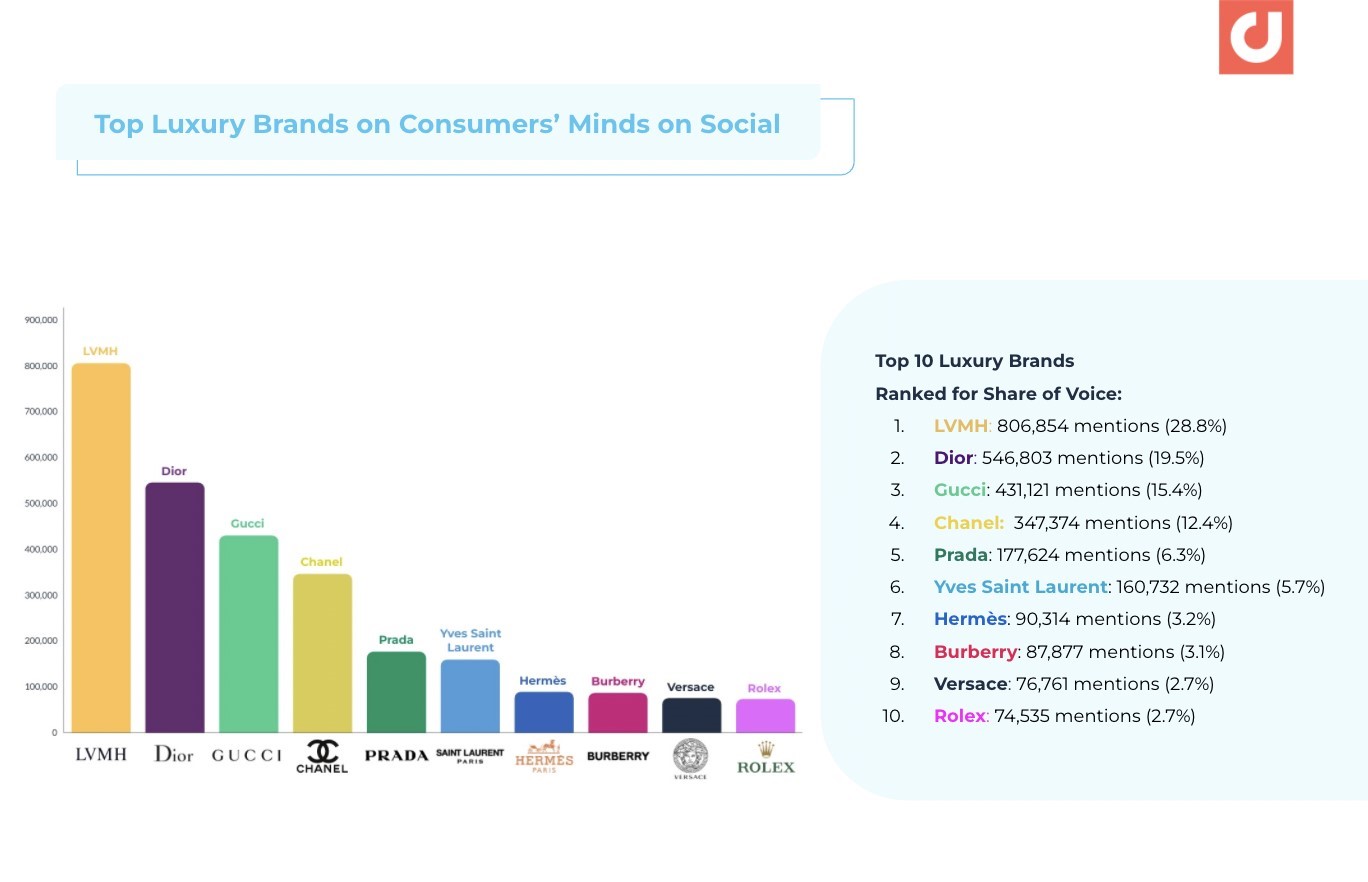

Luxury

The reasons highlighted which ensured the survival of luxury brands fell into the hands of wealthier demographics, such as the Chinese market that had the capacity to weather market volatility amid intermittent lockdowns. 10 out of 11 of the Luxury brands analyzed fell under the top 100 consumer brands, giving relevance to how vastly current the luxury industry is in comparison to other categories of consumer products when it comes to share of voice. Luxury brands have also done well to resonate with a new wave of younger consumers by leveraging the fan economy via A-list influencers to elevate their social branding.

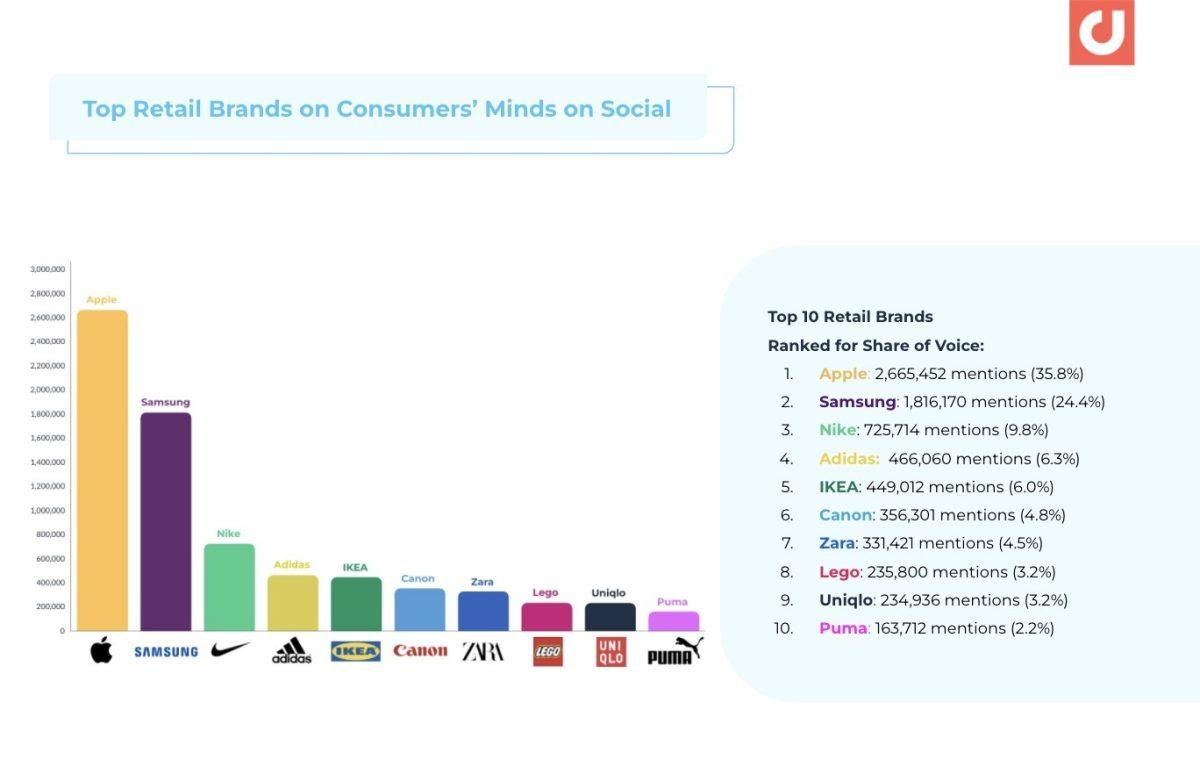

Retail

The retail industry was undoubtedly hit the hardest with Covid forcing the majority of consumers indoors and brands having to shift their operations online to remain profitable under the same pre-pandemic projections. The retail industry in this report is one of the biggest categories comprising around 27 brands, due to the sheer number of diverse, legacy brands familiar to APAC consumers, from Apple, 7-Eleven, to Razer.

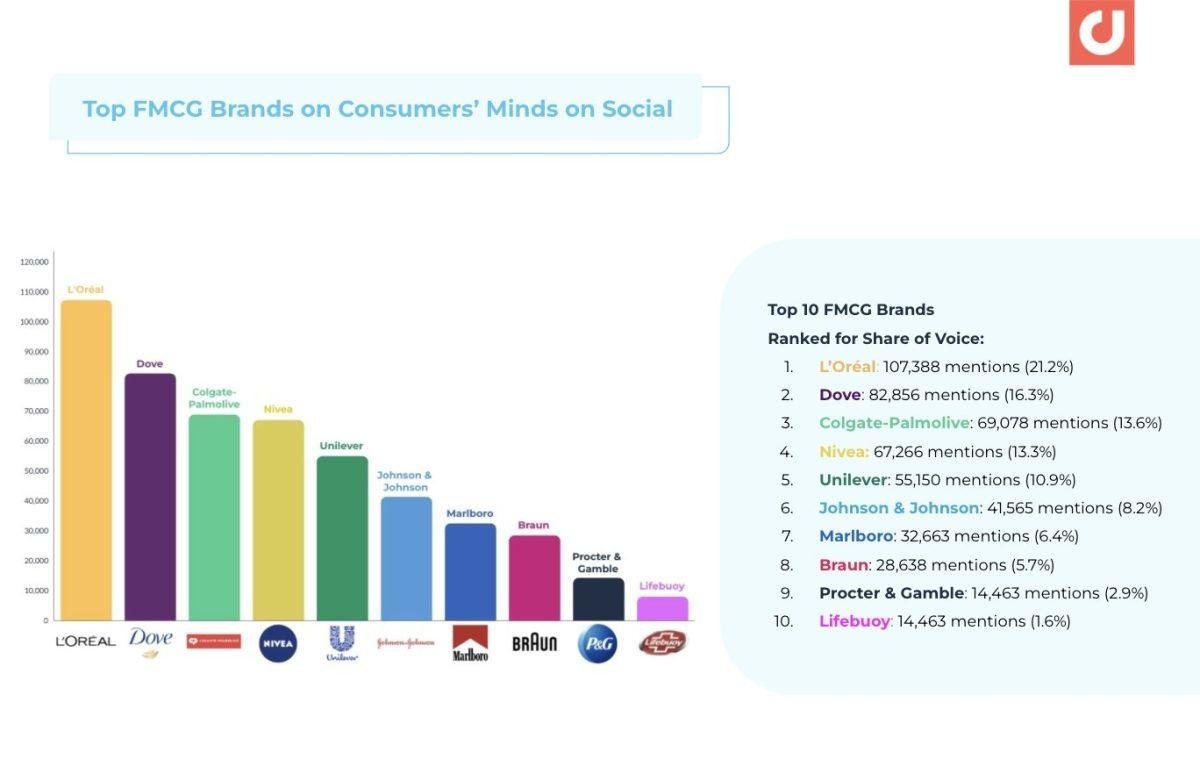

FMCG

The impact surrounding the current Covid climate continues to shape the FMCG industry by changing the way consumers look at brands from a perspective of value. eCommerce has become the main channel for the shopping experience, allowing consumers to easily take advantage of the sleuths of promotions and buy bulk purchases without ever leaving their homes.

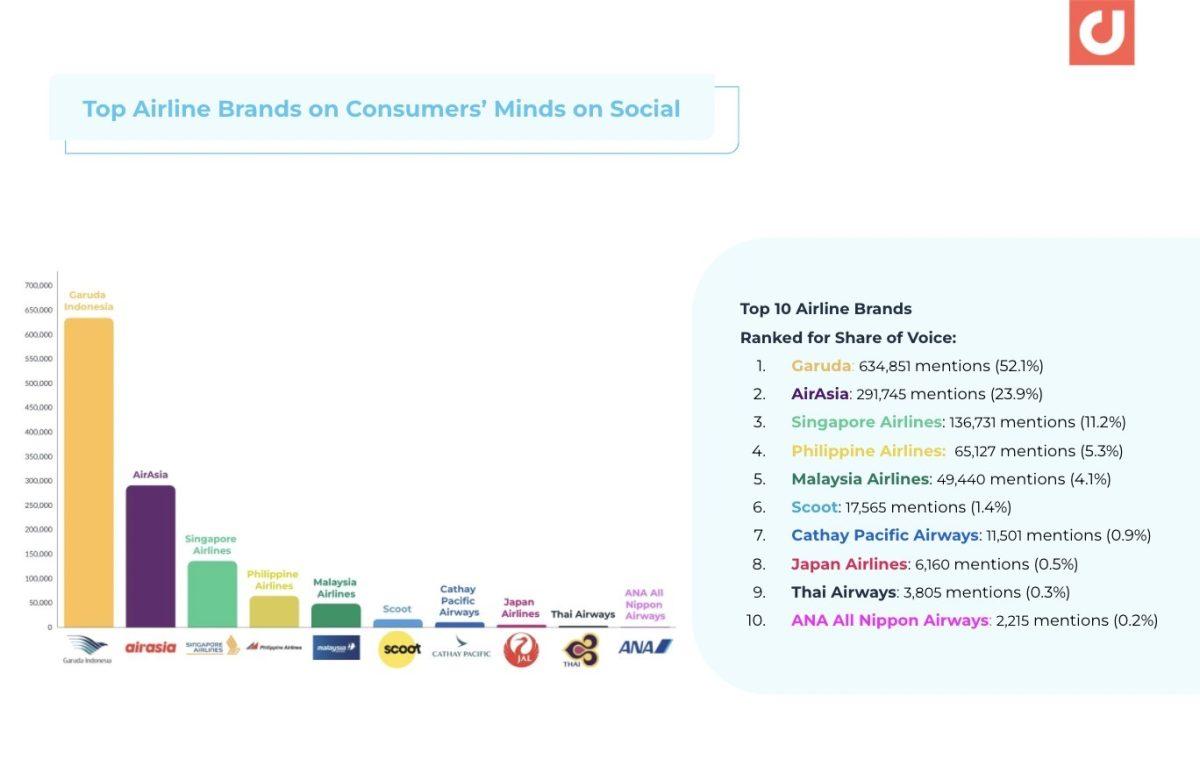

Airlines

The introduction of international travel in 2021 was a silver lining for the industry, as it demarcated the prospect for air traffic to return to pre-pandemic levels. Consumers were equally encouraged by the sight of quarantine-free travel schemes, as they removed the woes attributed to the time and additional expense needed to accommodate local government protocols.

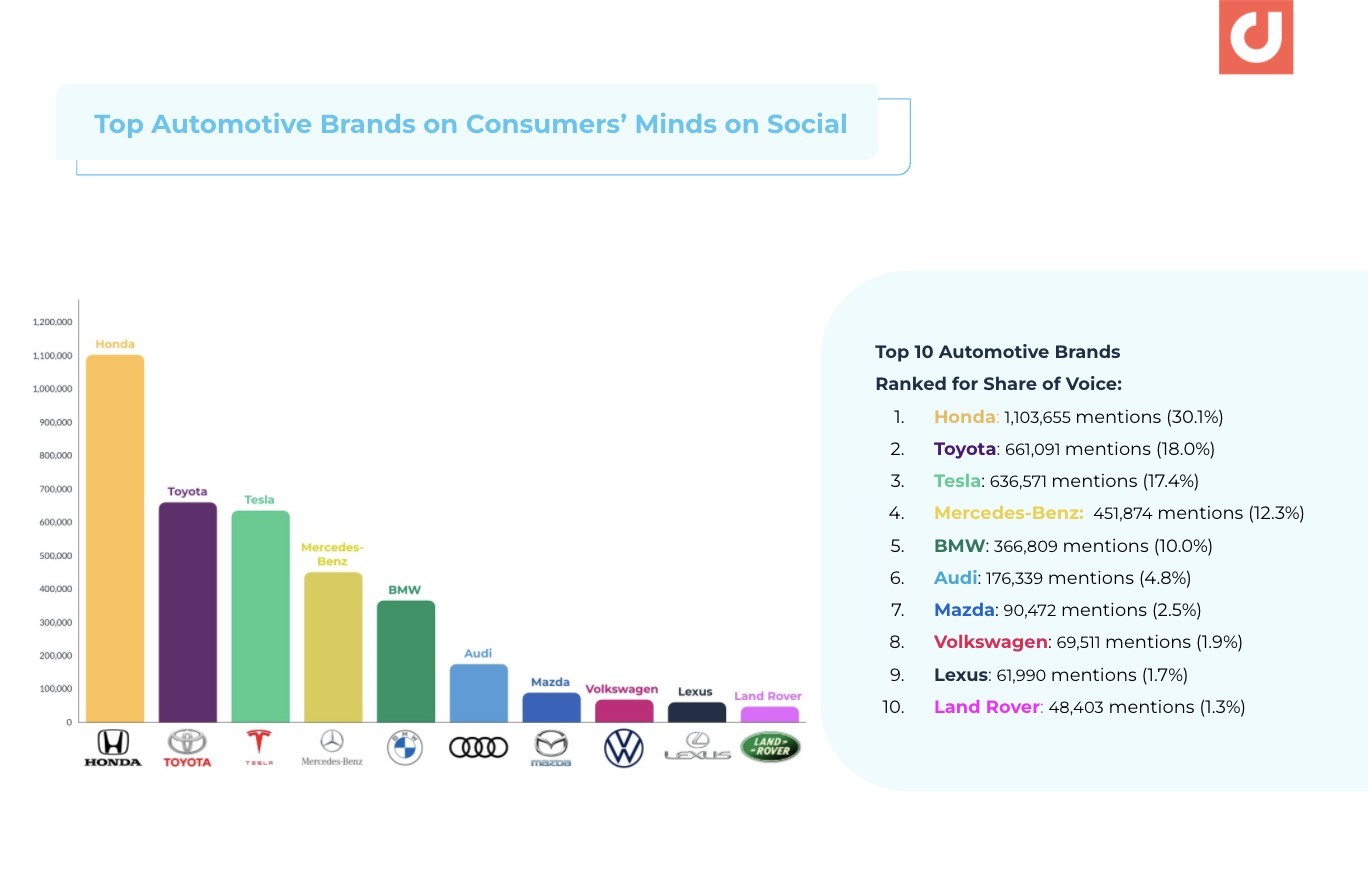

Automotive

Towards the end of 2020, buying behavior showed that auto consumers were beginning to show interest in vehicle purchases – boosting optimism that demand will pick up with countries on the rebound for recovery. Various purchasing behaviors and triggers should also be observed in the coming year, as consumers have had time over the last two years to prospect buying a car aligned to new needs and life milestones, such as career progression and starting a family. New generational sentiment around pre-owned vehicles or electric vehicles (EVs) has also heightened in light of environmental concerns and government-led green initiatives to encourage the adoption of EVs.

“Digital marketers and social analysts are increasingly finding a variety of ways to connect better with consumers and engage impactfully. To drive decisions forward, brands must look at historical data to understand trends and discover new customer personas, including insights on audience sentiment and brand reputation,” said Olivier Girard, Head of APAC, Digimind. “Gathering social data analytics instantly is imperative for today’s fast-moving market, knowing how rapid customer behaviors and buying trends are in flux, heightened further amid a Covid-19 reality. Staying reactive to consumer activity will be a key feature in how brands personalize their messaging, product, and service offerings.“

“By spotting patterns in the social landscape, brands can optimize retargeting strategy around the dips in a customer lifecycle, supplementing marketing efforts with greater social buzz when necessary.”

About this Report

Insights found in this report were extracted from Digimind’s Historical Search module, analyzed from the period of 1 January 2021 to 29 December 2021 in key markets such as Indonesia, Malaysia, Singapore, and the Philippines.